Assessing Descartes Systems Group (TSX:DSG)’s Valuation After New Buyback Plan and Earnings Growth

Reviewed by Simply Wall St

Descartes Systems Group (TSX:DSG) just paired a fresh earnings beat with a sizeable share repurchase plan, aiming to cancel up to roughly 10% of its stock over the next year.

See our latest analysis for Descartes Systems Group.

The new repurchase plan and solid quarterly numbers come after a choppy run for the stock, with a 1 month share price return of 6.55% but a year to date share price decline of 23.77%. At the same time, the 3 year total shareholder return of 32.71% and 5 year total shareholder return of 58.99% show that, despite the recent 1 year total shareholder return of negative 27.00%, long term holders are still comfortably ahead and will be watching to see if this buyback marks a turning point in momentum.

If you like the Descartes story but want a few more ideas in the same space, this could be a good time to explore high growth tech and AI stocks.

With double digit earnings growth, a modest discount to analyst targets and a near 10% buyback in play, the key question is whether Descartes is quietly undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative: 5.5% Undervalued

With Descartes Systems Group closing at CA$124.65 against a narrative fair value of CA$131.93, the story frames modest upside built on compounding fundamentals.

Ongoing digital transformation and automation initiatives in transportation and supply chain sectors, combined with Descartes' leadership in real time shipment tracking (MacroPoint) and AI driven optimization, are enhancing customer stickiness and differentiation and are likely supporting net margin expansion and increasing share in flat or declining end markets.

Want to see what kind of growth trajectory and margin expansion could underpin that premium earnings multiple and still imply upside from here? The full narrative reveals the playbook.

Result: Fair Value of CA$131.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness in freight volumes or a stumble in integrating acquisitions could quickly cap organic growth and challenge today’s premium valuation assumptions.

Find out about the key risks to this Descartes Systems Group narrative.

Another Angle on Valuation

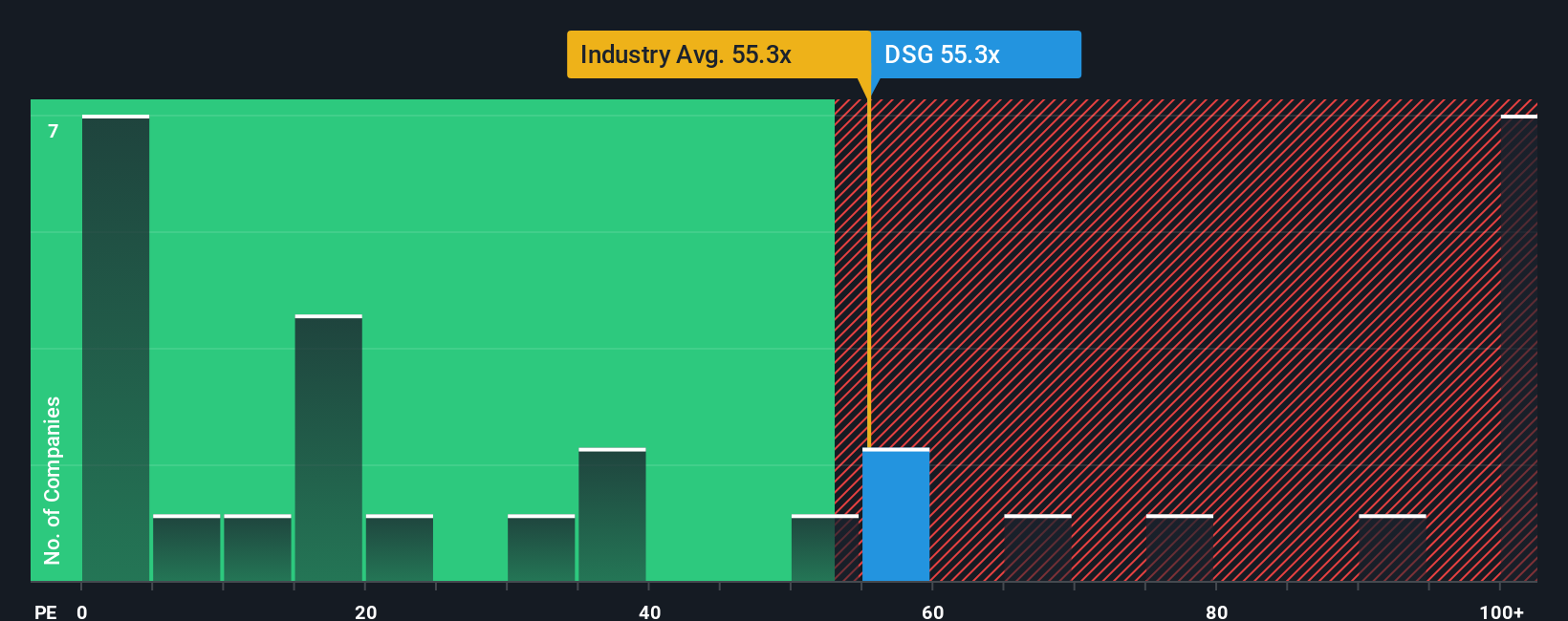

On a straightforward price-to-earnings view, Descartes looks richer than it first appears, trading at 50.1 times earnings versus a fair ratio of 31.2 times and slightly above the Canadian software average of 49.4 times. This suggests there may be less room for error than the DCF implies.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Descartes Systems Group Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Descartes Systems Group.

Looking for your next investing move?

Before the market locks in its next leaders, use the Simply Wall St Screener to uncover focused opportunities that match your strategy and sharpen your edge.

- Capture mispriced opportunities by scanning these 911 undervalued stocks based on cash flows where cash flow strength and valuation work together in your favor.

- Ride structural growth themes with these 25 AI penny stocks targeting companies pushing the boundaries of applied artificial intelligence.

- Strengthen your income stream through these 13 dividend stocks with yields > 3% designed for investors who want reliable yield without ignoring fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DSG

Descartes Systems Group

Provides global logistics technology solutions worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)