Improved Revenues Required Before EMERGE Commerce Ltd. (CVE:ECOM) Stock's 89% Jump Looks Justified

EMERGE Commerce Ltd. (CVE:ECOM) shareholders have had their patience rewarded with a 89% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 55% in the last year.

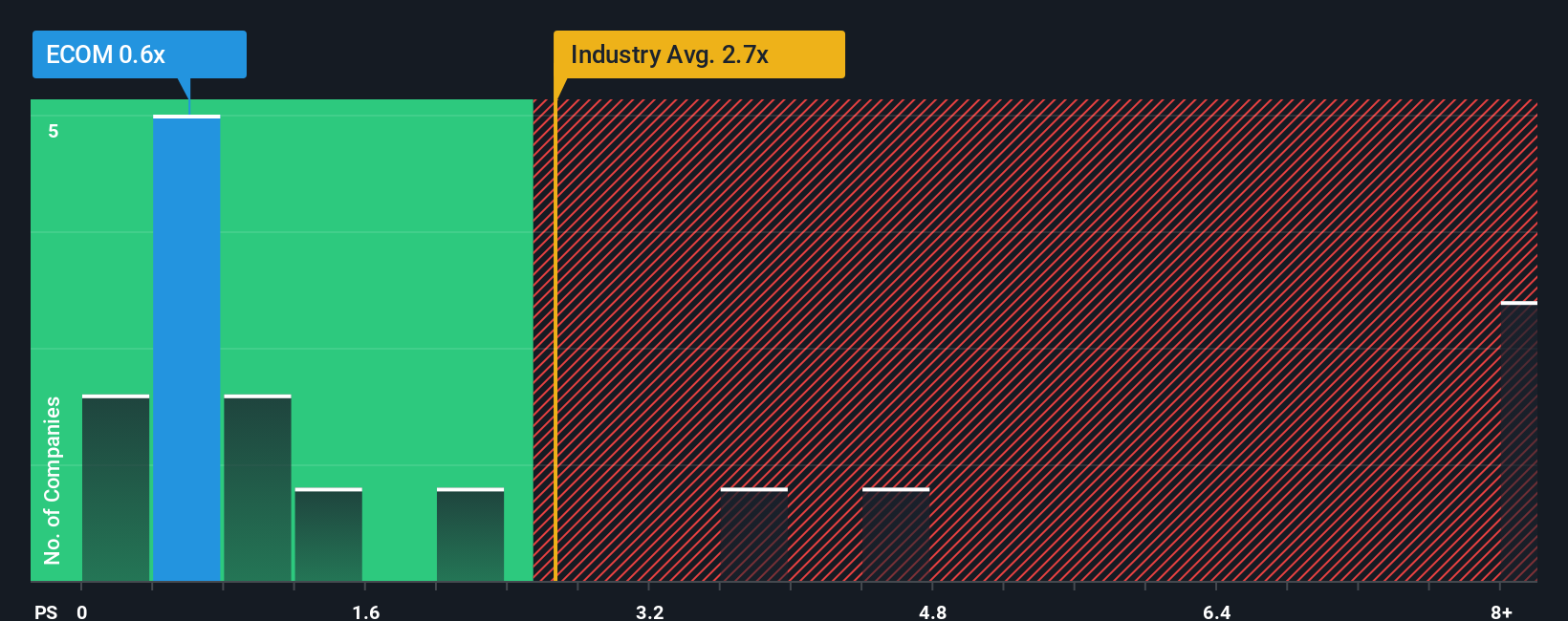

Although its price has surged higher, EMERGE Commerce may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.6x, considering almost half of all companies in the IT industry in Canada have P/S ratios greater than 1.3x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for EMERGE Commerce

How EMERGE Commerce Has Been Performing

EMERGE Commerce has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on EMERGE Commerce will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on EMERGE Commerce will help you shine a light on its historical performance.How Is EMERGE Commerce's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like EMERGE Commerce's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 10.0%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 44% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 19% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that EMERGE Commerce's P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

The latest share price surge wasn't enough to lift EMERGE Commerce's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of EMERGE Commerce revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 4 warning signs for EMERGE Commerce you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if EMERGE Commerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:ECOM

EMERGE Commerce

Owns and operates a portfolio of e-commerce marketplaces in Canada and the United States.

Acceptable track record with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.