Will Aduro Clean Technologies’ (CNSX:ACT) Investor Outreach Redefine Its Competitive Position in Recycling?

Reviewed by Sasha Jovanovic

- Aduro Clean Technologies Inc. recently presented at the International Plastics and Rubber Fair (K Dusseldorf) in Germany and announced upcoming participation at the LD Micro Main Event XIX investor conference in San Diego, where CEO Ofer Vicus will speak and meet investors.

- These prominent industry and investor events provide Aduro with platforms to highlight its technology advancements and engage with potential stakeholders, enhancing its profile within both the plastics recycling and investment communities.

- We'll explore how Aduro's emphasis on investor engagement and technology visibility may influence its investment narrative moving forward.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Aduro Clean Technologies' Investment Narrative?

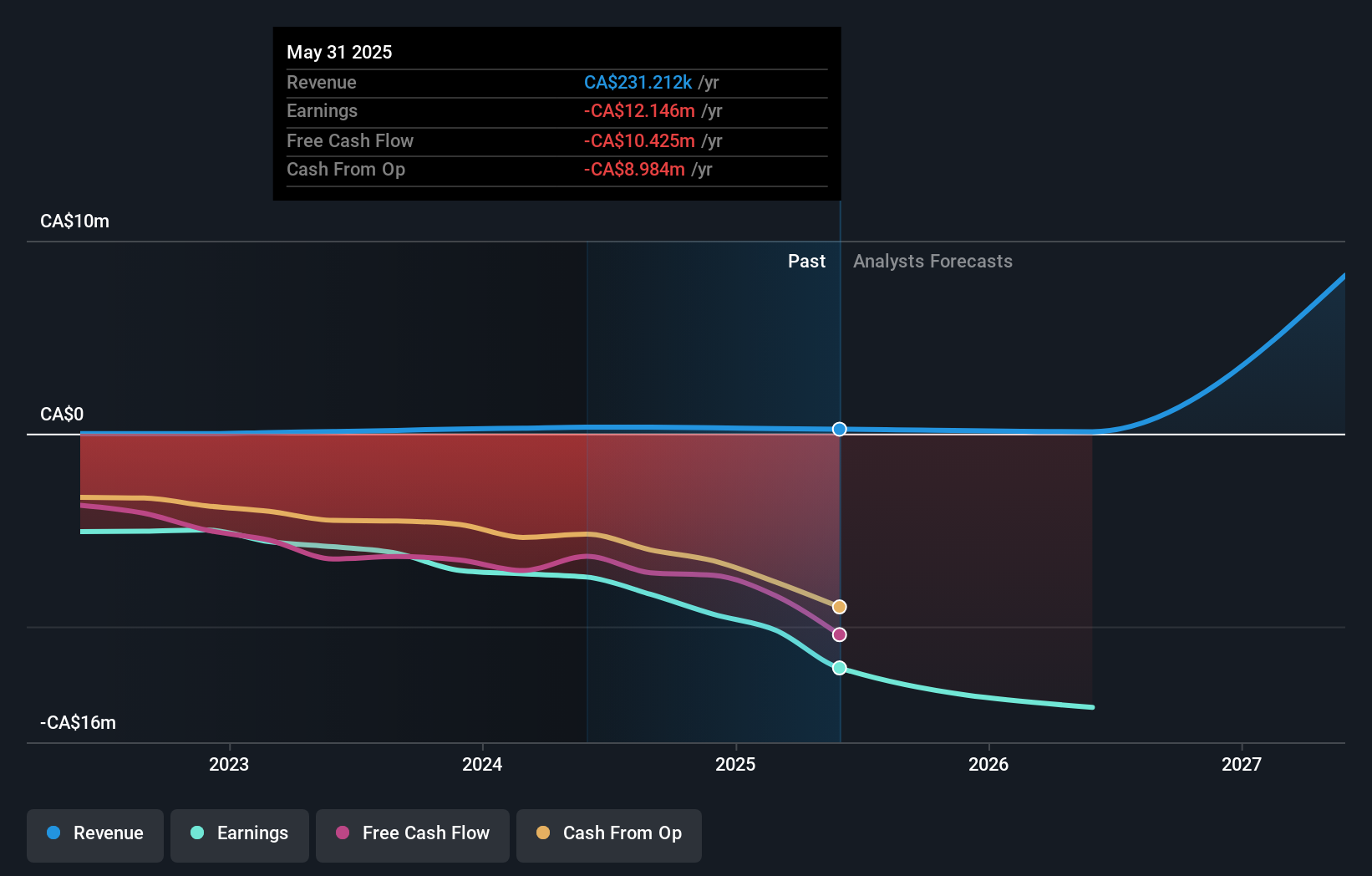

To see Aduro Clean Technologies as a potential opportunity, investors need to buy into the vision that its Hydrochemolytic Technology can become a meaningful solution within the chemical recycling sector, amid persistent commercial and technical hurdles. The company’s participation in high-profile industry and investor events, like K Dusseldorf and LD Micro Main Event XIX, raises its visibility and may help attract partners or future capital, which could support key short-term catalysts such as the commissioning of its next-gen pilot plant and further partnership deals. However, losses continue to widen, sales remain modest at under CA$250,000, and Aduro’s ability to scale and transition from pilot success to reliable commercial contracts is still unproven. While these recent appearances boost Aduro’s credibility and access, the direct material impact on financials remains to be seen. In contrast, the company’s track record of growing costs before demonstrating profitability could carry important implications.

Our comprehensive valuation report raises the possibility that Aduro Clean Technologies is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 2 other fair value estimates on Aduro Clean Technologies - why the stock might be worth less than half the current price!

Build Your Own Aduro Clean Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aduro Clean Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Aduro Clean Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aduro Clean Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:ACT

Aduro Clean Technologies

Engages in developing water-based chemical recycling technologies.

Flawless balance sheet with low risk.

Market Insights

Community Narratives