Is Dollarama Still Attractively Priced After Its 280% Five Year Share Price Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Dollarama at around $201.94 is still a smart buy or if you are late to the party, this article will help you cut through the noise and focus on what the valuation is really telling you.

- The stock is up 1.7% over the last week, 9.2% over the last month, 44.0% year to date, 44.5% over the past year, and an impressive 280.1% over five years. This naturally raises the question of whether the upside is mostly behind it or still ahead.

- Recent coverage has highlighted Dollarama as a defensive retail name that keeps gaining traction with value conscious shoppers, even as consumers feel the pinch of inflation. At the same time, analysts and commentators have been debating whether the market is paying a premium for that resilience or simply recognizing a structurally stronger business model in the Canadian discount space.

- Despite all that momentum, Dollarama only scores 1 out of 6 on our undervaluation checks, which may surprise investors expecting a clear bargain. Next, we will walk through different valuation approaches to unpack that score, and then finish with a more powerful way to think about Dollarama’s value that goes beyond any single metric.

Dollarama scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Dollarama Discounted Cash Flow (DCF) Analysis

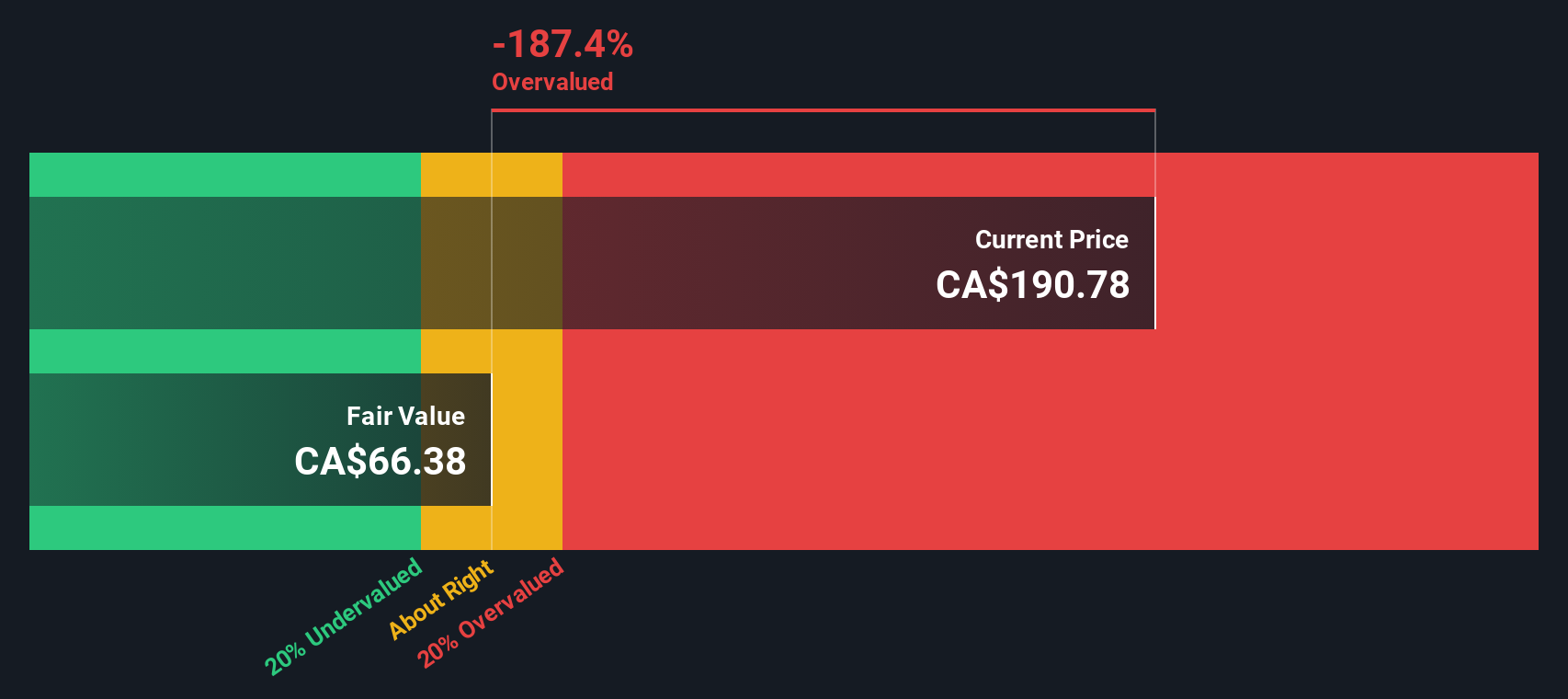

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today. For Dollarama, the model used is a 2 Stage Free Cash Flow to Equity approach, based on CA$ cash flows.

Dollarama currently generates about CA$1.42 billion in free cash flow over the last twelve months. Analysts expect free cash flow to keep growing, with projections supported by multiple analyst estimates in the near term and then extrapolated further out by Simply Wall St. By 2029, free cash flow is forecast to reach roughly CA$2.16 billion, with continuing growth assumed into the following decade.

When all of these projected cash flows are discounted back to today, the model arrives at an intrinsic value of about CA$215.63 per share. Compared with the recent share price around CA$201.94, the DCF suggests Dollarama is trading at roughly a 6.3% discount, which indicates a mild undervaluation rather than a deep bargain.

Result: ABOUT RIGHT

Dollarama is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

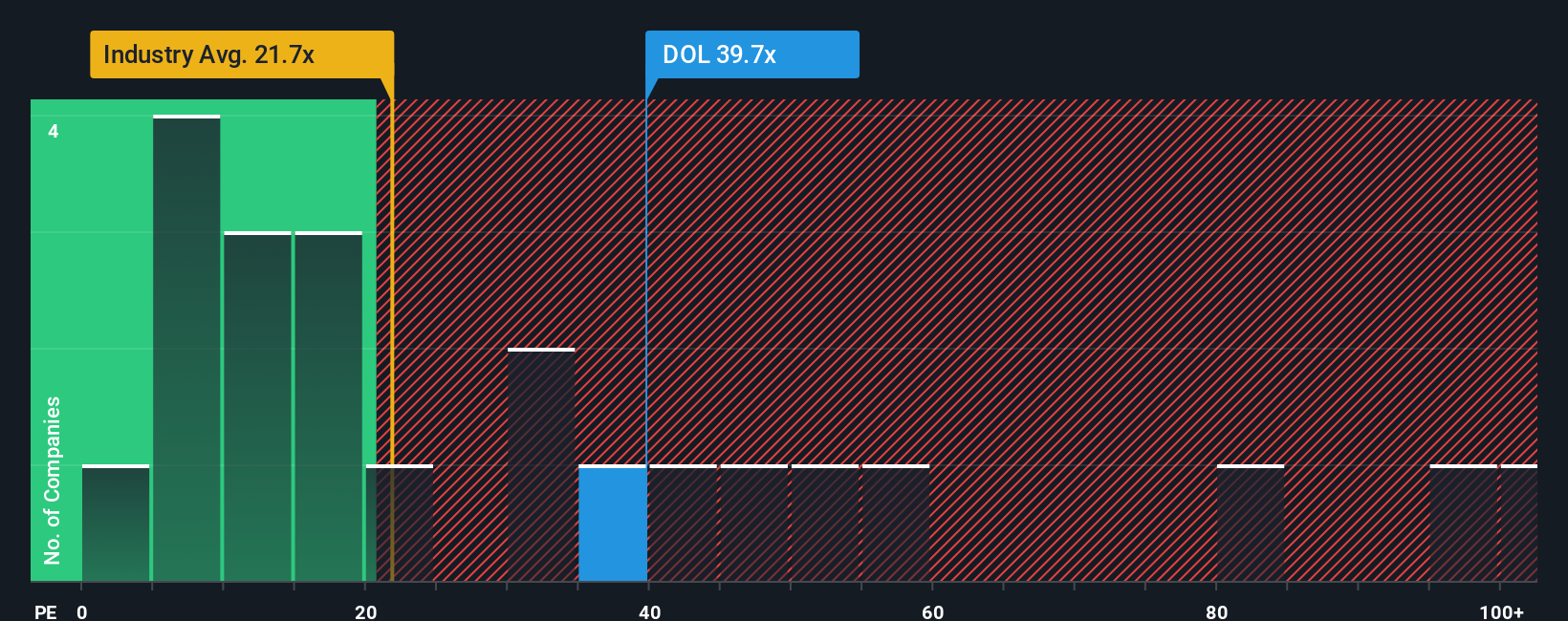

Approach 2: Dollarama Price vs Earnings

For profitable companies like Dollarama, the price to earnings (PE) ratio is a straightforward way to gauge how much investors are willing to pay for each dollar of current earnings. A higher PE can be justified when a business is expected to grow faster or is perceived as safer and more resilient, while slower growth or higher risk usually calls for a lower, more conservative multiple.

Dollarama currently trades on a PE of about 43.8x, which is more than double the Multiline Retail industry average of around 19.9x and well above the peer average of roughly 18.9x. On the surface, that makes the stock look expensive compared to its sector. However, Simply Wall St also calculates a Fair Ratio of 31.8x. This is a proprietary estimate of what Dollarama’s PE should be given its earnings growth outlook, risk profile, profit margins, industry positioning, and market cap.

This Fair Ratio offers a more tailored anchor than simple peer or industry comparisons because it adjusts for the specific strengths and risks of Dollarama’s business, rather than assuming all retailers deserve similar multiples. Comparing the Fair Ratio of 31.8x with the actual PE of 43.8x suggests the market is paying a meaningful premium for Dollarama’s qualities, pointing to an overvaluation on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1452 companies where insiders are betting big on explosive growth.

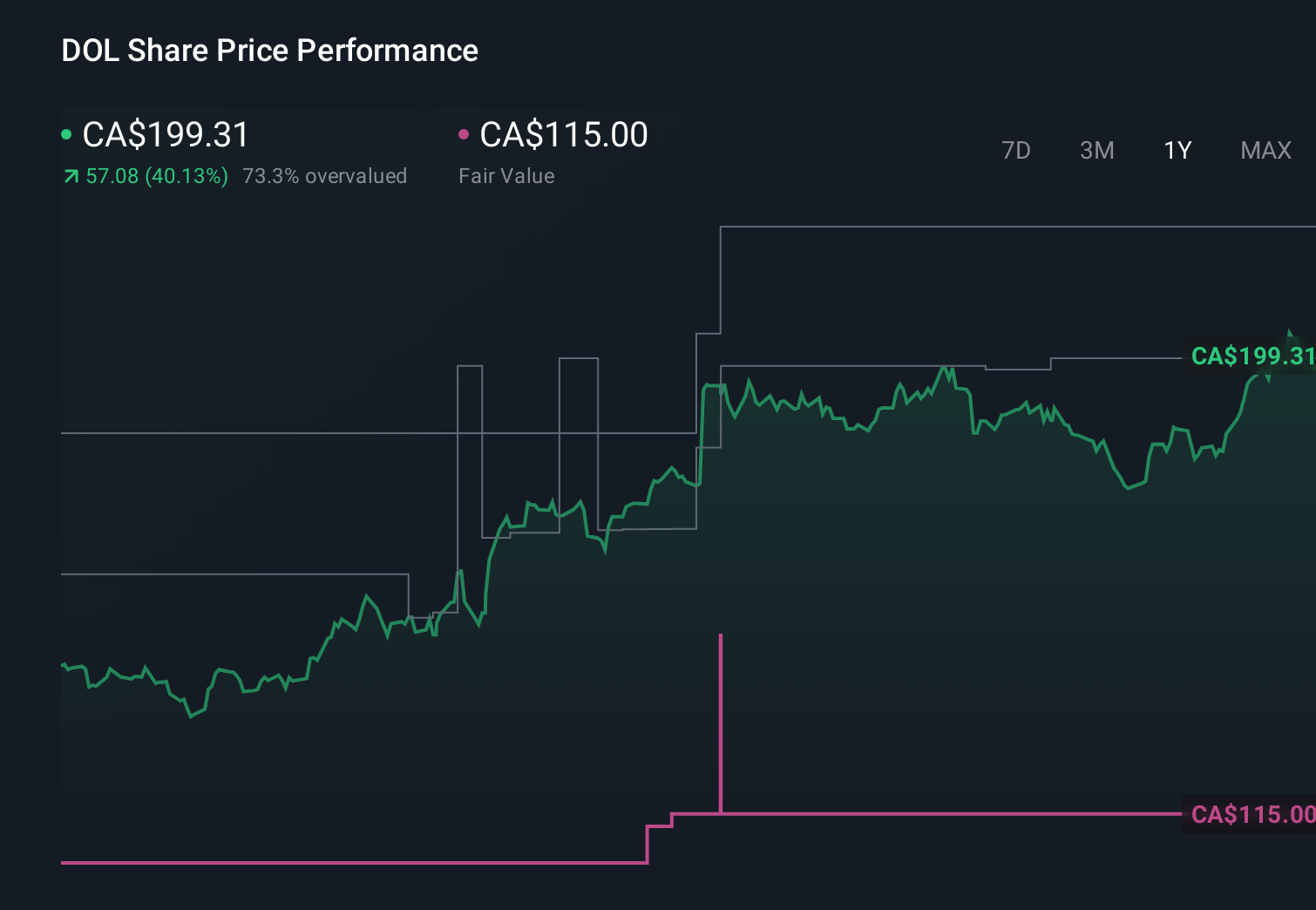

Upgrade Your Decision Making: Choose your Dollarama Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simple, user-created stories that link your view of Dollarama’s business, its future revenue, earnings and margins, to a financial forecast and therefore to a personal fair value estimate. You can easily build and compare these on Simply Wall St’s Community page, used by millions of investors, to help decide when to buy or sell by checking whether your fair value sits above or below the current share price. Those forecasts and fair values are dynamically refreshed as new news or earnings arrive. For example, one investor might build a bullish Narrative around international expansion and margin resilience that supports a fair value closer to the high analyst target near CA$223. Another might focus on execution risks, margin pressure and slower growth to justify a much lower fair value closer to the bottom end near CA$115, each using the same data but very different stories to guide their decisions.

Do you think there's more to the story for Dollarama? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DOL

Dollarama

Operates a chain of stores and provides related logistical and administrative support activities.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026