Does CEO’s C$10 Million Share Purchase Strengthen The Bull Case For Dollarama (TSX:DOL)?

Reviewed by Sasha Jovanovic

- Between October 10 and October 14, 2025, Dollarama CEO and Director Neil George Rossy acquired over C$10 million in common shares, both directly and indirectly, resulting in a very large increase in his total holdings.

- This significant insider buying reflects a marked show of confidence from Dollarama’s leadership, signaling management's belief in the company’s future prospects.

- To better understand the potential impact of CEO insider buying, we’ll examine how this development interacts with Dollarama’s investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Dollarama Investment Narrative Recap

To hold Dollarama shares, investors typically need to believe in the company’s ability to execute on its international expansion and adapt its business model to new markets while continuing to deliver consistent earnings growth. The recent insider buying by CEO Neil Rossy, while a strong show of leadership confidence, does not materially change the most important short term catalyst, successful integration of The Reject Shop in Australia, nor does it remove the associated execution risks.

Among the recent announcements, Dollarama’s acquisition and transformation of The Reject Shop stands out as highly relevant. This move represents both a significant growth avenue and a substantial test of management’s ability to achieve operational efficiencies and adapt to local conditions, with integration progress likely to be a key driver of performance in the coming quarters.

By contrast, investors should also consider the implications of market saturation risk in Canada, which could...

Read the full narrative on Dollarama (it's free!)

Dollarama's narrative projects CA$9.1 billion revenue and CA$1.6 billion earnings by 2028. This requires 10.9% yearly revenue growth and a CA$0.3 billion earnings increase from CA$1.3 billion currently.

Uncover how Dollarama's forecasts yield a CA$198.81 fair value, a 9% upside to its current price.

Exploring Other Perspectives

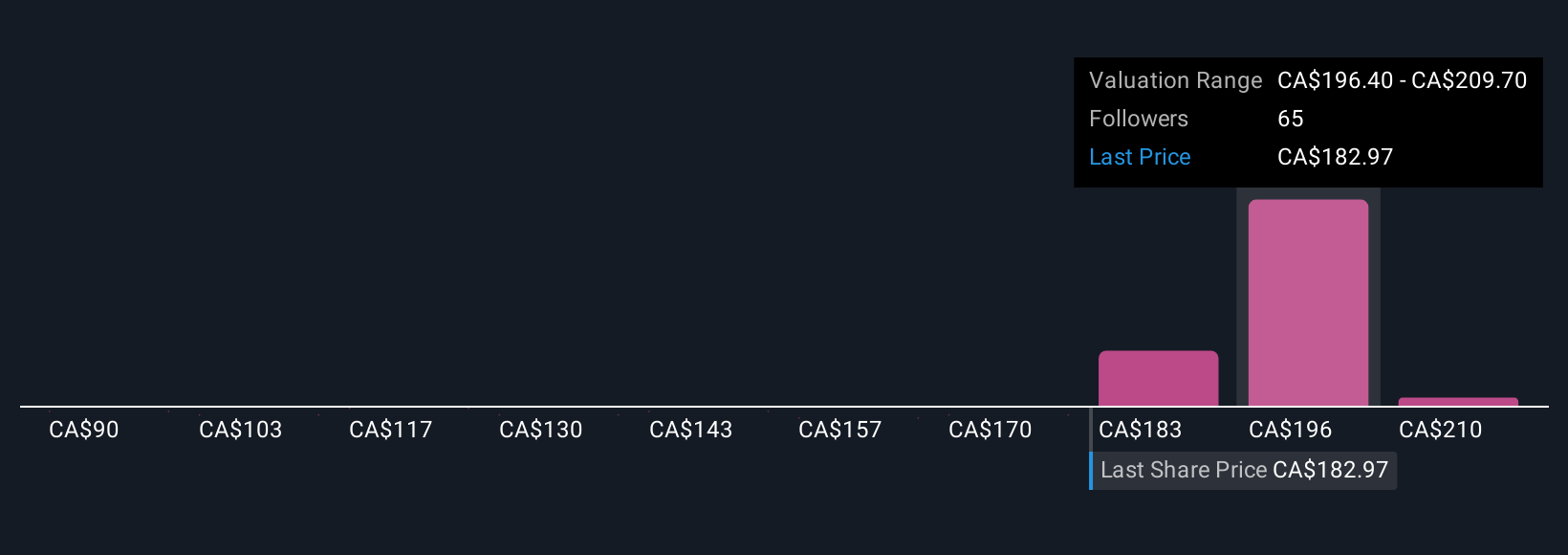

Seventeen fair value estimates from the Simply Wall St Community range from C$90 to C$223 per share, highlighting broad differences in individual forecasts. Many participants are watching Dollarama’s Australian integration for signs of sustained earnings momentum and overall business resilience, be sure to compare these diverse perspectives before forming your own view.

Explore 17 other fair value estimates on Dollarama - why the stock might be worth as much as 22% more than the current price!

Build Your Own Dollarama Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dollarama research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dollarama research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dollarama's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DOL

Dollarama

Operates a chain of stores and provides related logistical and administrative support activities.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives