Why Descartes Systems Group (TSX:DSG) Is Up 8.9% After Record Q2 Revenue and New Retail Partnerships

Reviewed by Simply Wall St

- Descartes Systems Group reported record second-quarter fiscal 2026 results on September 3, 2025, with revenues reaching US$179.82 million, a 10% increase over the prior year, as well as improved net income and earnings per share, supported by acquisitions and higher service revenues.

- The company’s recent collaboration with Golf Superstore, leveraging the Descartes Sellercloud omnichannel platform, highlights expanding adoption of its solutions among mid-market retailers seeking streamlined inventory and order management across physical and online sales channels.

- We’ll explore how these strong quarterly results and new customer wins reinforce Descartes’ position in logistics technology and recurring revenue growth.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Descartes Systems Group Investment Narrative Recap

To be a shareholder in Descartes Systems Group, you need to believe in the persistence of global logistics complexity and the company’s ability to drive recurring revenue through both organic growth and strategic acquisitions. The latest record quarterly results support this narrative, but near-term performance still hinges on the company’s success in integrating acquisitions to sustain revenue momentum; the risk of revenue fluctuations from slowdowns in underlying logistics volumes remains largely unchanged by this news.

Among recent announcements, the collaboration with Golf Superstore, utilizing Descartes Sellercloud for unified omnichannel operations, stands out. This partnership exemplifies the increasing adoption of Descartes’ e-commerce management solutions and links directly to one of the key short-term catalysts: expanding recurring services revenue as retailers seek efficiency gains across physical and online channels.

However, in contrast to these growth signals, it is important for investors to be aware of ongoing concerns about volatility in global trade volumes and how...

Read the full narrative on Descartes Systems Group (it's free!)

Descartes Systems Group is projected to reach $899.6 million in revenue and $240.4 million in earnings by 2028. This scenario assumes annual revenue growth of 10.4% and an earnings increase of $95.6 million from the current $144.8 million.

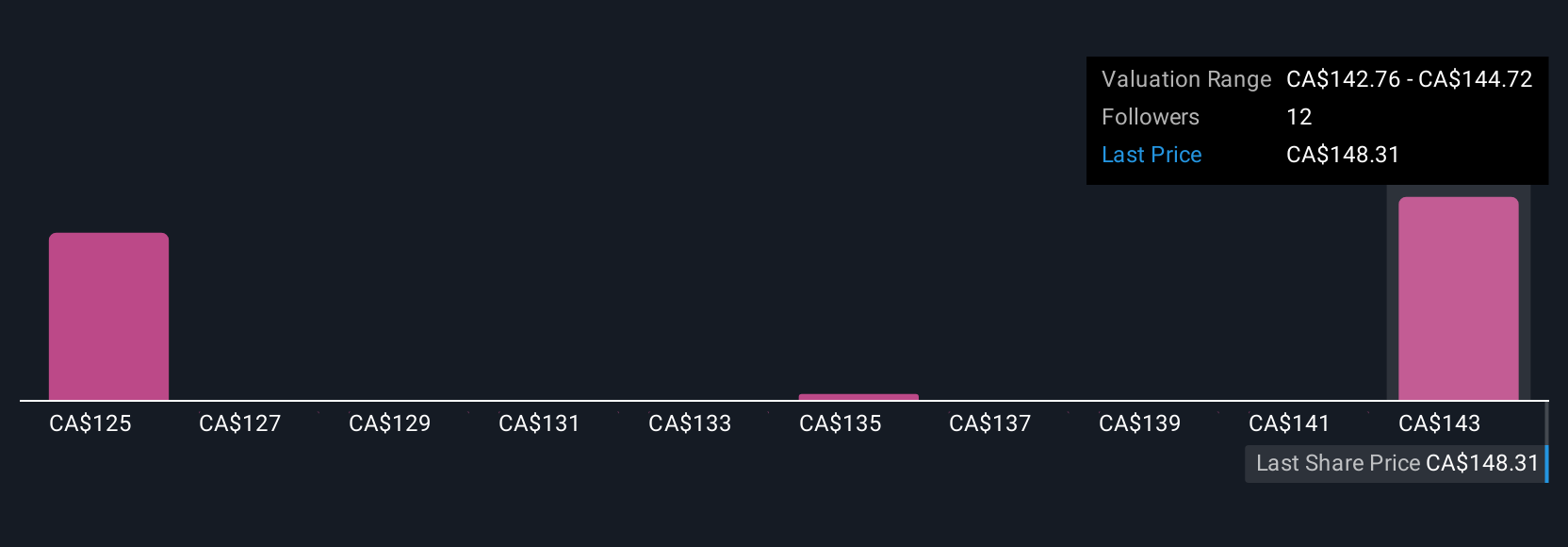

Uncover how Descartes Systems Group's forecasts yield a CA$144.72 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Three unique fair value estimates from the Simply Wall St Community put Descartes’ shares between CA$125.63 and CA$144.72. While some see room for higher recurring revenue, swings in core transportation volumes could weigh on performance, showing that opinions on the company’s outlook differ widely.

Explore 3 other fair value estimates on Descartes Systems Group - why the stock might be worth 16% less than the current price!

Build Your Own Descartes Systems Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Descartes Systems Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Descartes Systems Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Descartes Systems Group's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DSG

Descartes Systems Group

Provides global logistics technology solutions worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives