- Canada

- /

- Metals and Mining

- /

- TSXV:LRA

Alithya Group And 2 Other TSX Penny Stocks To Consider

Reviewed by Simply Wall St

The Canadian market has shown resilience, climbing 1.0% over the last week and 27% over the past year, with earnings forecast to grow by 16% annually. Investing in penny stocks—an area often associated with smaller or newer companies—can still offer unique growth opportunities when these stocks are supported by strong financial health. Despite being considered a niche investment category, penny stocks may present underappreciated chances for growth at lower price points, especially when they exhibit solid fundamentals and balance sheet strength.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$620.88M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$4.4M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.24 | CA$297.04M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$119.71M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$303.41M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$221.84M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$30.89M | ★★★★★★ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Alithya Group (TSX:ALYA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alithya Group Inc. offers strategy and digital technology services across Canada, the United States, and Europe, with a market cap of CA$173.51 million.

Operations: The company generates revenue from its Management Consulting Services segment, which amounts to CA$480.41 million.

Market Cap: CA$173.51M

Alithya Group Inc., with a market cap of CA$173.51 million, operates in the digital technology services sector and reported first-quarter revenue of CA$120.88 million, down from CA$131.6 million a year earlier. Despite being unprofitable, Alithya has managed to reduce its net loss to CA$2.76 million from CA$7.25 million and maintains a strong cash runway exceeding three years due to positive free cash flow growth of 48.1% annually. The company is trading at 81.5% below estimated fair value and has completed share buybacks totaling 576,151 shares for CAD 1.08 million since September 2023.

- Unlock comprehensive insights into our analysis of Alithya Group stock in this financial health report.

- Assess Alithya Group's future earnings estimates with our detailed growth reports.

Quipt Home Medical (TSX:QIPT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Quipt Home Medical Corp. operates through its subsidiaries to provide durable and home medical equipment and supplies in the United States, with a market cap of CA$174.51 million.

Operations: The company generates revenue of $244.23 million from its provision of durable and home medical equipment and supplies in the United States.

Market Cap: CA$174.51M

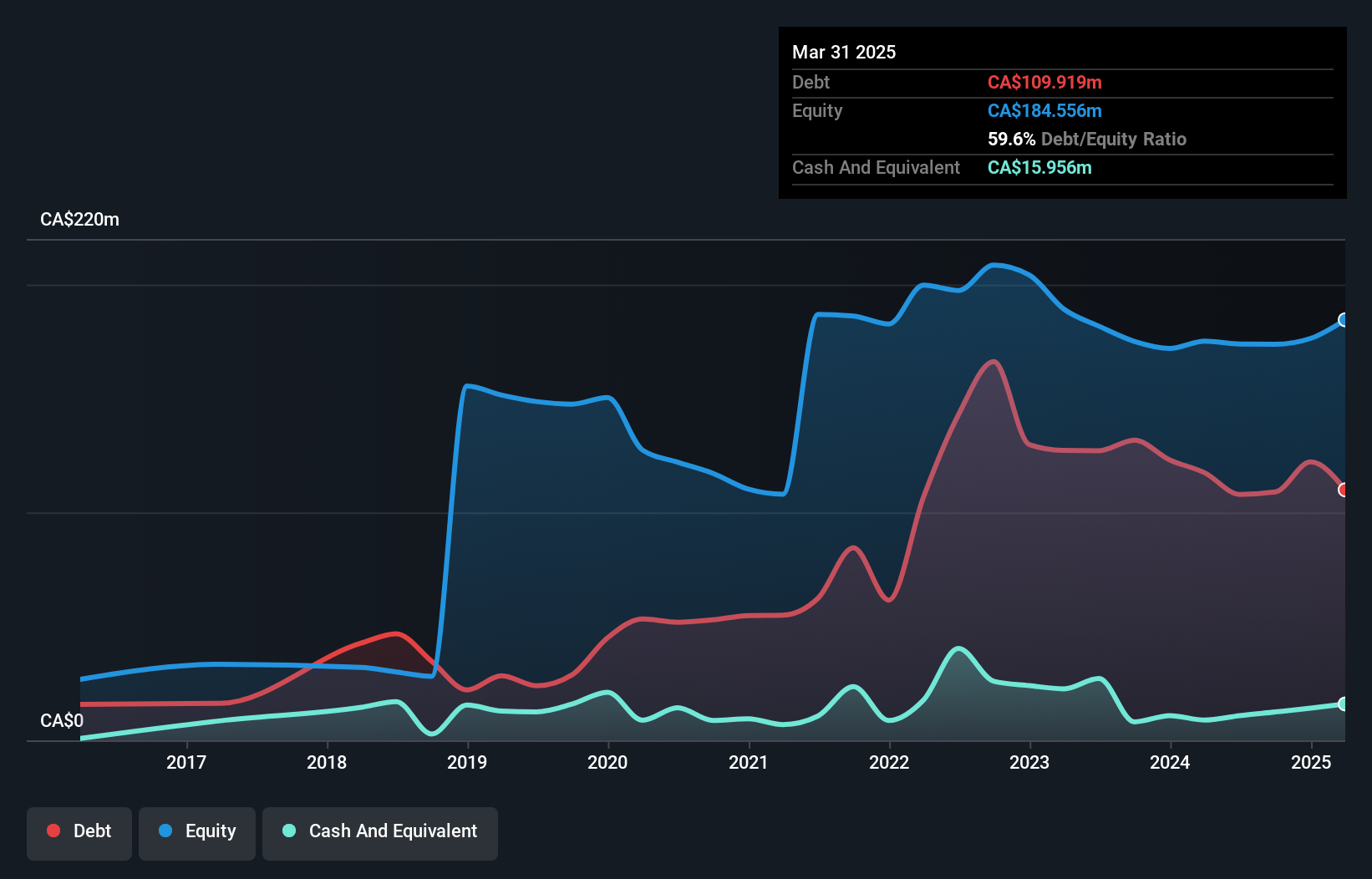

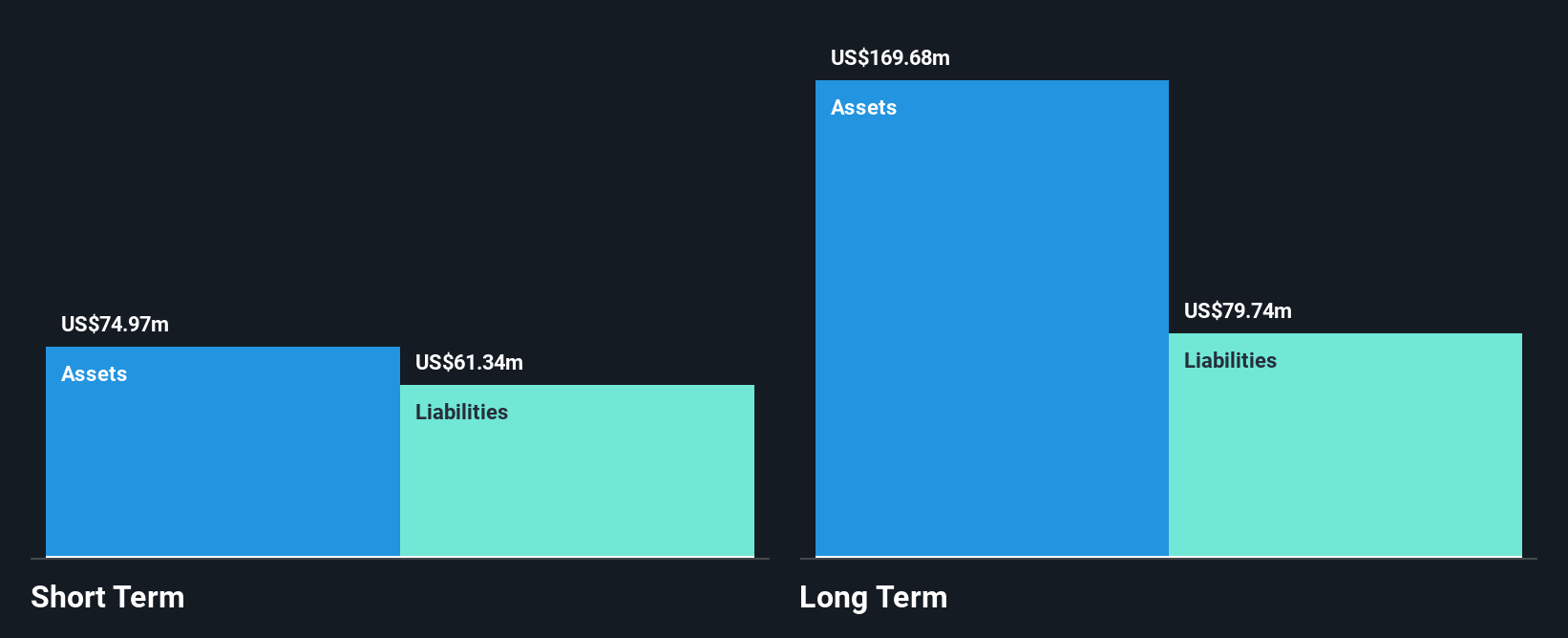

Quipt Home Medical, with a market cap of CA$174.51 million, is navigating the challenges of being unprofitable while focusing on strategic growth. Despite a net loss increase to US$3.65 million for the nine months ending June 2024, revenue rose to US$193.29 million from US$159.22 million year-on-year, reflecting its operational resilience in the U.S. healthcare market. The company has a seasoned management team and maintains sufficient cash runway for over three years due to positive free cash flow growth, positioning it well for potential acquisitions amidst higher interest rates and volatile markets, while trading below estimated fair value.

- Get an in-depth perspective on Quipt Home Medical's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Quipt Home Medical's future.

Lara Exploration (TSXV:LRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lara Exploration Ltd., with a market cap of CA$62.64 million, operates through its subsidiaries to acquire, explore, develop, and evaluate mineral properties in Brazil, Peru, and Chile.

Operations: Lara Exploration Ltd. does not report specific revenue segments but focuses on the acquisition, exploration, development, and evaluation of mineral properties in Brazil, Peru, and Chile.

Market Cap: CA$62.64M

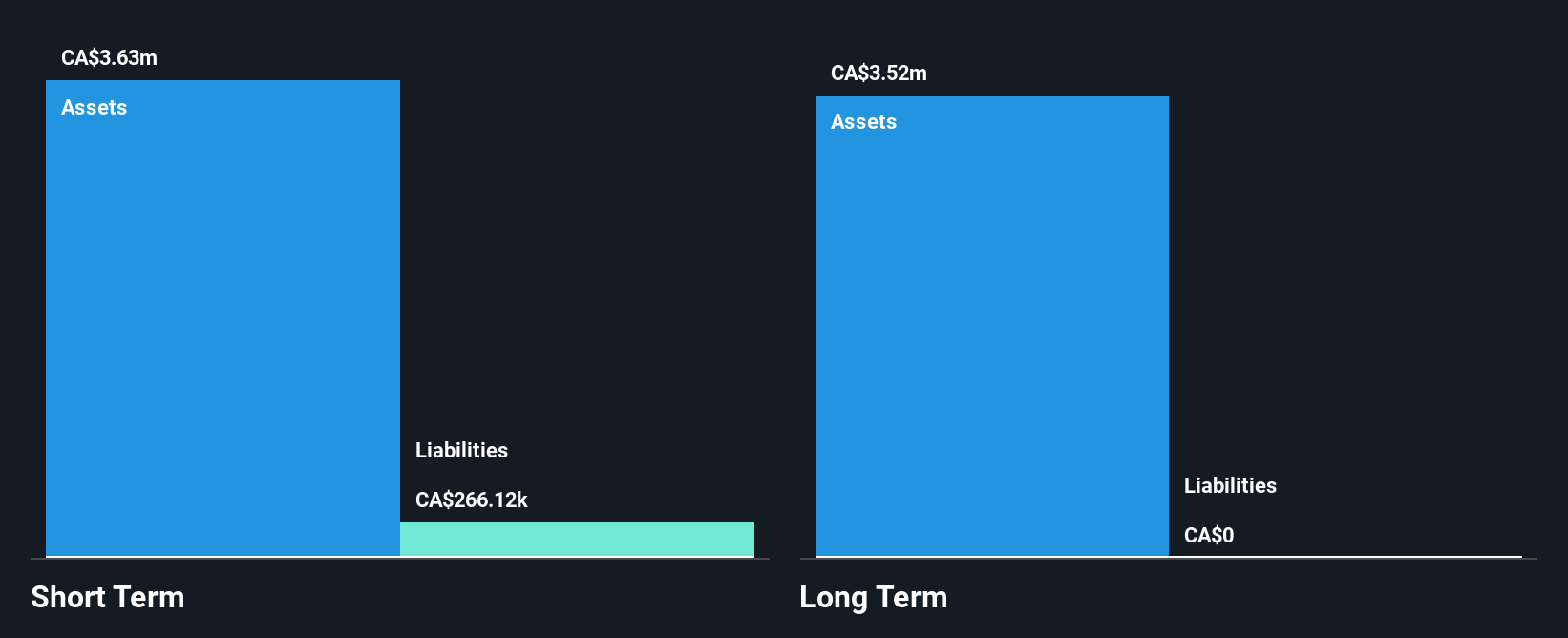

Lara Exploration Ltd., with a market cap of CA$62.64 million, is pre-revenue and unprofitable, yet holds potential due to its strategic mineral assets in Brazil, Peru, and Chile. The recent initial resource estimate for the Planalto Copper-Gold Project in Brazil highlights significant indicated resources of 47.7 million tonnes at an average grade of 0.53% copper and inferred resources totaling 154 million tonnes at an average grade of 0.36% copper. The company benefits from a debt-free balance sheet and experienced management team but faces challenges with declining earnings over the past five years despite recent profitability improvements reported in Q2 2024 results.

- Click here to discover the nuances of Lara Exploration with our detailed analytical financial health report.

- Evaluate Lara Exploration's historical performance by accessing our past performance report.

Next Steps

- Explore the 947 names from our TSX Penny Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LRA

Lara Exploration

Through its subsidiaries, engages in the acquisition, exploration, development, and evaluation of mineral properties in Brazil, Peru, and Chile.

Adequate balance sheet slight.

Market Insights

Community Narratives