Assessing Aduro Clean Technologies (CNSX:ACT) Valuation Following S&P Global BMI Index Inclusion

Reviewed by Kshitija Bhandaru

Aduro Clean Technologies (CNSX:ACT) is grabbing headlines after the company was added to the S&P Global BMI Index, a move that can increase attention from institutional investors and index funds. When a stock joins a widely followed index, sudden bursts of interest tend to follow since index funds often need to buy in and traders start watching for liquidity shifts. This kind of event is one that investors keep a close eye on because it sometimes marks a turning point for growth companies just starting to gain broader market recognition.

Zooming out, Aduro Clean Technologies has actually seen strong price momentum building over the year. Shares have climbed nearly 188% over the past twelve months and have surged 25% in the past month alone. The company has also made the rounds at several high-profile industry events in Europe this September, which likely added to investor curiosity. Compared to its longer-term track record, the recent increase in visibility and price might signal a shift in how the market is valuing future prospects.

After that impressive run and the index inclusion, is there still an opportunity to buy at a good value, or is the market already factoring in all that growth potential?

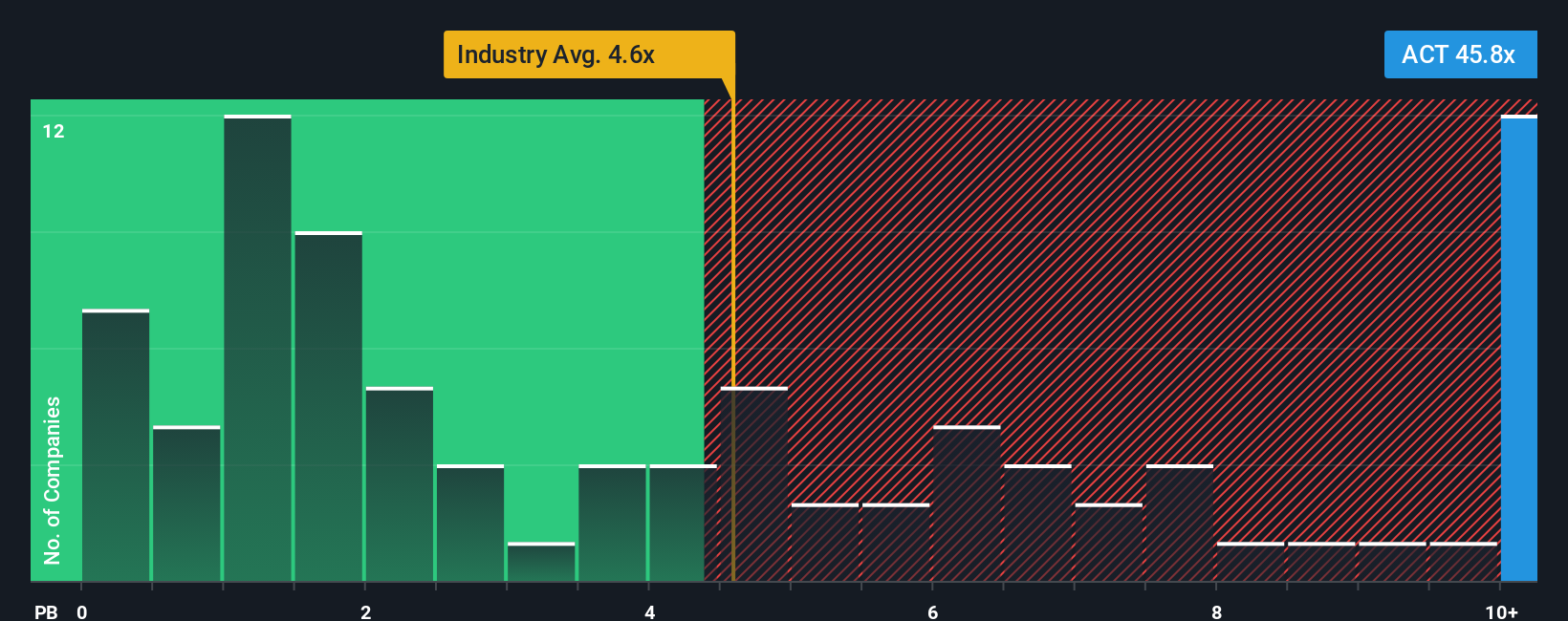

Price-to-Book of 49.1x: Is it justified?

The current valuation shows Aduro Clean Technologies trading at a price-to-book ratio of 49.1 times. This is exceedingly high compared to its industry peers, who average 8.2 times, and the Canadian software sector, where the class norm is 4.9 times. In simple terms, this multiple measures how much investors are willing to pay for each dollar of the company’s net assets.

The price-to-book ratio is especially relevant for early-stage or unprofitable technology companies because it can signal whether investors are betting on future growth or speculating beyond what the company’s current balance sheet suggests. In Aduro’s case, the elevated ratio strongly implies that the market is paying a hefty premium based on the belief that significant advancements or rapid growth could materialize.

However, such a large gap raises the question of whether market optimism is surpassing the company’s underlying fundamentals, as sector comparables are far lower. Unless Aduro delivers on aggressive growth or profitability goals, this premium may be difficult to defend.

Result: Fair Value of $18.65 (OVERVALUED)

See our latest analysis for Aduro Clean Technologies.However, weak profitability and very high expectations could quickly sour sentiment if revenue growth slows or promised advancements fail to materialize.

Find out about the key risks to this Aduro Clean Technologies narrative.Another Perspective: Comparing Industry Standards

Looking from another angle, Aduro Clean Technologies still appears expensive when measured against the industry norm for this ratio. This finding is similar to the earlier verdict, but how much weight should we place on market optimism compared to fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aduro Clean Technologies Narrative

If you disagree or want to take a different angle, the data is all there. It's simple to form your own perspective in just a few minutes. Do it your way

A great starting point for your Aduro Clean Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take control of your next investment move and don't miss opportunities beyond the headlines. Use Simply Wall Street’s tools to target stocks with serious potential, tailored to your interests.

- Supercharge your search for overlooked bargains by scanning for undervalued stocks based on cash flows. These could provide a hidden edge for your portfolio.

- Capitalize on game-changing innovation by tracking quantum computing stocks as they disrupt industries with advancements in computing.

- Lock in reliable income by uncovering dividend stocks with yields > 3% offering steady yields well above the market average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:ACT

Aduro Clean Technologies

Engages in developing water-based chemical recycling technologies.

Flawless balance sheet with low risk.

Market Insights

Community Narratives