Analysts Just Made A Significant Upgrade To Their BlackBerry Limited (TSE:BB) Forecasts

BlackBerry Limited (TSE:BB) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with analysts modelling a real improvement in business performance.

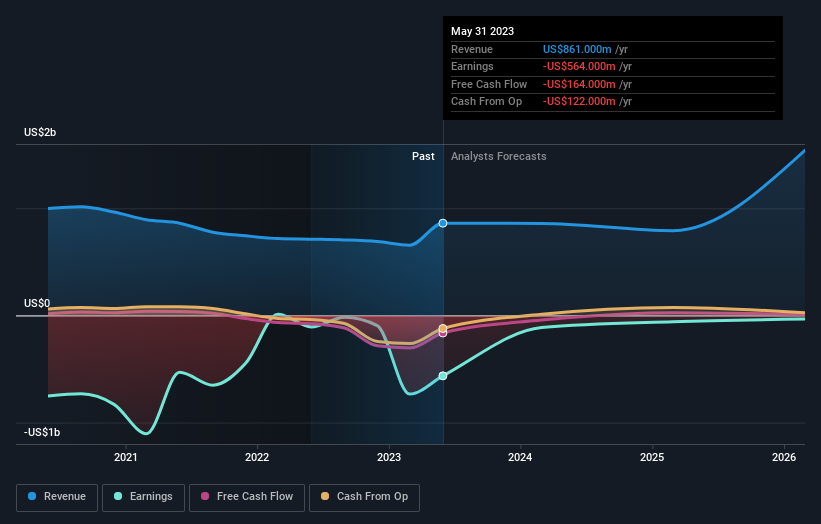

Following the latest upgrade, BlackBerry's nine analysts currently expect revenues in 2024 to be US$859m, approximately in line with the last 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 82% to US$0.18. However, before this estimates update, the consensus had been expecting revenues of US$699m and US$0.20 per share in losses. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a sizeable increase to their revenue forecasts while also reducing the estimated loss as the business grows towards breakeven.

View our latest analysis for BlackBerry

The consensus price target rose 5.1% to US$4.71, with the analysts encouraged by the higher revenue and lower forecast losses for this year. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic BlackBerry analyst has a price target of US$6.48 per share, while the most pessimistic values it at US$6.03. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting BlackBerry is an easy business to forecast or the underlying assumptions are obvious.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would also point out that the forecast 0.3% annualised revenue decline to the end of 2024 is better than the historical trend, which saw revenues shrink 6.2% annually over the past five years By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue grow 16% per year. So it's pretty clear that, while it does have declining revenues, the analysts also expect BlackBerry to suffer worse than the wider industry.

The Bottom Line

The highlight for us was that the consensus reduced its estimated losses this year, perhaps suggesting BlackBerry is moving incrementally towards profitability. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, BlackBerry could be worth investigating further.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for BlackBerry going out to 2026, and you can see them free on our platform here..

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if BlackBerry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BB

BlackBerry

Provides intelligent security software and services to enterprises and governments worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026