- Canada

- /

- Metals and Mining

- /

- TSX:TFPM

TSX Value Picks: NanoXplore And 2 Other Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

The Canadian TSX has experienced a modest decline of about 3%, mirroring the broader market's reaction to softening labor market data and economic uncertainties. Despite these fluctuations, the fundamentals still support ongoing market expansion, making it an opportune time for long-term investors to consider undervalued stocks that could offer potential growth.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Computer Modelling Group (TSX:CMG) | CA$11.67 | CA$22.25 | 47.5% |

| Alvopetro Energy (TSXV:ALV) | CA$5.08 | CA$9.12 | 44.3% |

| Calian Group (TSX:CGY) | CA$42.88 | CA$72.69 | 41% |

| Kinaxis (TSX:KXS) | CA$144.65 | CA$284.08 | 49.1% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Currency Exchange International (TSX:CXI) | CA$25.15 | CA$39.66 | 36.6% |

| Endeavour Mining (TSX:EDV) | CA$27.57 | CA$53.03 | 48% |

| Triple Flag Precious Metals (TSX:TFPM) | CA$20.82 | CA$33.59 | 38% |

| NanoXplore (TSX:GRA) | CA$2.30 | CA$4.22 | 45.5% |

| Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

We're going to check out a few of the best picks from our screener tool.

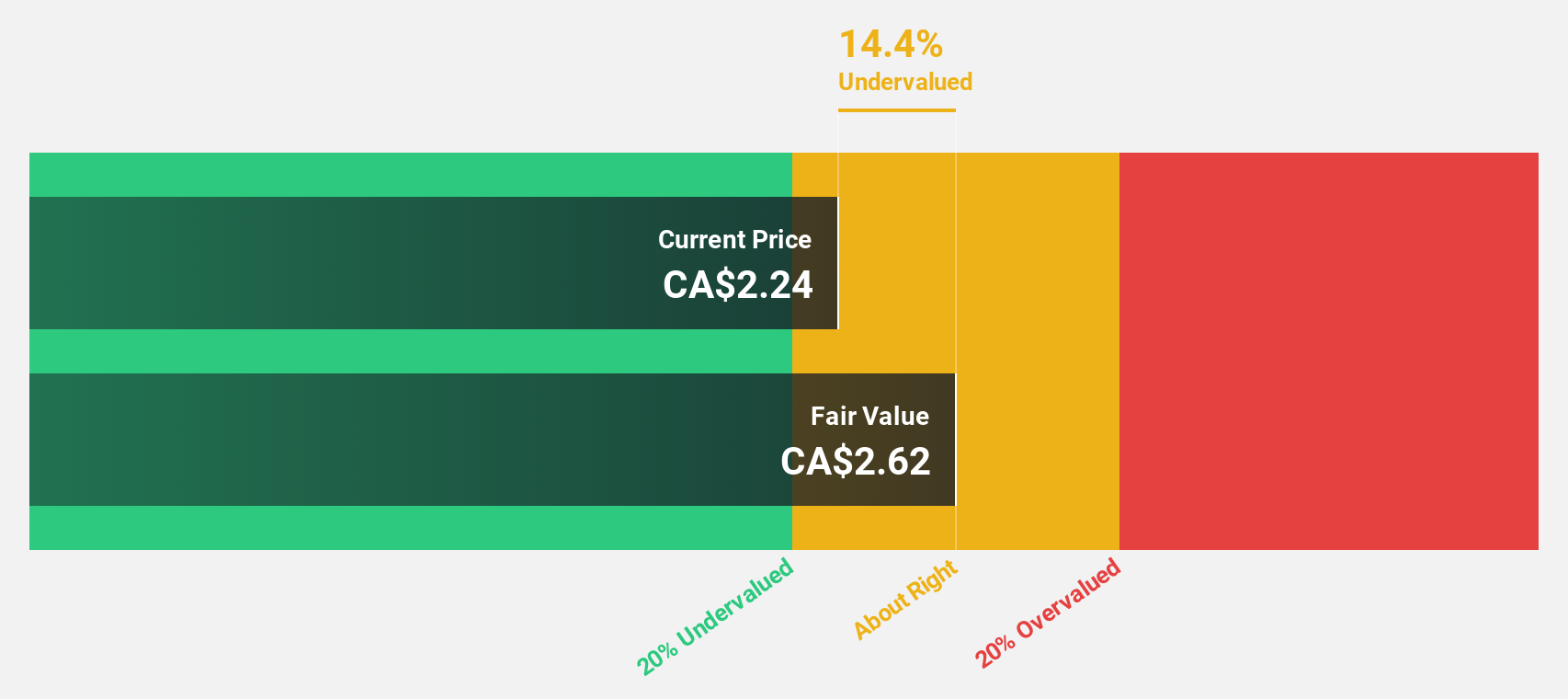

NanoXplore (TSX:GRA)

Overview: NanoXplore Inc. (TSX:GRA) is a graphene company that manufactures and supplies graphene powder for industrial markets, with a market cap of CA$392.40 million.

Operations: Revenue Segments (in millions of CA$): NanoXplore generates revenue from manufacturing and supplying graphene powder for industrial markets.

Estimated Discount To Fair Value: 45.5%

NanoXplore appears significantly undervalued, trading at CA$2.30 while its estimated fair value is CA$4.22. The company’s revenue is forecast to grow 22.8% annually, outpacing the Canadian market average of 6.7%. Despite having less than one year of cash runway, NanoXplore's earnings are expected to grow 59.35% per year and achieve profitability within three years. Recent board addition Hélène V. Gagnon brings extensive sustainability and governance expertise, potentially bolstering strategic initiatives.

- The analysis detailed in our NanoXplore growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of NanoXplore.

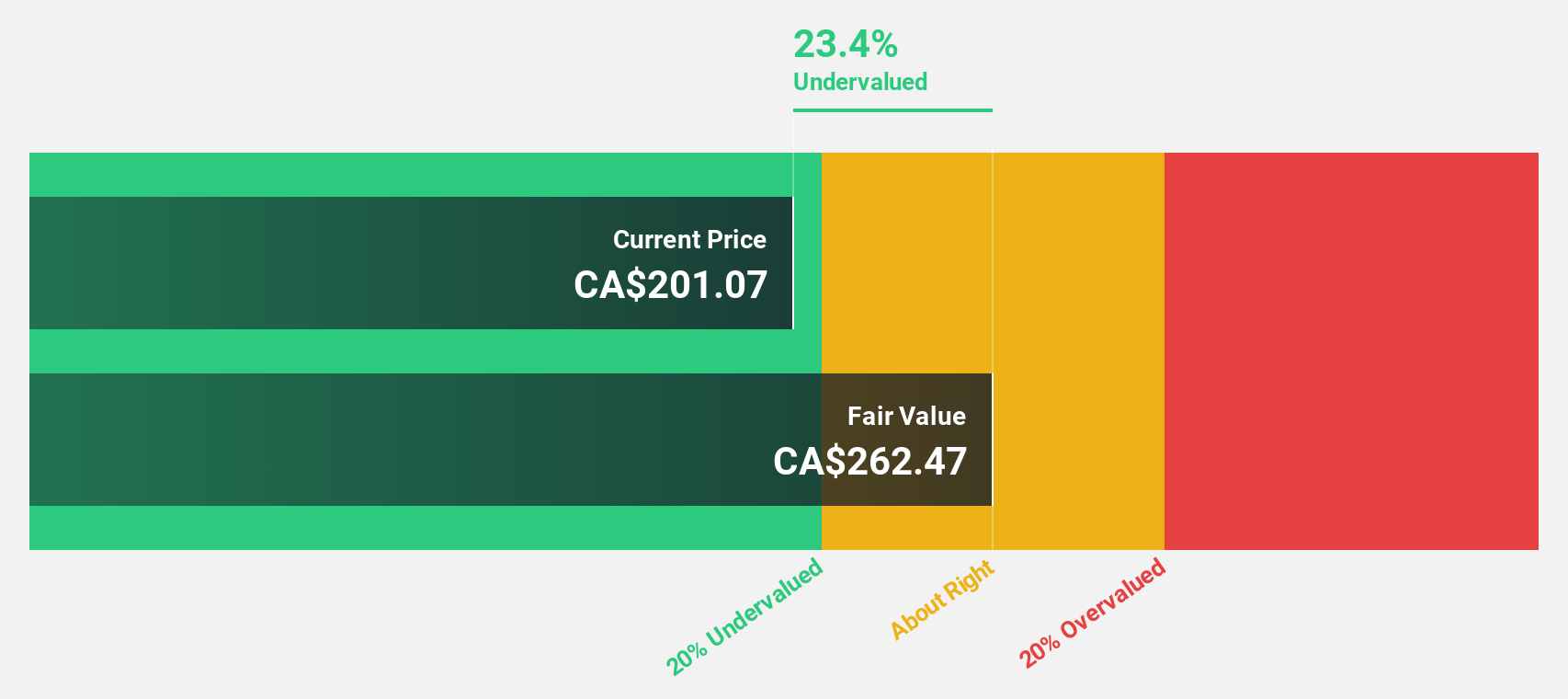

Kinaxis (TSX:KXS)

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada, with a market cap of CA$4.08 billion.

Operations: The company's revenue is primarily derived from its software and programming segment, which generated $457.72 million.

Estimated Discount To Fair Value: 49.1%

Kinaxis is trading at CA$144.65, significantly below its estimated fair value of CA$284.08. Earnings are forecast to grow 47.4% annually over the next three years, outpacing the Canadian market's 15.3%. Despite recent executive departures and investor activism urging a sale, Kinaxis remains strong in supply chain planning with new client wins like Brother and Syensqo, and innovative products such as the AI-powered Maestro platform enhancing its competitive edge.

- According our earnings growth report, there's an indication that Kinaxis might be ready to expand.

- Take a closer look at Kinaxis' balance sheet health here in our report.

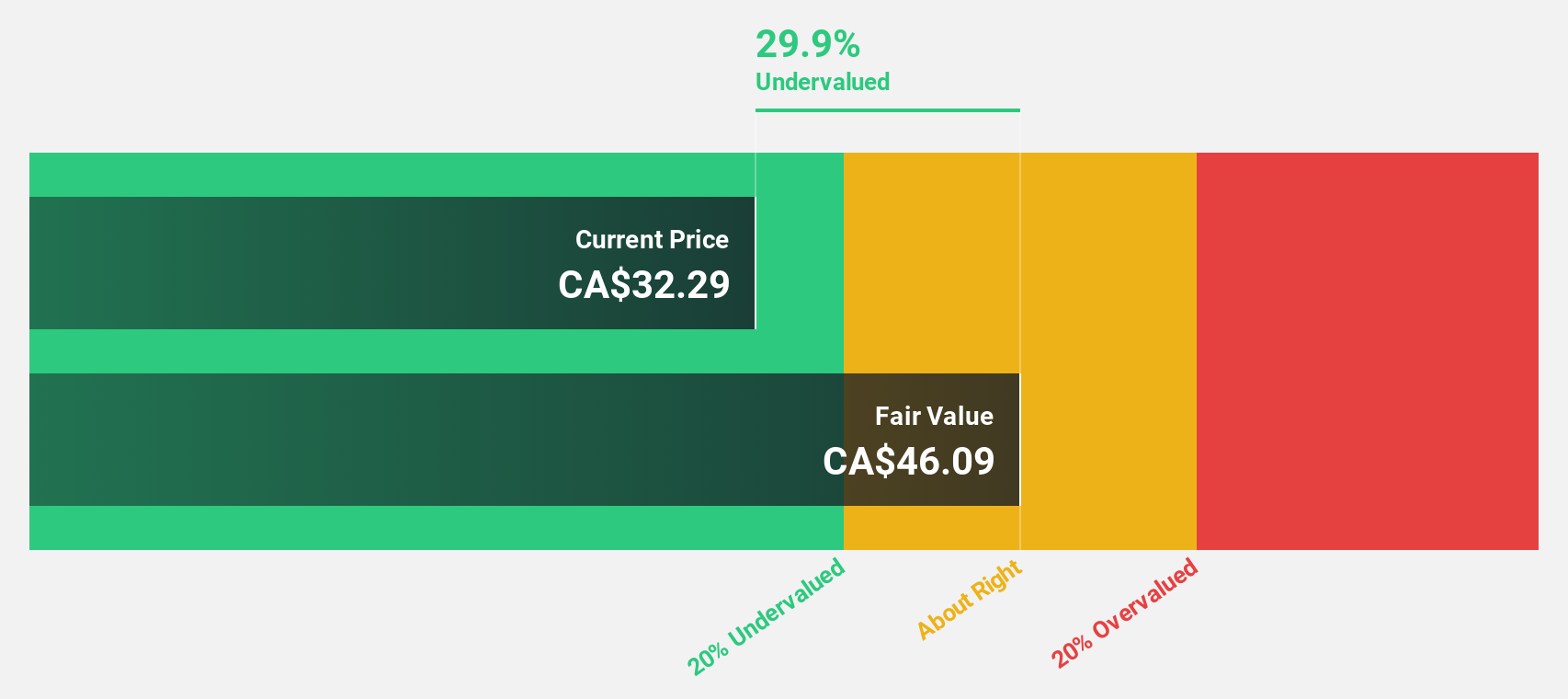

Triple Flag Precious Metals (TSX:TFPM)

Overview: Triple Flag Precious Metals Corp., a precious-metals-focused streaming and royalty company with operations in various countries including Australia, Canada, and the United States, has a market cap of approximately CA$4.19 billion.

Operations: The company's revenue segment focuses on acquiring and managing precious metal and other high-quality streams and royalties, generating $222.27 million.

Estimated Discount To Fair Value: 38%

Triple Flag Precious Metals is trading at CA$20.82, significantly below its estimated fair value of CA$33.59. Despite a recent net loss of US$111.44 million and significant insider selling, the company has expanded its portfolio by acquiring 3% gold streams on Agbaou and Bonikro mines for US$53 million. Revenue is forecast to grow 9.2% annually, outpacing the Canadian market's 6.7%, with earnings expected to rise substantially as the company becomes profitable within three years.

- Insights from our recent growth report point to a promising forecast for Triple Flag Precious Metals' business outlook.

- Unlock comprehensive insights into our analysis of Triple Flag Precious Metals stock in this financial health report.

Seize The Opportunity

- Take a closer look at our Undervalued TSX Stocks Based On Cash Flows list of 30 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triple Flag Precious Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TFPM

Triple Flag Precious Metals

A precious-metals-focused streaming and royalty company, engages in acquiring and managing precious metals, streams, royalties and other mineral interests in Australia, Canada, Colombia, Cote d’Ivoire, Honduras, Mexico, Mongolia, Peru, South Africa, the United States, and internationally.

Excellent balance sheet with moderate growth potential.