- Canada

- /

- Oil and Gas

- /

- TSX:PEY

Peyto Exploration & Development (TSX:PEY) Confirms $0.11 Dividend Amid 24.6% Projected Earnings Growth

Reviewed by Simply Wall St

Dive into the specifics of Peyto Exploration & Development here with our thorough analysis report.

Unique Capabilities Enhancing Peyto Exploration & Development's Market Position

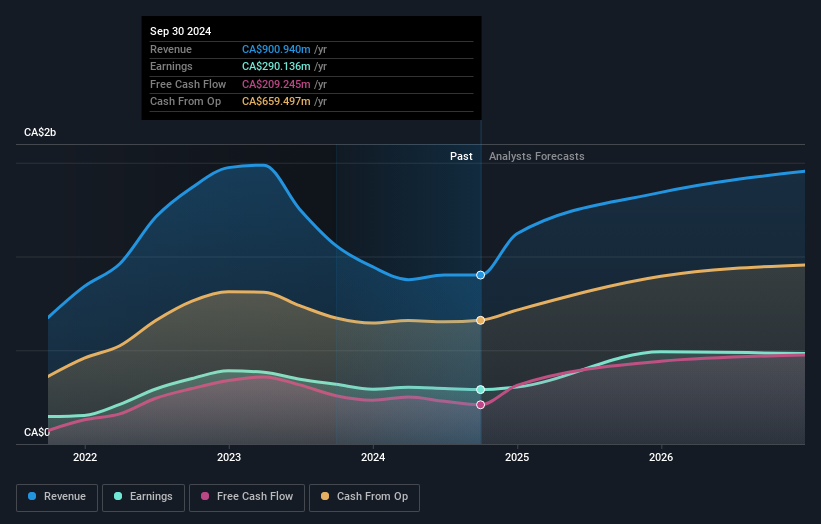

Peyto Exploration & Development has demonstrated operational efficiency, maintaining the lowest cash costs in its sector and achieving an impressive operating margin of 64%, as noted by CEO Jean-Paul Lachance. This efficiency is complemented by a strategic drilling program, which has led to a 40% productivity improvement on Repsol lands. Such operational strengths are pivotal in driving the company's earnings growth, projected at 24.6% annually over the next three years. Furthermore, Peyto's net profit margins have improved to 32.2%, reflecting effective cost management. The company's financial health is further underscored by its dividend yield of 8.15%, placing it among the top 25% of Canadian dividend payers. The recent affirmation of a $0.11 per share dividend for December 2024 reinforces its commitment to returning value to shareholders.

Challenges Constraining Peyto Exploration & Development's Potential

Peyto faces challenges such as increased operating costs, partly due to production curtailments and higher government levies, as highlighted by VP Todd Burdick. The company's financial management is under scrutiny, with CapEx and dividends exceeding free funds flow, raising concerns about sustainability. Additionally, Peyto's net debt to equity ratio stands at a high 48.9%, which could impact its financial stability. The company's earnings growth has seen a 7.3% decline over the past year, and its return on equity is relatively low at 10.6%, below the industry threshold. While Peyto is trading below its estimated fair value, this valuation suggests potential but also highlights its relative expense compared to industry averages.

Potential Strategies for Leveraging Growth and Competitive Advantage

Opportunities for Peyto include expansion through new discoveries, such as the prolific Falher channel, which offers 20 follow-up drilling locations. The preliminary 2025 budget plans to allocate $450-$500 million for drilling 70-80 wells, indicating a strong growth trajectory. Market diversification is also a focus, with strategic contracts like the TC mainline transportation service to Union Parkway Belt and a gas supply agreement with the Cascade power plant. These initiatives not only enhance Peyto's market position but also capitalize on emerging opportunities in the energy sector, potentially driving increased investor interest.

Competitive Pressures and Market Risks Facing Peyto Exploration & Development

Peyto must navigate commodity price volatility, despite hedging close to $800 million in fixed revenue for the next year, as mentioned by Lachance. Regulatory and environmental costs, including unexpected government levies, pose additional challenges. The company also faces competitive pressures from insider selling and high debt levels, which could affect its market share and financial stability. These external factors necessitate careful management to sustain growth and maintain investor confidence.

Conclusion

Peyto Exploration & Development's operational efficiency and strategic drilling initiatives have positioned it for substantial earnings growth, projected at 24.6% annually over the next three years. This strong performance is reflected in its impressive operating margin and improved net profit margins, which underscore effective cost management and financial health. However, the company faces challenges such as increased operating costs and high debt levels, which could impact financial stability. Peyto's expansion plans and market diversification efforts present significant growth opportunities. Trading below its estimated fair value, Peyto represents a potential investment opportunity, with the caveat of its higher relative expense compared to industry peers. This suggests that while there are risks, the company's strategic initiatives and market positioning could lead to favorable future performance for investors willing to navigate these complexities.

Summing It All Up

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PEY

Peyto Exploration & Development

Engages in the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta’s deep basin.

Good value average dividend payer.

Market Insights

Community Narratives