Most Shareholders Will Probably Find That The Compensation For Thinkific Labs Inc.'s (TSE:THNC) CEO Is Reasonable

Key Insights

- Thinkific Labs' Annual General Meeting to take place on 20th of June

- CEO Greg Smith's total compensation includes salary of US$258.0k

- Total compensation is 64% below industry average

- Over the past three years, Thinkific Labs' EPS grew by 9.7% and over the past three years, the total loss to shareholders 79%

Performance at Thinkific Labs Inc. (TSE:THNC) has been rather uninspiring recently and shareholders may be wondering how CEO Greg Smith plans to fix this. At the next AGM coming up on 20th of June, they can influence managerial decision making through voting on resolutions, including executive remuneration. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. In our opinion, CEO compensation does not look excessive and we discuss why.

See our latest analysis for Thinkific Labs

How Does Total Compensation For Greg Smith Compare With Other Companies In The Industry?

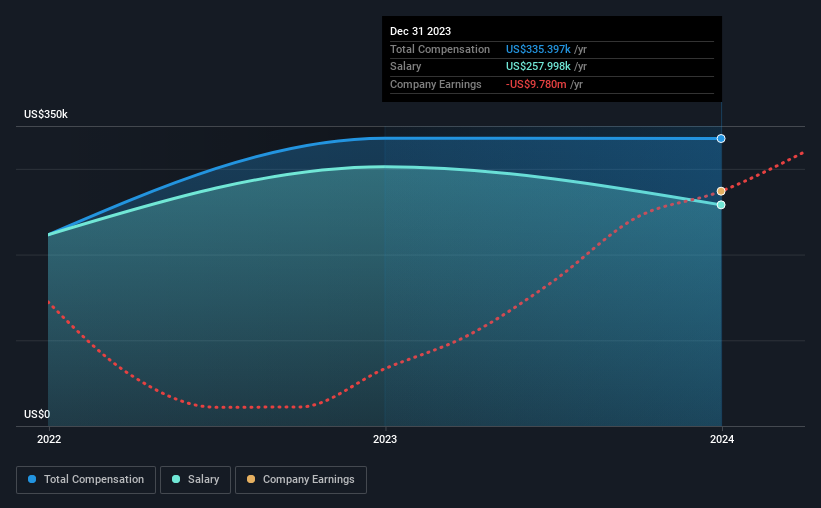

At the time of writing, our data shows that Thinkific Labs Inc. has a market capitalization of CA$291m, and reported total annual CEO compensation of US$335k for the year to December 2023. That is, the compensation was roughly the same as last year. In particular, the salary of US$258.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Canadian Software industry with market capitalizations ranging between CA$137m and CA$549m had a median total CEO compensation of US$921k. Accordingly, Thinkific Labs pays its CEO under the industry median. Moreover, Greg Smith also holds CA$93m worth of Thinkific Labs stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$258k | US$302k | 77% |

| Other | US$77k | US$33k | 23% |

| Total Compensation | US$335k | US$336k | 100% |

Speaking on an industry level, nearly 75% of total compensation represents salary, while the remainder of 25% is other remuneration. Although there is a difference in how total compensation is set, Thinkific Labs more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Thinkific Labs Inc.'s Growth

Thinkific Labs Inc. has seen its earnings per share (EPS) increase by 9.7% a year over the past three years. Its revenue is up 13% over the last year.

We think the revenue growth is good. And, while modest, the EPS growth is noticeable. So while performance isn't amazing, we think it really does seem quite respectable. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Thinkific Labs Inc. Been A Good Investment?

With a total shareholder return of -79% over three years, Thinkific Labs Inc. shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

The fact that shareholders have earned a negative share price return is certainly disconcerting. The lacklustre earnings growth perhaps may have something to do with the downward trend in the share price. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Thinkific Labs that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Thinkific Labs might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:THNC

Thinkific Labs

Engages in the development, marketing, and support management of cloud-based platform in Canada, the United States, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)