TSX Growth Companies With High Insider Ownership For May 2025

Reviewed by Simply Wall St

As the Canadian market navigates potential changes in U.S. tax policies and the implications of rising bond yields, investors are keenly observing how these factors might influence their portfolios. In this environment, growth companies with high insider ownership can offer a compelling investment opportunity, as they often indicate strong confidence from those who know the business best and may provide stability amid broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.5% | 33% |

| Robex Resources (TSXV:RBX) | 19.8% | 147.4% |

| Almonty Industries (TSX:AII) | 11.4% | 55.8% |

| Intermap Technologies (TSX:IMP) | 14.5% | 98.1% |

| goeasy (TSX:GSY) | 21.9% | 18.2% |

| Enterprise Group (TSX:E) | 32.2% | 24.8% |

| Aritzia (TSX:ATZ) | 17.5% | 22.4% |

| Discovery Silver (TSX:DSV) | 17.5% | 42.1% |

| Allied Gold (TSX:AAUC) | 16% | 80% |

| Tenaz Energy (TSX:TNZ) | 10.4% | 151.2% |

Let's explore several standout options from the results in the screener.

Canfor (TSX:CFP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Canfor Corporation is an integrated forest products company with operations in the United States, Asia, Canada, Europe, and internationally, and has a market cap of CA$1.56 billion.

Operations: The company's revenue segments include Lumber at CA$4.64 billion and Pulp & Paper at CA$772.50 million.

Insider Ownership: 22.7%

Canfor Corporation has seen substantial insider buying over the past three months, indicating confidence in its growth prospects. The company trades at a good value compared to peers and is expected to achieve revenue growth of 5.8% annually, outpacing the Canadian market average. Despite recent net losses, Canfor aims for profitability within three years. Recent executive changes and a share repurchase program underscore strategic adjustments amidst maintenance outages impacting production levels.

- Dive into the specifics of Canfor here with our thorough growth forecast report.

- Our expertly prepared valuation report Canfor implies its share price may be lower than expected.

Lightspeed Commerce (TSX:LSPD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lightspeed Commerce Inc. provides cloud-based software subscriptions and payment solutions for retailers, restaurants, and golf course operators globally, with a market cap of CA$2.01 billion.

Operations: The company generates revenue primarily from its software and programming segment, amounting to $1.08 billion.

Insider Ownership: 10.5%

Lightspeed Commerce has experienced recent net losses, with a full-year loss of US$667.2 million, yet its revenue grew to US$1.08 billion. The company forecasts further revenue growth of 10% to 12% for fiscal year 2026 and is expected to become profitable within three years. Recent product innovations in retail and hospitality aim to enhance operational efficiency, while a completed share buyback program reflects strategic financial management amidst ongoing growth initiatives in the golf industry.

- Click here to discover the nuances of Lightspeed Commerce with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Lightspeed Commerce's share price might be too pessimistic.

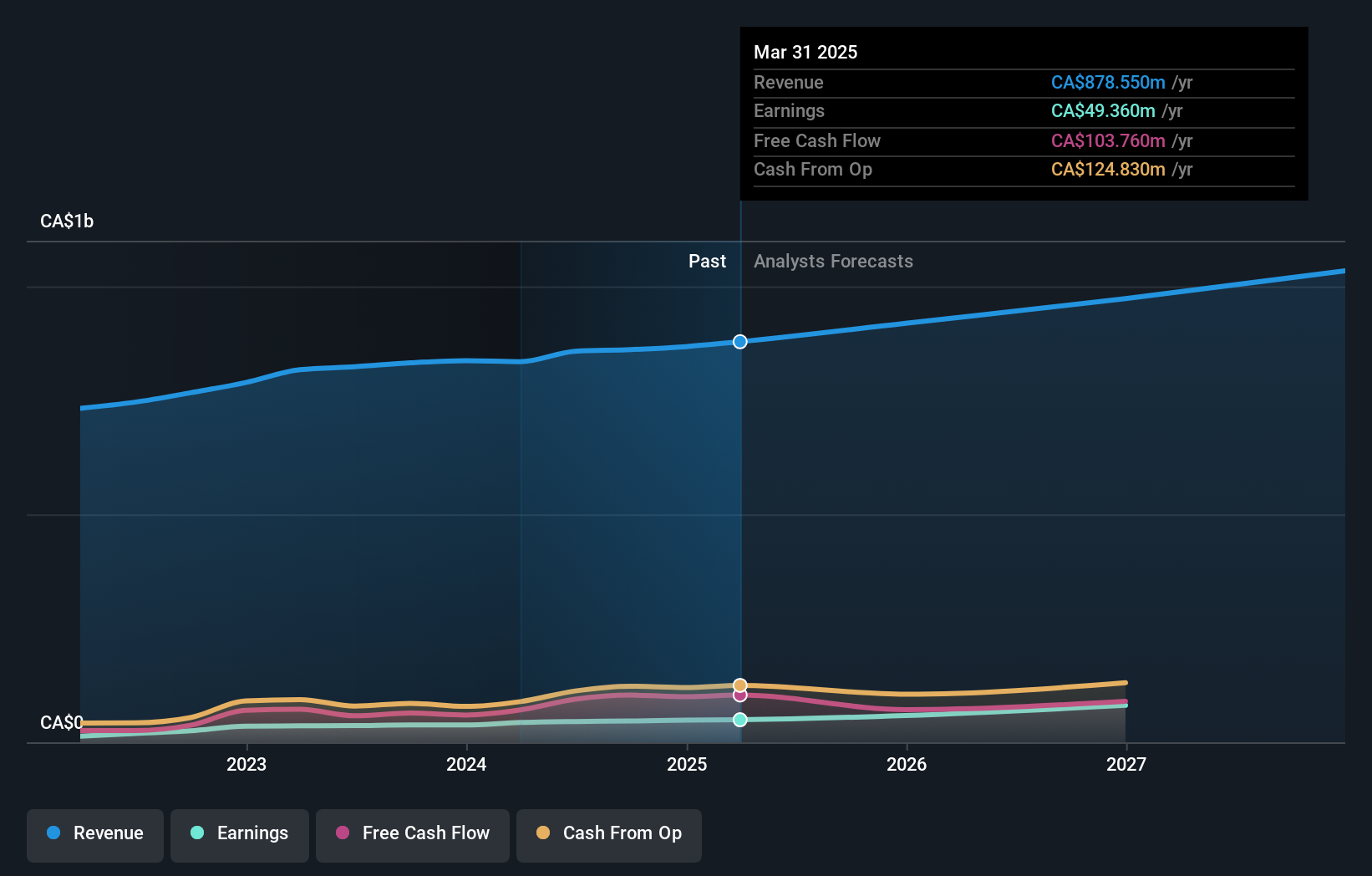

Savaria (TSX:SIS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and internationally with a market cap of CA$1.39 billion.

Operations: The company's revenue segments include Patient Care, which generated CA$194.92 million, with a Segment Adjustment of CA$683.63 million.

Insider Ownership: 17.3%

Savaria Corporation has demonstrated revenue growth, reporting CAD 220.23 million in Q1 2025, up from CAD 209.44 million the previous year. The company forecasts further growth of 5-8% for fiscal 2025, driven by volume and price increases, new product launches, and favorable exchange rates in its Accessibility and Patient Care segments. Insider activity shows substantial buying over the past three months, indicating confidence in future performance amidst reliable dividend payments of CAD 0.045 per share monthly.

- Click here and access our complete growth analysis report to understand the dynamics of Savaria.

- The valuation report we've compiled suggests that Savaria's current price could be quite moderate.

Seize The Opportunity

- Embark on your investment journey to our 42 Fast Growing TSX Companies With High Insider Ownership selection here.

- Looking For Alternative Opportunities? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 23 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SIS

Savaria

Provides accessibility solutions for the elderly and physically challenged people in Canada, the United States, Europe, and internationally.

Established dividend payer and good value.

Market Insights

Community Narratives