Need To Know: Analysts Are Much More Bullish On Converge Technology Solutions Corp. (TSE:CTS)

Converge Technology Solutions Corp. (TSE:CTS) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. The market seems to be pricing in some improvement in the business too, with the stock up 5.6% over the past week, closing at CA$11.43. Could this big upgrade push the stock even higher?

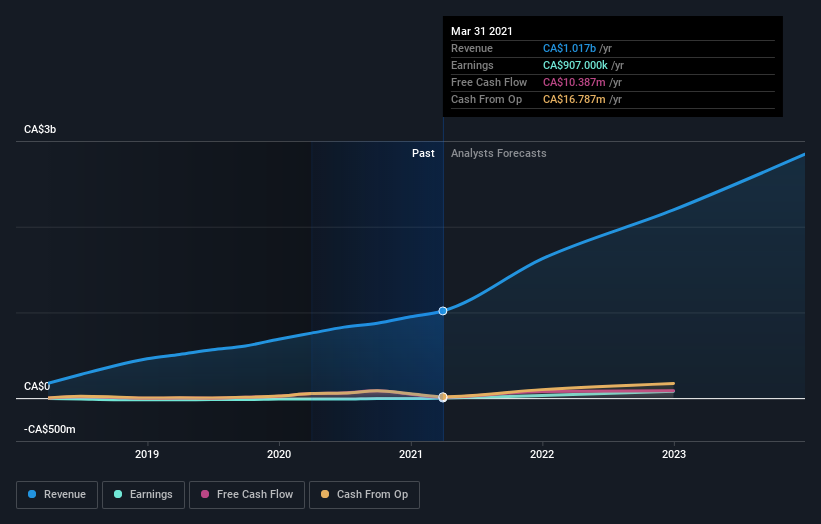

Following the upgrade, the most recent consensus for Converge Technology Solutions from its eight analysts is for revenues of CA$1.7b in 2021 which, if met, would be a sizeable 63% increase on its sales over the past 12 months. Statutory earnings per share are presumed to jump 5,763% to CA$0.33. Before this latest update, the analysts had been forecasting revenues of CA$1.5b and earnings per share (EPS) of CA$0.28 in 2021. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

See our latest analysis for Converge Technology Solutions

It will come as no surprise to learn that the analysts have increased their price target for Converge Technology Solutions 20% to CA$13.53 on the back of these upgrades. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Converge Technology Solutions, with the most bullish analyst valuing it at CA$14.75 and the most bearish at CA$12.50 per share. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or that the analysts have a clear view on its prospects.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's clear from the latest estimates that Converge Technology Solutions' rate of growth is expected to accelerate meaningfully, with the forecast 93% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 43% p.a. over the past three years. Compare this with other companies in the same industry, which are forecast to grow their revenue 13% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Converge Technology Solutions to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. With a serious upgrade to expectations and a rising price target, it might be time to take another look at Converge Technology Solutions.

Analysts are definitely bullish on Converge Technology Solutions, but no company is perfect. Indeed, you should know that there are several potential concerns to be aware of, including major dilution from new stock issuance in the past year. For more information, you can click through to our platform to learn more about this and the 2 other concerns we've identified .

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:CTS

Converge Technology Solutions

Provides software-enabled IT and cloud solutions in the United States and Canada.

Undervalued with excellent balance sheet.