David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Lightspeed Commerce Inc. (TSE:LSPD) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Lightspeed Commerce

What Is Lightspeed Commerce's Debt?

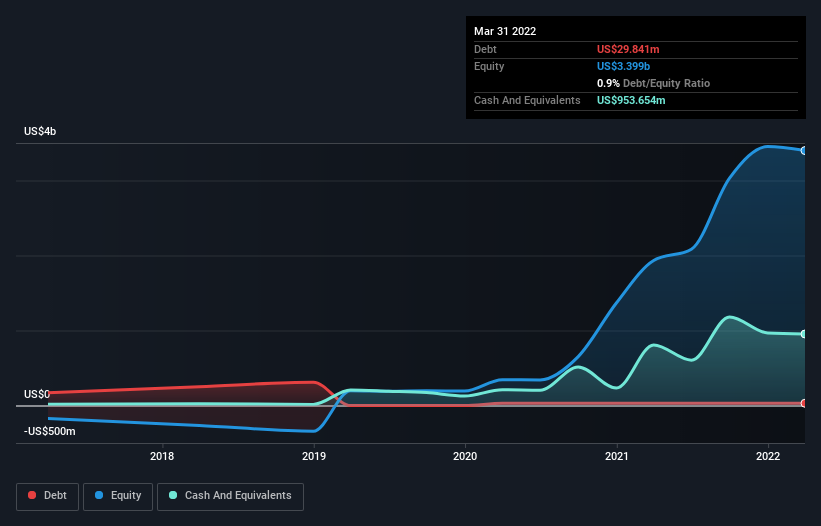

The chart below, which you can click on for greater detail, shows that Lightspeed Commerce had US$29.8m in debt in March 2022; about the same as the year before. But on the other hand it also has US$953.7m in cash, leading to a US$923.8m net cash position.

A Look At Lightspeed Commerce's Liabilities

According to the last reported balance sheet, Lightspeed Commerce had liabilities of US$157.9m due within 12 months, and liabilities of US$62.8m due beyond 12 months. Offsetting these obligations, it had cash of US$953.7m as well as receivables valued at US$39.5m due within 12 months. So it can boast US$772.4m more liquid assets than total liabilities.

This surplus suggests that Lightspeed Commerce is using debt in a way that is appears to be both safe and conservative. Due to its strong net asset position, it is not likely to face issues with its lenders. Simply put, the fact that Lightspeed Commerce has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Lightspeed Commerce's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Lightspeed Commerce wasn't profitable at an EBIT level, but managed to grow its revenue by 147%, to US$548m. So its pretty obvious shareholders are hoping for more growth!

So How Risky Is Lightspeed Commerce?

Statistically speaking companies that lose money are riskier than those that make money. And the fact is that over the last twelve months Lightspeed Commerce lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through US$98m of cash and made a loss of US$288m. But the saving grace is the US$923.8m on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. Importantly, Lightspeed Commerce's revenue growth is hot to trot. While unprofitable companies can be risky, they can also grow hard and fast in those pre-profit years. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that Lightspeed Commerce is showing 3 warning signs in our investment analysis , you should know about...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:LSPD

Lightspeed Commerce

Engages in sale of cloud-based software subscriptions and payments solutions for single and multi-location retailers, restaurants, golf course operators, and other businesses.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Salesforce (CRM) The Agentic Pivot: Salesforce Redefines the SaaS Era

Nvidia (NVDA) The Sovereign of Silicon: Accelerating Beyond the $5 Trillion Horizon

IA Analysis

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks