Amid ongoing concerns about tariffs and their potential impact on economic growth, both the U.S. and Canadian markets continue to show resilience with above-trend growth, rising corporate profits, and historically low unemployment rates. For investors exploring beyond well-known stocks, penny stocks—often representing smaller or newer companies—can still present intriguing opportunities despite their somewhat outdated label. These stocks offer a blend of affordability and potential growth when supported by strong financials, making them a noteworthy consideration in today's market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.985 | CA$182.79M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.57 | CA$1.02B | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.73 | CA$441.37M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.45 | CA$124.55M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.41 | CA$235.26M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.51 | CA$14.61M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$647.19M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.6M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.86 | CA$397.63M | ★★★★★☆ |

Click here to see the full list of 943 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Alithya Group (TSX:ALYA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alithya Group Inc. offers strategy and digital technology services across Canada, the United States, and Europe with a market cap of CA$167.97 million.

Operations: The company generates revenue of CA$473.43 million from its Management Consulting Services segment.

Market Cap: CA$167.97M

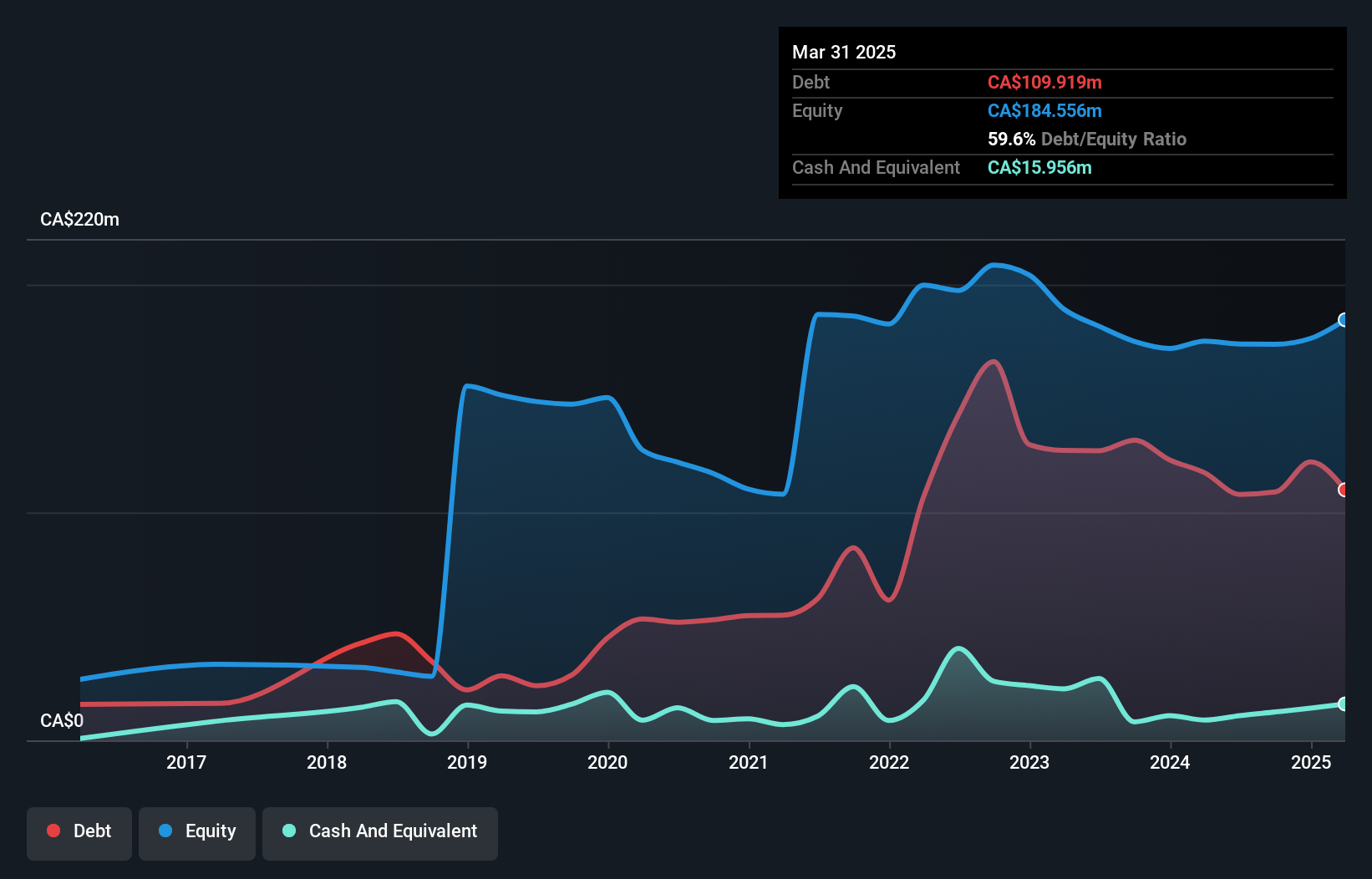

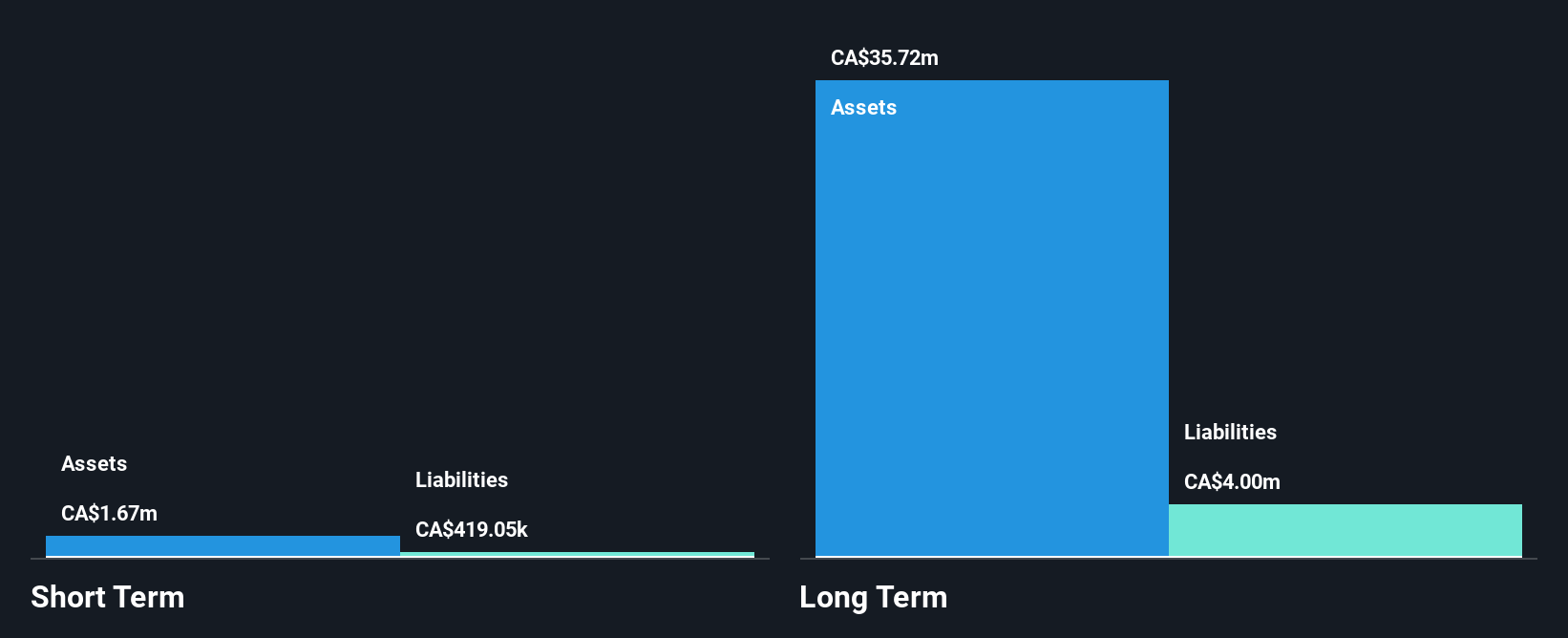

Alithya Group Inc., with a market cap of CA$167.97 million, is navigating the challenges typical of penny stocks, such as high debt levels and unprofitability. Despite these hurdles, Alithya's recent executive change appointing Nicolas Lavoie as CFO could bolster its strategic direction through his extensive M&A experience. The company reported reduced net losses for the second quarter of 2024 compared to the previous year and has a stable cash runway exceeding three years due to positive free cash flow. Additionally, its short-term assets surpass both short-term and long-term liabilities, indicating reasonable financial management amidst volatility.

- Dive into the specifics of Alithya Group here with our thorough balance sheet health report.

- Assess Alithya Group's future earnings estimates with our detailed growth reports.

Cartier Resources (TSXV:ECR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cartier Resources Inc. is involved in the acquisition and exploration of mining properties in Canada, with a market cap of CA$39.19 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$39.19M

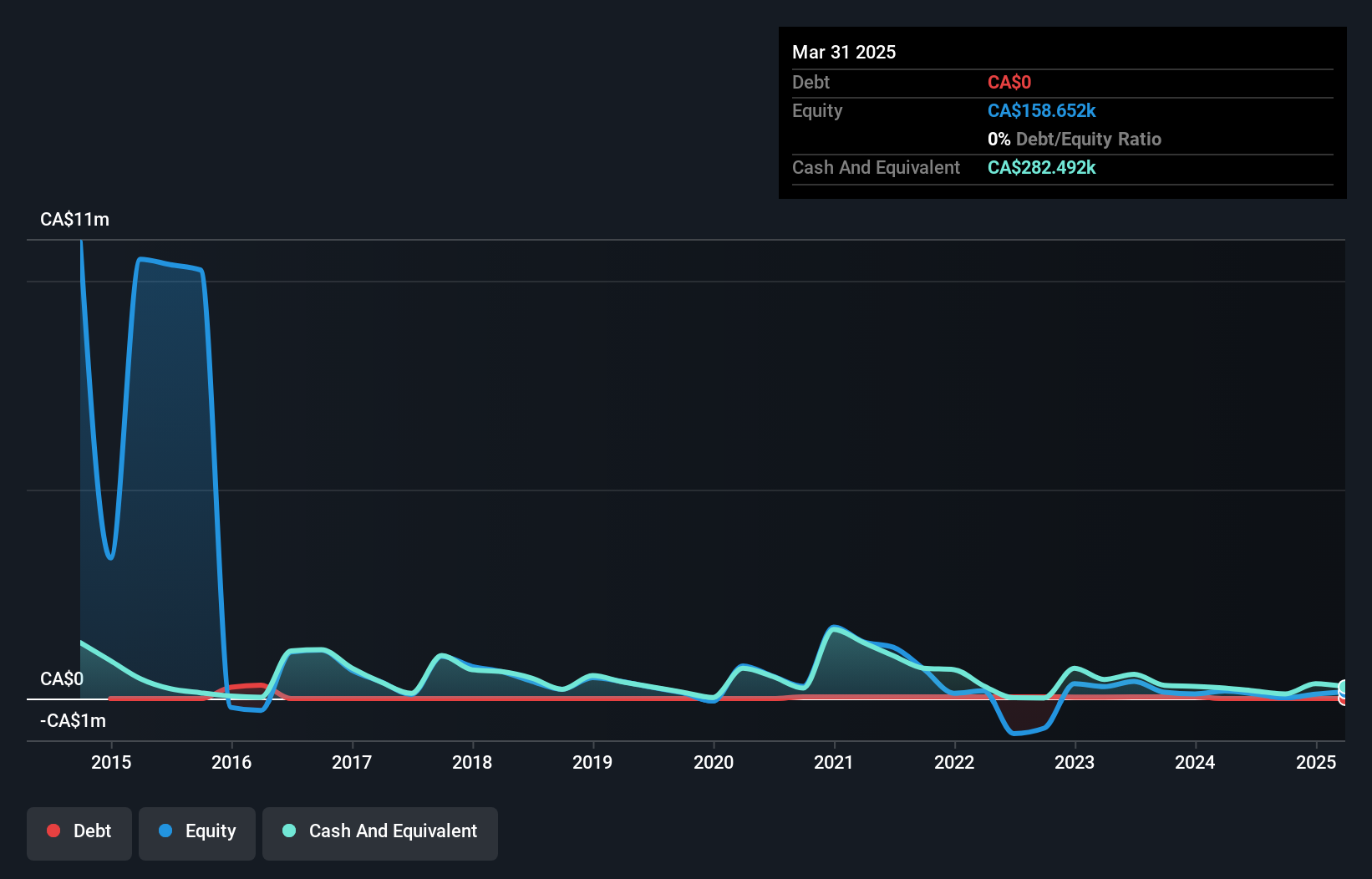

Cartier Resources Inc., with a market cap of CA$39.19 million, is pre-revenue and debt-free, positioning it uniquely among Canadian penny stocks. Recent drilling at its East Cadillac property revealed promising high-grade gold intersections, suggesting potential for future resource expansion. Despite a net loss increase to CA$0.42 million in Q3 2024, the company maintains financial stability through successful private placements raising over CA$1 million in late 2024. Its seasoned management and board bring extensive industry experience, supporting strategic exploration efforts while navigating typical challenges faced by early-stage mining ventures like limited cash runway and unprofitability.

- Unlock comprehensive insights into our analysis of Cartier Resources stock in this financial health report.

- Review our historical performance report to gain insights into Cartier Resources' track record.

Inventus Mining (TSXV:IVS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Inventus Mining Corp. focuses on the acquisition, exploration, and development of mineral properties in Canada and has a market cap of CA$18.30 million.

Operations: Currently, Inventus Mining Corp. does not report any revenue segments.

Market Cap: CA$18.3M

Inventus Mining Corp., with a market cap of CA$18.30 million, is pre-revenue and debt-free, focusing on its Pardo Gold Project in Ontario. The company recently completed an 80-hole Phase 1 drilling program aimed at supporting future mineral resource estimates for potential low-cost surface mining. Despite being unprofitable, Inventus has reduced its losses by 8.5% annually over the past five years and maintains sufficient cash runway for over a year based on current free cash flow. Participation in the Ontario Junior Exploration Program offers financial support, covering up to CA$200,000 of exploration costs at Pardo.

- Click here to discover the nuances of Inventus Mining with our detailed analytical financial health report.

- Gain insights into Inventus Mining's historical outcomes by reviewing our past performance report.

Make It Happen

- Navigate through the entire inventory of 943 TSX Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ALYA

Alithya Group

Provides information technology services and solutions through digital technologies in Canada, the United States, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives