- China

- /

- Communications

- /

- SZSE:300627

High Growth Tech Stocks To Watch Including EmbedWay Technologies Shanghai And Two More

Reviewed by Simply Wall St

In a week where global markets have seen mixed performances, with the S&P 500 and Nasdaq Composite reaching new highs bolstered by solid corporate earnings, small-cap indices like the Russell 2000 have also shown positive momentum despite broader market challenges such as rising inflation and geopolitical tensions. In this environment, identifying high-growth tech stocks that can leverage favorable economic data while navigating potential headwinds is crucial for investors seeking opportunities in dynamic sectors.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| Gold Circuit Electronics | 20.76% | 25.89% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.51% | 23.48% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Pharma Mar | 26.67% | 43.29% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

EmbedWay Technologies (Shanghai) (SHSE:603496)

Simply Wall St Growth Rating: ★★★★★☆

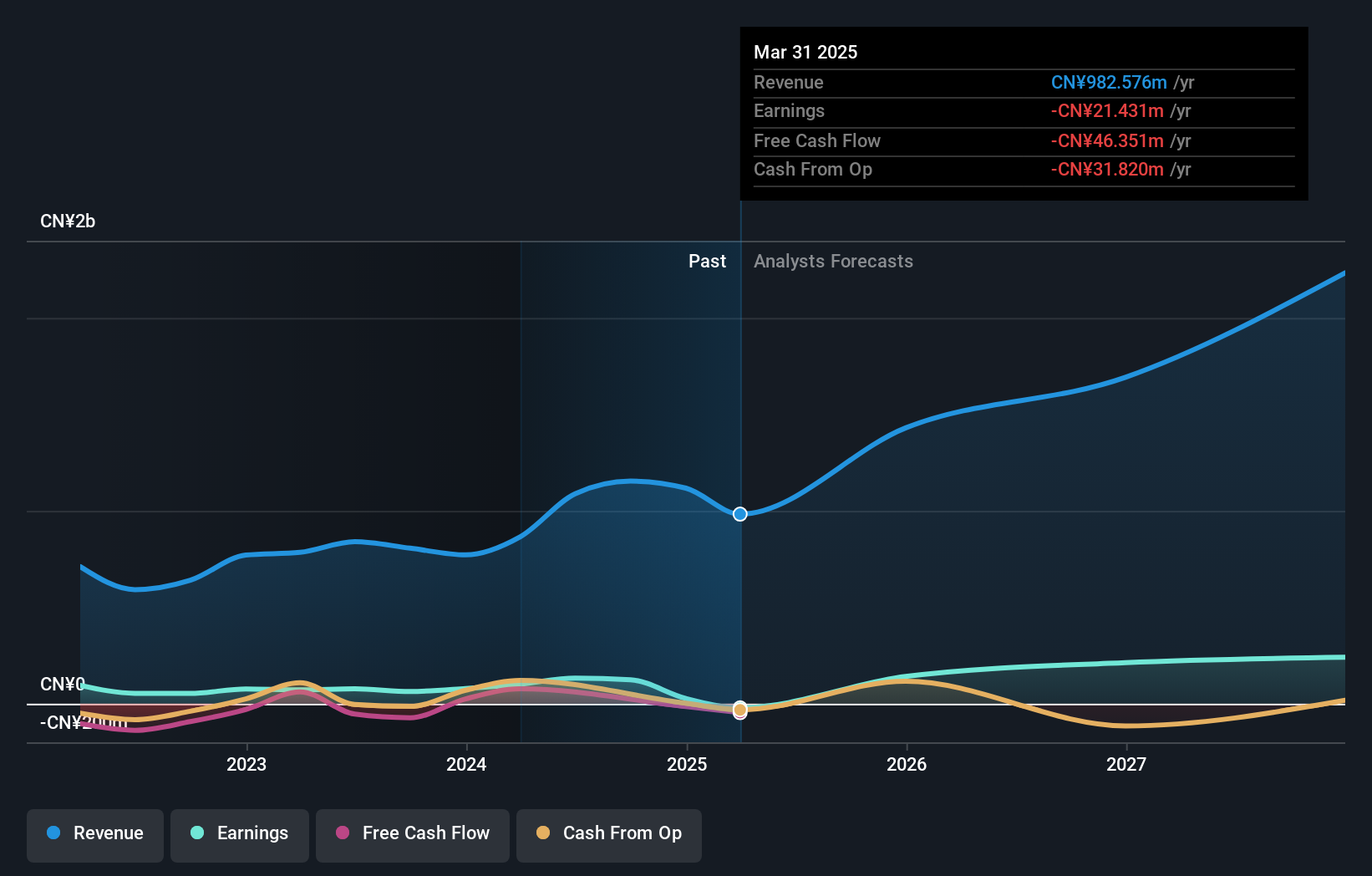

Overview: EmbedWay Technologies (Shanghai) Corporation operates as a network visibility infrastructure and intelligent system platform vendor in China, with a market cap of approximately CN¥8.94 billion.

Operations: The company generates revenue primarily from the Computer, Communication, and Other Electronic Equipment Manufacturing segment, totaling approximately CN¥982.58 million.

Despite a challenging quarter where EmbedWay Technologies (Shanghai) saw its revenue halve to CNY 124.84 million and shifted from a net profit of CNY 40.38 million to a loss of CNY 7.9 million, the company's future appears promising with an expected annual revenue growth rate of 27.2%. This growth is significantly above the Chinese market average of 12.4%, positioning EmbedWay potentially ahead in recovery and expansion within the tech sector. Moreover, with earnings forecasted to surge by approximately 66.3% annually, there is an anticipation of profitability within three years, reflecting strong adaptive strategies despite current financial setbacks.

Shanghai Huace Navigation Technology (SZSE:300627)

Simply Wall St Growth Rating: ★★★★★★

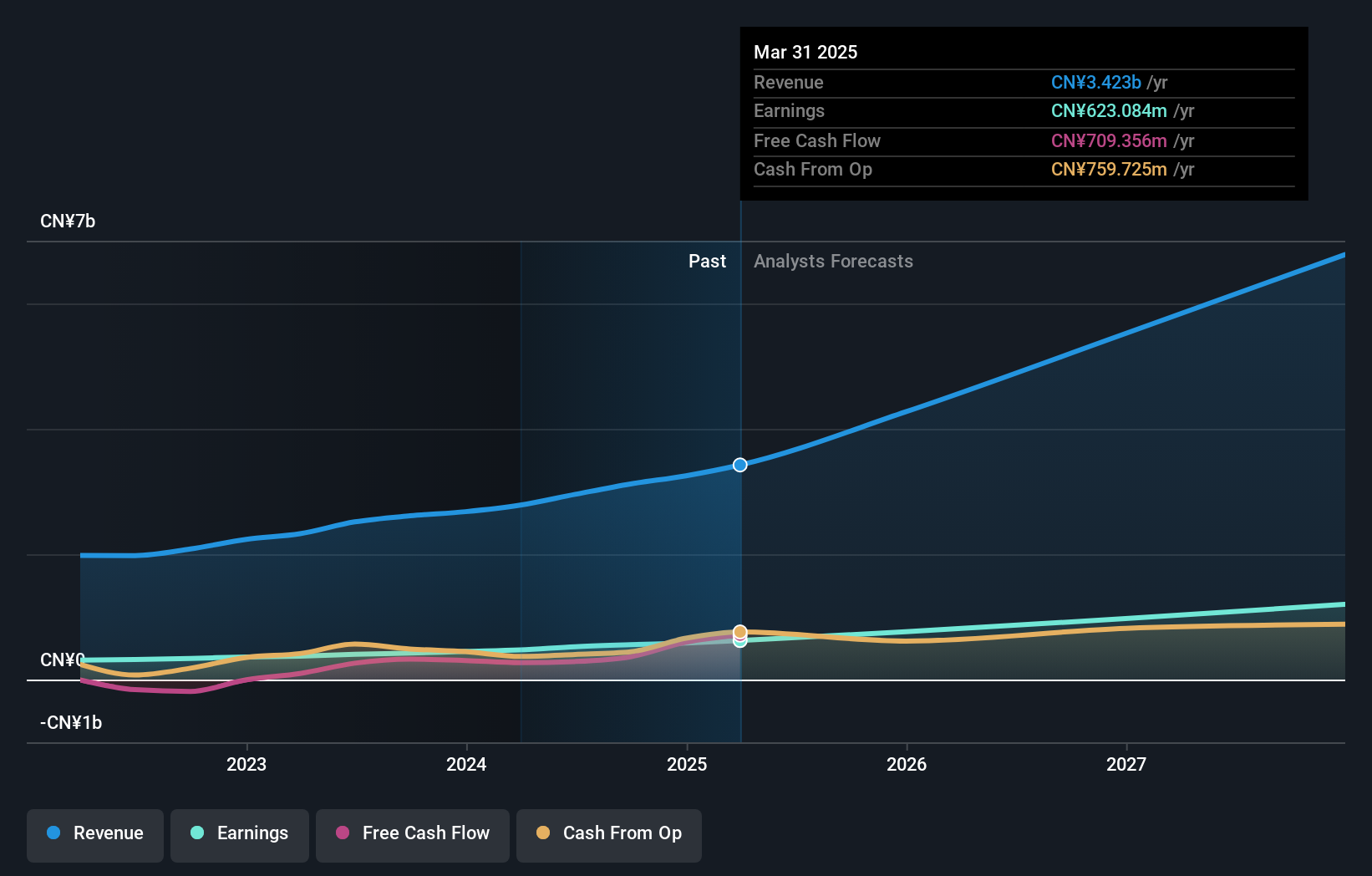

Overview: Shanghai Huace Navigation Technology Ltd. specializes in providing high-precision navigation and positioning solutions, with a market capitalization of CN¥27.70 billion.

Operations: Huace Navigation generates revenue primarily from high-precision navigation and positioning solutions. The company's market capitalization is CN¥27.70 billion, reflecting its significant presence in this specialized technology sector.

Shanghai Huace Navigation Technology Ltd. is distinguishing itself in the competitive tech landscape with a robust 24.5% annual revenue growth and a 23.5% increase in earnings, outpacing the broader Chinese market averages of 12.4% and 23.4%, respectively. This performance is bolstered by significant R&D investments, which have surged to CNY 50 million this year, accounting for nearly 6.3% of their total revenue, underscoring a commitment to innovation that propels their market position forward. Recent dividends and corporate structural changes suggest proactive governance that aligns with its financial strategies aimed at sustaining growth trajectories and enhancing shareholder value.

Lightspeed Commerce (TSX:LSPD)

Simply Wall St Growth Rating: ★★★★☆☆

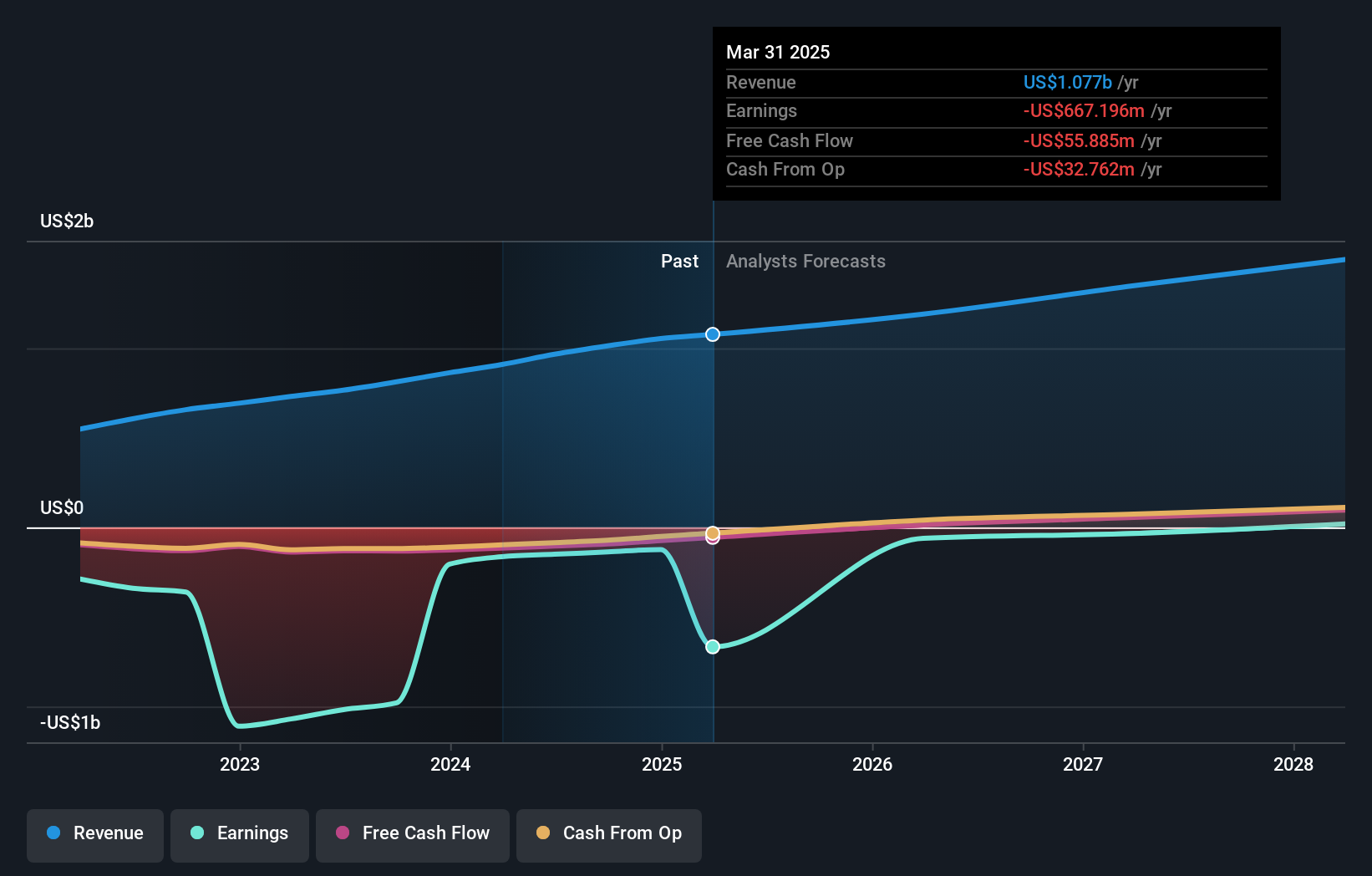

Overview: Lightspeed Commerce Inc. provides cloud-based software subscriptions and payment solutions for various businesses, including retailers and restaurants, across multiple countries, with a market cap of CA$2.44 billion.

Operations: The company generates revenue primarily through the sale of cloud-based software subscriptions and payment solutions, catering to single and multi-location retailers, restaurants, and golf course operators across several countries. Its software & programming segment reported a revenue of $1.08 billion.

Lightspeed Commerce Inc. is navigating through a challenging tech landscape, evidenced by a significant net loss of $667.2 million for the fiscal year ending March 2025, deepening from a previous $163.96 million. Despite these financial setbacks, the company's strategic initiatives are noteworthy; their recent partnership with Whoosh aims to modernize golf and club operations through integrated technology solutions, enhancing customer service and operational efficiency in this niche market. This move parallels their robust R&D focus which remains integral to their strategy for reversing current losses and fueling future growth, as reflected in their expected revenue growth of 10% to 12% for FY2026.

- Click here and access our complete health analysis report to understand the dynamics of Lightspeed Commerce.

Understand Lightspeed Commerce's track record by examining our Past report.

Make It Happen

- Dive into all 743 of the Global High Growth Tech and AI Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300627

Shanghai Huace Navigation Technology

Shanghai Huace Navigation Technology Ltd.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives