Canadian Tire Corporation, Limited's (TSE:CTC.A) Subdued P/E Might Signal An Opportunity

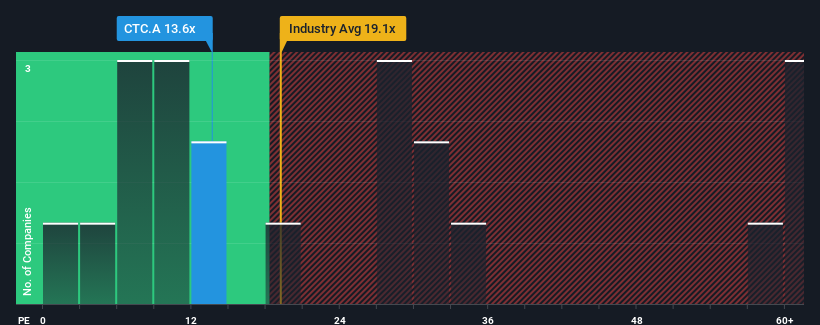

There wouldn't be many who think Canadian Tire Corporation, Limited's (TSE:CTC.A) price-to-earnings (or "P/E") ratio of 13.6x is worth a mention when the median P/E in Canada is similar at about 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times haven't been advantageous for Canadian Tire Corporation as its earnings have been falling quicker than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Canadian Tire Corporation

What Are Growth Metrics Telling Us About The P/E?

Canadian Tire Corporation's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 41% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 5.4% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 28% per annum as estimated by the six analysts watching the company. That's shaping up to be materially higher than the 7.9% per year growth forecast for the broader market.

With this information, we find it interesting that Canadian Tire Corporation is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Canadian Tire Corporation's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Having said that, be aware Canadian Tire Corporation is showing 3 warning signs in our investment analysis, and 1 of those is a bit concerning.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CTC.A

Canadian Tire Corporation

Provides a range of retail goods and services in Canada.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives