Dollarama (TSX:DOL) Valuation in Focus Following Major $10M Insider Share Purchase by CEO

Reviewed by Kshitija Bhandaru

Dollarama (TSX:DOL) has caught investor attention after CEO Neil George Rossy purchased more than $10 million worth of shares over several days this October, more than doubling his personal holdings. This insider activity often sparks questions about management’s confidence and the company’s future direction.

See our latest analysis for Dollarama.

Dollarama’s share price has surged over 30% year-to-date, a sign of building momentum as the retailer continues to outperform the broader market. Despite a modest pullback in the last month, the stock’s remarkable 27% total shareholder return over the past year and 130% return across three years highlight resilient long-term growth. Management’s recent insider buying also provides a further confidence boost.

If Dollarama’s momentum has you considering other opportunities, now’s the perfect time to discover fast growing stocks with high insider ownership

Yet, with shares up significantly and trading just shy of analyst price targets, investors are left to wonder: is there still room for upside, or has the market already priced in Dollarama’s future growth potential?

Most Popular Narrative: 8% Undervalued

The most widely followed narrative puts Dollarama’s fair value at CA$198.81, about 8% above the last close of CA$182.97, highlighting optimism about the company’s growth initiatives and profitability trajectory.

The company's aggressive international expansion, which includes opening Dollarcity's first store in Mexico and acquiring Australia's largest discount retailer, unlocks new, large addressable markets. This positions Dollarama for multi-year top-line revenue growth through broader geographic and demographic exposure.

Curious what makes this fair value tick? A future profit outlook, scale-driven expansion plays, and key operating margin assumptions could all surprise you. Want to see which forecasts are setting the pace for Dollarama’s price target?

Result: Fair Value of $198.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as integrating new international acquisitions and rising competition at home could slow Dollarama's pace and put pressure on future earnings growth.

Find out about the key risks to this Dollarama narrative.

Another View: Are Dollarama Shares Priced for Perfection?

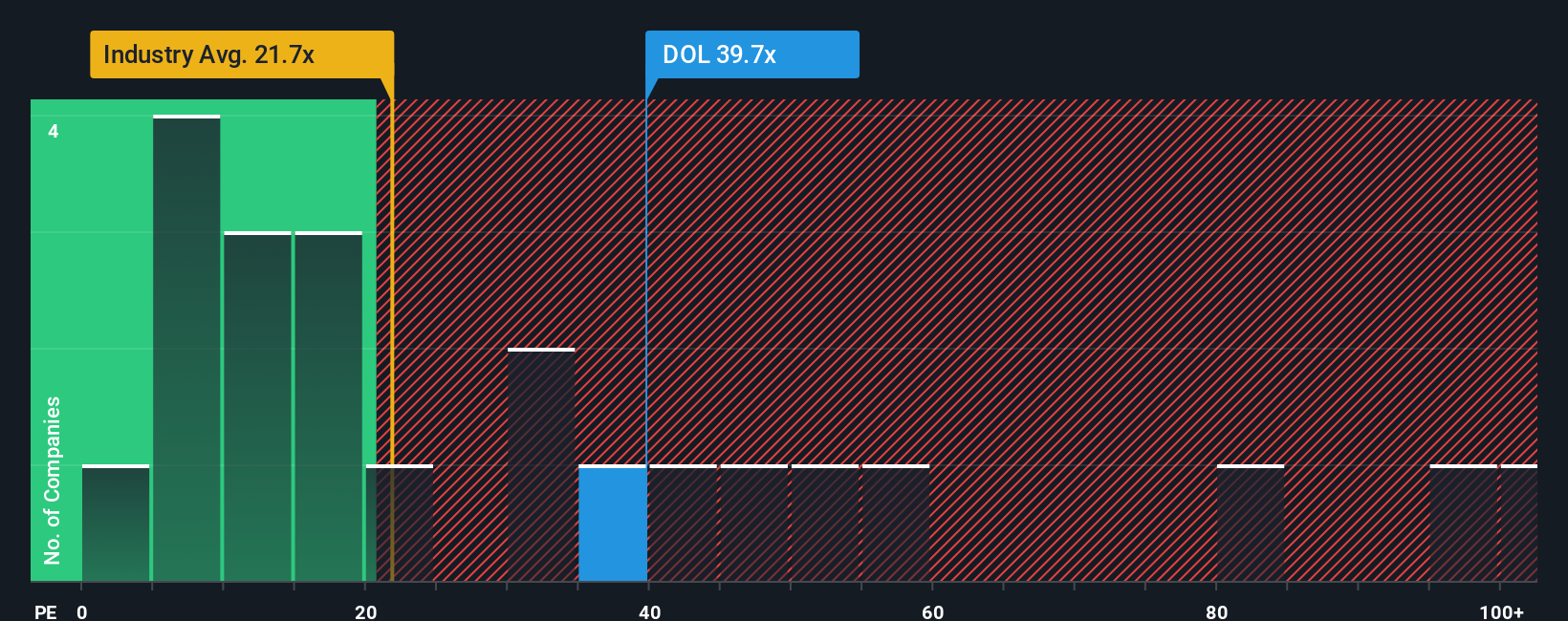

While analyst consensus points to Dollarama being undervalued, a look at its price-to-earnings ratio tells a different story. Shares trade at 39.7 times earnings, which is far above both the global retail average of 20.6x and the peer average of 19x. Even compared to the fair ratio of 29.7x, the current valuation appears stretched. Is the market banking too much on continued growth, or does Dollarama have the momentum to justify this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dollarama Narrative

If you see things differently or want to dive into the numbers yourself, you can craft your own Dollarama narrative and share your take in just a few minutes. Do it your way.

A great starting point for your Dollarama research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

There’s a world of opportunities beyond Dollarama, and the smartest moves often come from looking where others aren’t. Don’t miss your chance to uncover stocks with potential that fits your financial goals and interests.

- Unlock the power of stable income streams and see which companies offer strong yields by scanning these 18 dividend stocks with yields > 3% right now.

- Catch the next wave in artificial intelligence by spotting growth stories among these 24 AI penny stocks poised for breakthroughs and industry leadership.

- Tap into value that others might overlook and seize advantages with these 878 undervalued stocks based on cash flows before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DOL

Dollarama

Operates a chain of stores and provides related logistical and administrative support activities.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives