Amid a backdrop of political developments and economic shifts, global markets have been experiencing notable movements, with U.S. stocks reaching record highs driven by optimism surrounding trade policies and artificial intelligence investments. As major indices continue to navigate these changes, investors are increasingly on the lookout for stocks that might be trading below their estimated value, presenting potential opportunities in an evolving market landscape. Identifying such undervalued stocks often involves assessing fundamentals and market sentiment to determine if they offer a margin of safety relative to their intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Aidma Holdings (TSE:7373) | ¥1822.00 | ¥3615.82 | 49.6% |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.58 | CN¥100.77 | 49.8% |

| GlobalData (AIM:DATA) | £1.78 | £3.56 | 49.9% |

| Zhaojin Mining Industry (SEHK:1818) | HK$12.14 | HK$24.09 | 49.6% |

| Bufab (OM:BUFAB) | SEK464.20 | SEK926.28 | 49.9% |

| Nidaros Sparebank (OB:NISB) | NOK100.02 | NOK198.62 | 49.6% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥25.94 | 49.7% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥13.83 | CN¥27.64 | 50% |

| South32 (ASX:S32) | A$3.36 | A$6.68 | 49.7% |

| Condor Energies (TSX:CDR) | CA$1.83 | CA$3.64 | 49.7% |

Underneath we present a selection of stocks filtered out by our screen.

EuroGroup Laminations (BIT:EGLA)

Overview: EuroGroup Laminations S.p.A. designs, produces, and distributes motor cores for electric motors and generators across various regions including Europe, the Middle East, Africa, North America, Mexico, the United States, Asia, and China with a market cap of €409.26 million.

Operations: The company's revenue is derived from two main segments: Industrial, contributing €311.06 million, and EV & Automotive, which accounts for €529.81 million.

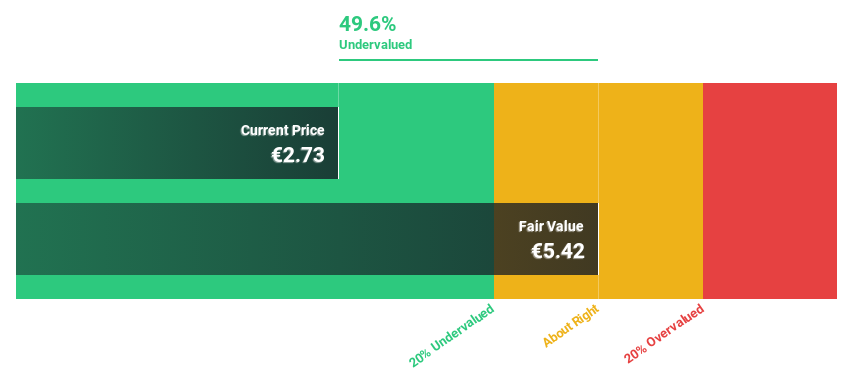

Estimated Discount To Fair Value: 48.7%

EuroGroup Laminations appears undervalued based on cash flows, trading at €2.62, below its estimated fair value of €5.1. Despite a decline in net income to €16.86 million for the nine months ending September 2024, revenue is expected to grow 13.9% annually, outpacing the Italian market's 4%. Earnings are forecasted to grow significantly at 43.1% per year, suggesting potential upside despite recent volatility and reduced profit margins from last year.

- Our comprehensive growth report raises the possibility that EuroGroup Laminations is poised for substantial financial growth.

- Get an in-depth perspective on EuroGroup Laminations' balance sheet by reading our health report here.

74Software (ENXTPA:74SW)

Overview: 74Software is an infrastructure software publisher with operations in France, the rest of Europe, the Americas, and the Asia Pacific, and has a market cap of €779.50 million.

Operations: The company's revenue segments consist of License (€8.46 million), Maintenance (€77.04 million), Subscription (€201.19 million), and Services excluding Subscription (€35.49 million).

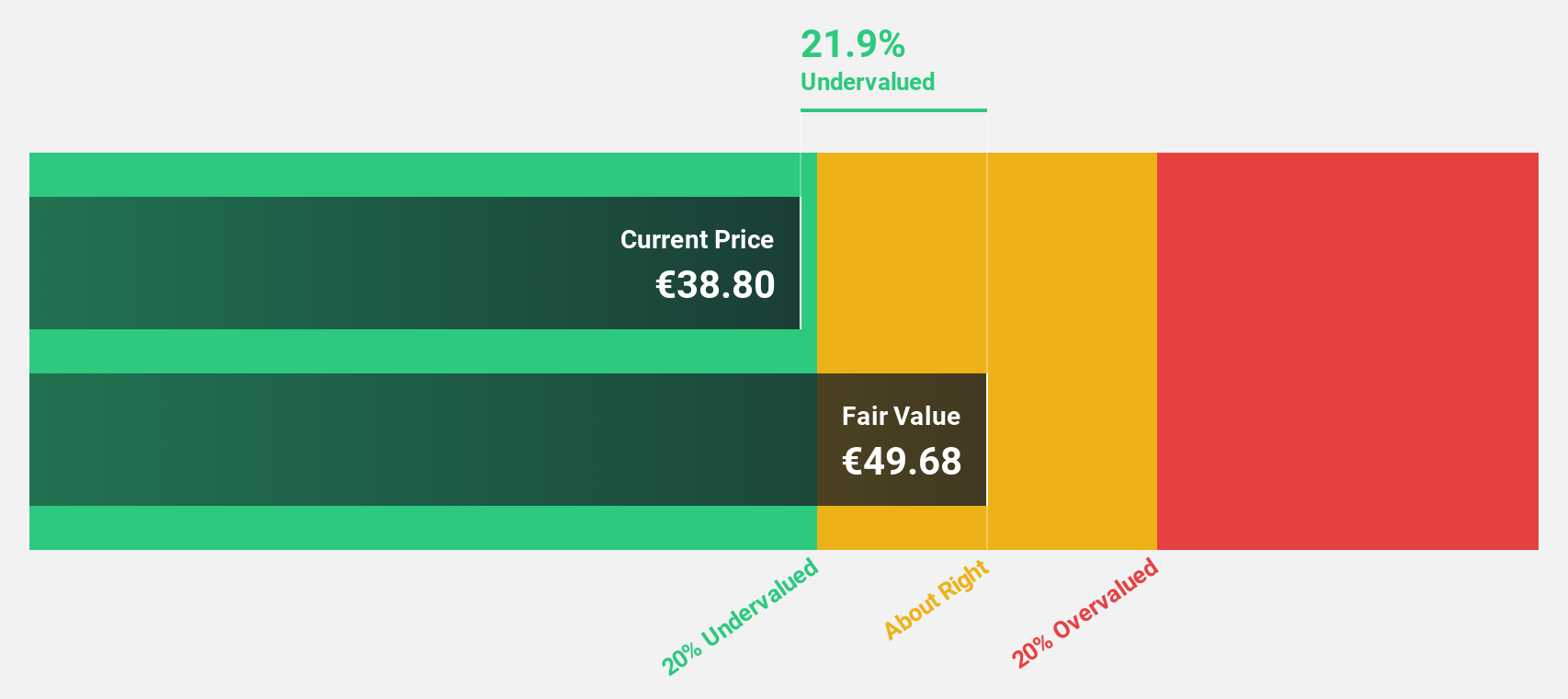

Estimated Discount To Fair Value: 48.6%

74Software, formerly Axway Software SA, is trading at €27.1, significantly below its estimated fair value of €52.77, highlighting its undervaluation based on cash flows. The company became profitable this year and is forecasted to grow earnings by 20.94% annually, surpassing the French market's growth rate. Although shareholders experienced substantial dilution last year and return on equity is expected to remain low at 8.4%, revenue growth prospects remain robust at 13.4% per year.

- The analysis detailed in our 74Software growth report hints at robust future financial performance.

- Navigate through the intricacies of 74Software with our comprehensive financial health report here.

Computer Modelling Group (TSX:CMG)

Overview: Computer Modelling Group Ltd. is a software and consulting technology company that develops and licenses reservoir simulation and seismic interpretation software, with a market cap of CA$847.96 million.

Operations: The company's revenue segments include CA$34.74 million from BHV and CA$90.55 million from CMG, focusing on reservoir simulation and seismic interpretation software and related services.

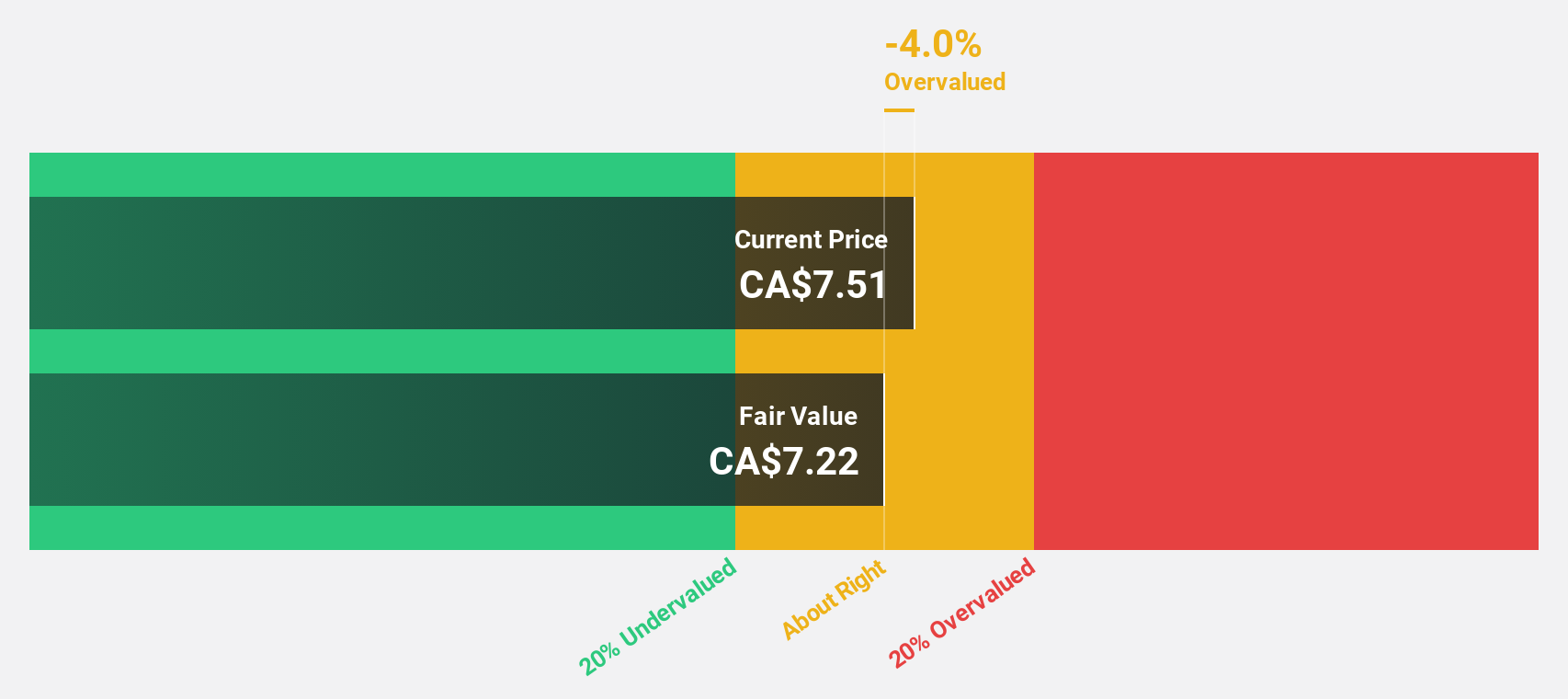

Estimated Discount To Fair Value: 15.9%

Computer Modelling Group, trading at CA$10.43, is undervalued with a fair value estimate of CA$12.4, supported by strong forecasted earnings growth of 35.5% annually—outpacing the Canadian market. Despite lower profit margins this year compared to last and an unstable dividend track record, CMG's collaboration with NVIDIA aims to enhance simulation solutions for energy efficiency and carbon capture projects, potentially boosting its long-term cash flow generation capabilities.

- Upon reviewing our latest growth report, Computer Modelling Group's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Computer Modelling Group with our detailed financial health report.

Next Steps

- Get an in-depth perspective on all 908 Undervalued Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CMG

Computer Modelling Group

A software and consulting technology company, engages in the development and licensing of reservoir simulation and seismic interpretation software and related services.

Flawless balance sheet and good value.

Market Insights

Community Narratives