Results: Absolute Software Corporation Beat Earnings Expectations And Analysts Now Have New Forecasts

Investors in Absolute Software Corporation (TSE:ABT) had a good week, as its shares rose 2.6% to close at CA$9.76 following the release of its second-quarter results. Revenues were US$26m, approximately in line with what analysts expected, although statutory earnings per share (EPS) crushed expectations, coming in at US$0.06, an impressive 25% ahead of estimates. Analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We've gathered the most recent statutory forecasts to see whether analysts have changed their earnings models, following these results.

View our latest analysis for Absolute Software

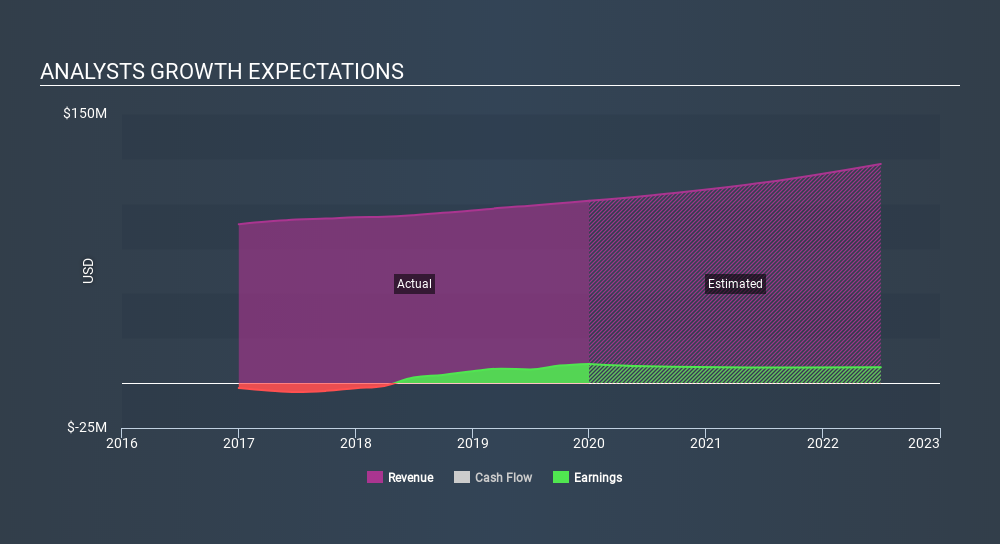

After the latest results, the six analysts covering Absolute Software are now predicting revenues of US$104.5m in 2020. If met, this would reflect a reasonable 2.8% improvement in sales compared to the last 12 months. Statutory earnings per share are forecast to decline 16% to US$0.22 in the same period. Before this earnings report, analysts had been forecasting revenues of US$104.7m and earnings per share (EPS) of US$0.21 in 2020. So the consensus seems to have become somewhat more optimistic on Absolute Software's earnings potential following these results.

The consensus price target rose 9.0% to US$7.97, suggesting that higher earnings estimates flow through to the stock's valuation as well. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Absolute Software analyst has a price target of US$9.79 per share, while the most pessimistic values it at US$7.16. This shows there is still quite a bit of diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

It can also be useful to step back and take a broader view of how analyst forecasts compare to Absolute Software's performance in recent years. Analysts are definitely expecting Absolute Software's growth to accelerate, with the forecast 2.8% growth ranking favourably alongside historical growth of 1.6% per annum over the past five years. Compare this with other companies in the same market, which are forecast to see a revenue decline of 17% next year. It seems obvious that, while the future growth outlook is brighter than the recent past, analysts also expect Absolute Software to grow slower than the wider market.

The Bottom Line

The biggest takeaway for us from these new estimates is that the consensus upgraded its earnings per share estimates, showing a clear improvement in sentiment around Absolute Software's earnings potential next year. On the plus side, there were no major changes to revenue estimates; although analyst forecasts imply revenues will perform worse than the wider market. There was also a nice increase in the price target, with analysts feeling that the intrinsic value of the business is improving.

With that in mind, we wouldn't be too quick to come to a conclusion on Absolute Software. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Absolute Software going out to 2022, and you can see them free on our platform here..

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:ABST

Absolute Software

Absolute Software Corporation develops, markets, and provides software services that support the management and security of computing devices, applications, data, and networks for various organizations.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)