Is Stronger Q3 Earnings And Dividend Move Altering The Investment Case For Dollarama (TSX:DOL)?

Reviewed by Sasha Jovanovic

- In December 2025, Dollarama Inc. reported third-quarter 2025 results showing sales of CA$1,909.44 million and net income of CA$321.72 million, both higher than a year earlier, alongside basic earnings per share from continuing operations rising to CA$1.17.

- For the nine months ended November 2, 2025, the company’s stronger earnings performance and the board’s approval of a CA$0.1058 eligible quarterly dividend appear to underscore management’s confidence in the business.

- We’ll now examine how Dollarama’s higher quarterly earnings and confirmed dividend payout could influence the longer-term investment narrative around the stock.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Dollarama Investment Narrative Recap

To own Dollarama, you need to believe its value-focused model can keep drawing traffic as it expands across Canada and new international markets, without eroding margins or overreaching on growth. The latest quarterly results show higher sales and earnings, but they do not materially change the near term focus on integrating The Reject Shop in Australia as a key catalyst, or the risk that faster international expansion could pressure margins.

Among recent announcements, the reaffirmed quarterly dividend of CA$0.1058 per share stands out because it directly connects rising earnings with ongoing cash returns to shareholders. For investors watching Dollarama’s rapid store rollout and international push, the consistency of this payout may be reassuring, but it also highlights the importance of monitoring how future cash needs for expansion and integration balance against returning capital to shareholders.

Yet beneath the strong recent numbers, investors should still pay close attention to the risk that Dollarama’s aggressive international growth could...

Read the full narrative on Dollarama (it's free!)

Dollarama's narrative projects CA$9.1 billion revenue and CA$1.6 billion earnings by 2028.

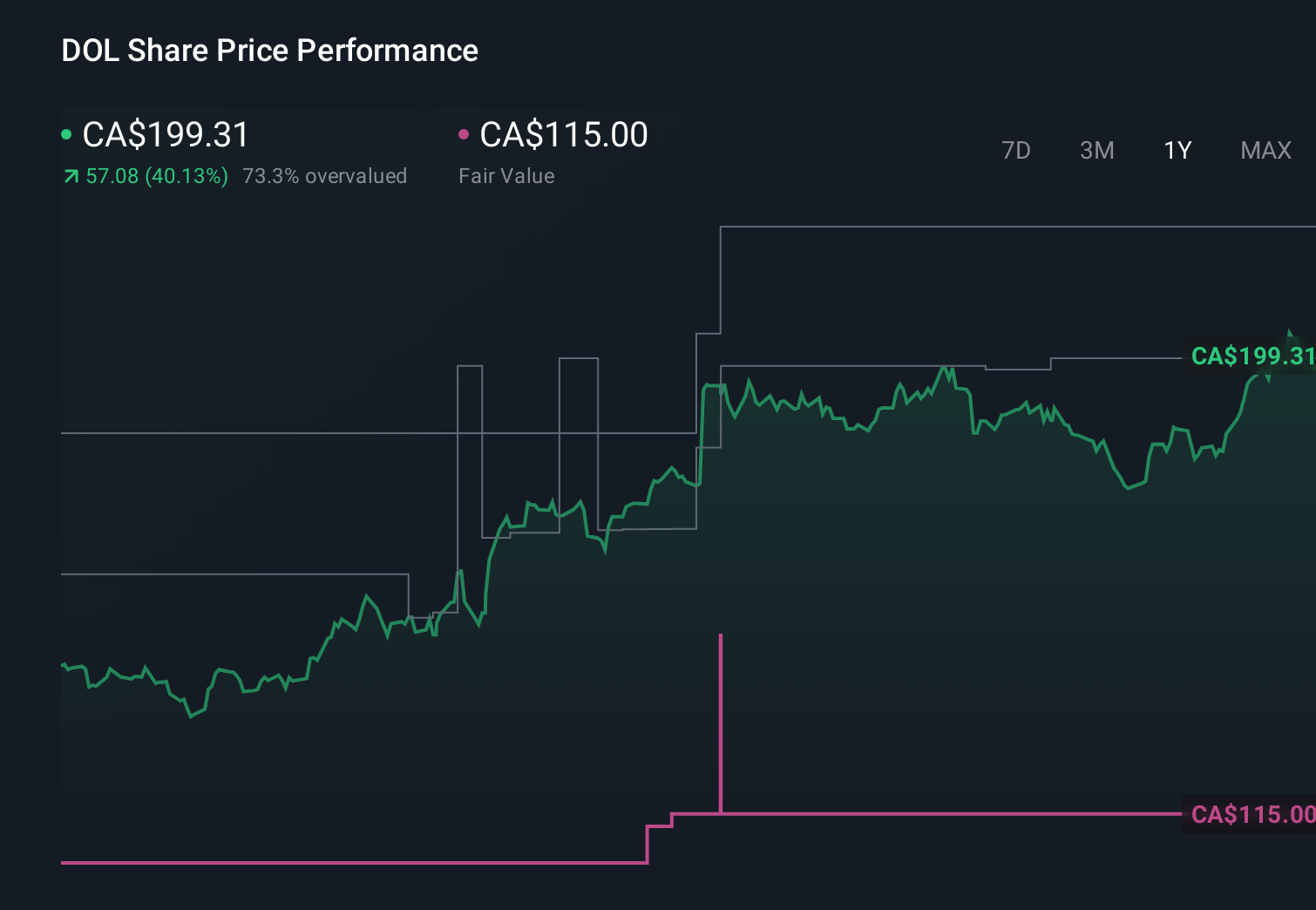

Uncover how Dollarama's forecasts yield a CA$200.81 fair value, in line with its current price.

Exploring Other Perspectives

Fourteen members of the Simply Wall St Community currently see Dollarama’s fair value anywhere from CA$117.50 to CA$223.00, underlining how far views on upside and downside can stretch. As you weigh those perspectives, remember that much of the long term story now hinges on whether its expansion into markets such as Australia can support earnings without putting too much strain on margins and financial flexibility.

Explore 14 other fair value estimates on Dollarama - why the stock might be worth as much as 11% more than the current price!

Build Your Own Dollarama Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dollarama research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dollarama research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dollarama's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DOL

Dollarama

Operates a chain of stores and provides related logistical and administrative support activities.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)