- Canada

- /

- Specialty Stores

- /

- TSX:GRGD

TSX Stocks That May Be Trading At A Discount: Aris Mining And Two Others

Reviewed by Simply Wall St

The Canadian market is navigating a complex landscape with potential catalysts for volatility, such as trade developments and central bank meetings, while maintaining resilience supported by solid fundamentals. In this environment, identifying stocks that may be trading at a discount can offer opportunities for investors seeking value amid the market's fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VersaBank (TSX:VBNK) | CA$15.30 | CA$26.16 | 41.5% |

| TerraVest Industries (TSX:TVK) | CA$168.15 | CA$300.77 | 44.1% |

| OceanaGold (TSX:OGC) | CA$6.63 | CA$12.15 | 45.4% |

| Metalla Royalty & Streaming (TSXV:MTA) | CA$4.96 | CA$8.26 | 39.9% |

| Magna Mining (TSXV:NICU) | CA$1.89 | CA$3.06 | 38.1% |

| Lithium Royalty (TSX:LIRC) | CA$5.20 | CA$8.43 | 38.3% |

| Kolibri Global Energy (TSX:KEI) | CA$9.35 | CA$17.85 | 47.6% |

| Groupe Dynamite (TSX:GRGD) | CA$16.09 | CA$28.78 | 44.1% |

| First Majestic Silver (TSX:AG) | CA$11.46 | CA$20.29 | 43.5% |

| Endeavour Silver (TSX:EDR) | CA$6.83 | CA$11.91 | 42.6% |

Let's uncover some gems from our specialized screener.

Aris Mining (TSX:ARIS)

Overview: Aris Mining Corporation, with a market cap of CA$1.57 billion, is involved in the acquisition, exploration, development, and operation of gold properties across Canada, Colombia, and Guyana.

Operations: The company's revenue is primarily derived from its Segovia operations, contributing $497.75 million, and Marmato operations, which add $62.76 million.

Estimated Discount To Fair Value: 32.9%

Aris Mining appears undervalued, trading at CA$8.75 compared to a fair value estimate of CA$13.05. Earnings are forecast to grow significantly at 68.44% annually, outpacing the Canadian market's growth rate of 12.6%. Recent Q1 earnings showed sales increasing to US$157.53 million from US$107.62 million year-over-year, with net income turning positive at US$2.37 million from a loss previously, despite past shareholder dilution concerns and low future return on equity forecasts (14.8%).

- The analysis detailed in our Aris Mining growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Aris Mining stock in this financial health report.

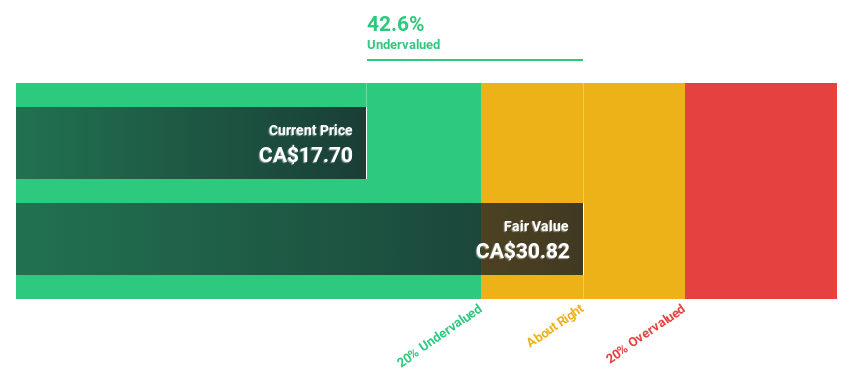

Groupe Dynamite (TSX:GRGD)

Overview: Groupe Dynamite Inc. designs, distributes, and sells women's apparel under the Dynamite and Garage brand names in Canada and the United States, with a market cap of CA$1.74 billion.

Operations: The company's revenue is primarily generated from its apparel segment, totaling CA$958.53 million.

Estimated Discount To Fair Value: 44.1%

Groupe Dynamite is trading at CA$16.09, significantly below its fair value estimate of CA$28.78, indicating it may be undervalued based on cash flows. Recent earnings show robust growth, with net income rising to CA$135.77 million from CA$85.82 million year-over-year and sales increasing to CA$958.53 million from CA$800.83 million previously. The company plans a share buyback program, potentially enhancing shareholder value further amidst strong profit forecasts exceeding the Canadian market's growth rate.

- Our growth report here indicates Groupe Dynamite may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Groupe Dynamite.

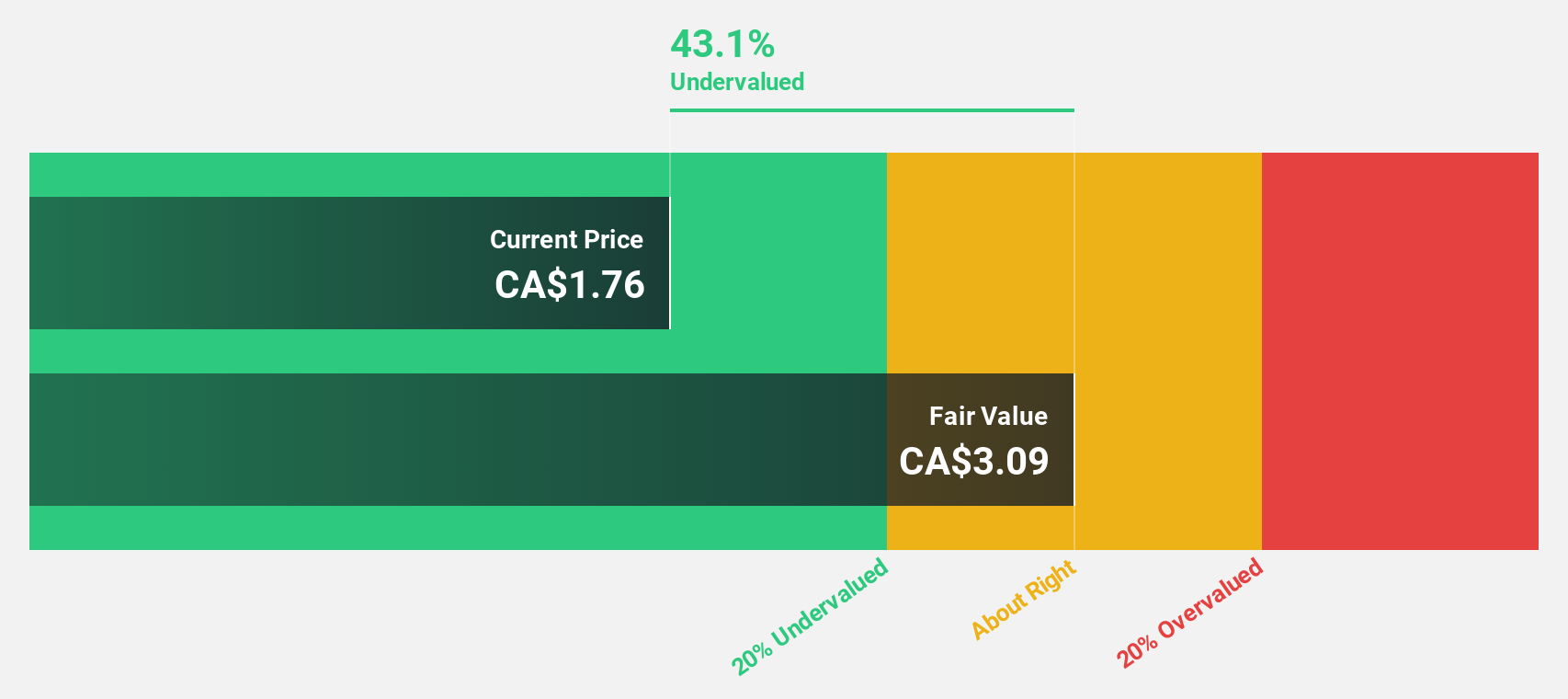

Magna Mining (TSXV:NICU)

Overview: Magna Mining Inc. focuses on the acquisition, exploration, and development of mineral properties in Canada, with a market cap of CA$352.21 million.

Operations: Magna Mining Inc. does not currently report any revenue segments in millions of CA$.

Estimated Discount To Fair Value: 38.1%

Magna Mining's current trading price of CA$1.89 is considerably below its estimated fair value of CA$3.06, highlighting potential undervaluation based on cash flows. The company recently reported a significant turnaround with net income reaching CA$29.1 million for Q1 2025, compared to a loss last year, and revenues at CA$4.45 million despite limited sales capacity. Earnings are projected to grow over 50% annually, outpacing the broader Canadian market growth rate significantly.

- Insights from our recent growth report point to a promising forecast for Magna Mining's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Magna Mining.

Summing It All Up

- Investigate our full lineup of 23 Undervalued TSX Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GRGD

Groupe Dynamite

Designs, distributes, and sells women’s apparel under the Dynamite and Garage brand names in Canada and the United States.

Outstanding track record with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion