- Canada

- /

- Specialty Stores

- /

- TSX:ATZ

TSX Value Picks Including Aritzia And Two Other Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

As 2025 draws to a close, the Canadian market is navigating through a period of noisy but encouraging economic data, with signs of easing inflation and stabilizing labor conditions providing a constructive outlook for 2026. In this environment, identifying undervalued stocks can be particularly rewarding as investors seek opportunities beyond elevated tech valuations and explore broader equity diversification; Aritzia and two other stocks on the TSX are currently estimated to be trading below their fair value, making them noteworthy considerations in this shifting landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Topicus.com (TSXV:TOI) | CA$125.99 | CA$224.92 | 44% |

| Major Drilling Group International (TSX:MDI) | CA$13.20 | CA$22.14 | 40.4% |

| kneat.com (TSX:KSI) | CA$4.87 | CA$9.37 | 48% |

| GURU Organic Energy (TSX:GURU) | CA$4.92 | CA$8.91 | 44.8% |

| EQB (TSX:EQB) | CA$102.63 | CA$184.94 | 44.5% |

| Endeavour Mining (TSX:EDV) | CA$71.18 | CA$124.55 | 42.8% |

| Dexterra Group (TSX:DXT) | CA$12.00 | CA$22.93 | 47.7% |

| Decisive Dividend (TSXV:DE) | CA$7.14 | CA$14.22 | 49.8% |

| Black Diamond Group (TSX:BDI) | CA$14.40 | CA$28.44 | 49.4% |

| 5N Plus (TSX:VNP) | CA$17.86 | CA$30.98 | 42.3% |

We'll examine a selection from our screener results.

Aritzia (TSX:ATZ)

Overview: Aritzia Inc., along with its subsidiaries, designs, develops, and sells apparel and accessories for women in the United States and Canada, with a market capitalization of approximately CA$13.55 billion.

Operations: The company's revenue is primarily derived from its apparel segment, which generated CA$3.10 billion.

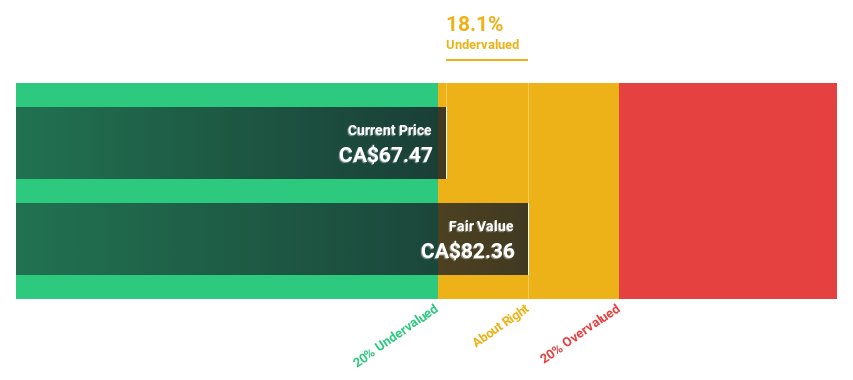

Estimated Discount To Fair Value: 11.9%

Aritzia's stock is trading at CA$117.38, slightly below its estimated fair value of CA$133.3, indicating potential undervaluation based on cash flows. The company's earnings are projected to grow at 19.4% annually, outpacing the Canadian market average of 11.9%. Recent financial results show robust performance with net income rising significantly year-over-year and strong revenue growth expected to continue into 2026, supported by expansion in both Canada and the U.S.

- In light of our recent growth report, it seems possible that Aritzia's financial performance will exceed current levels.

- Click here to discover the nuances of Aritzia with our detailed financial health report.

Black Diamond Group (TSX:BDI)

Overview: Black Diamond Group Limited provides modular space and workforce accommodation solutions in Canada, the United States, and Australia, with a market cap of CA$987.22 million.

Operations: The company's revenue segments consist of CA$202.72 million from Workforce Solutions and CA$242.93 million from Modular Space Solutions.

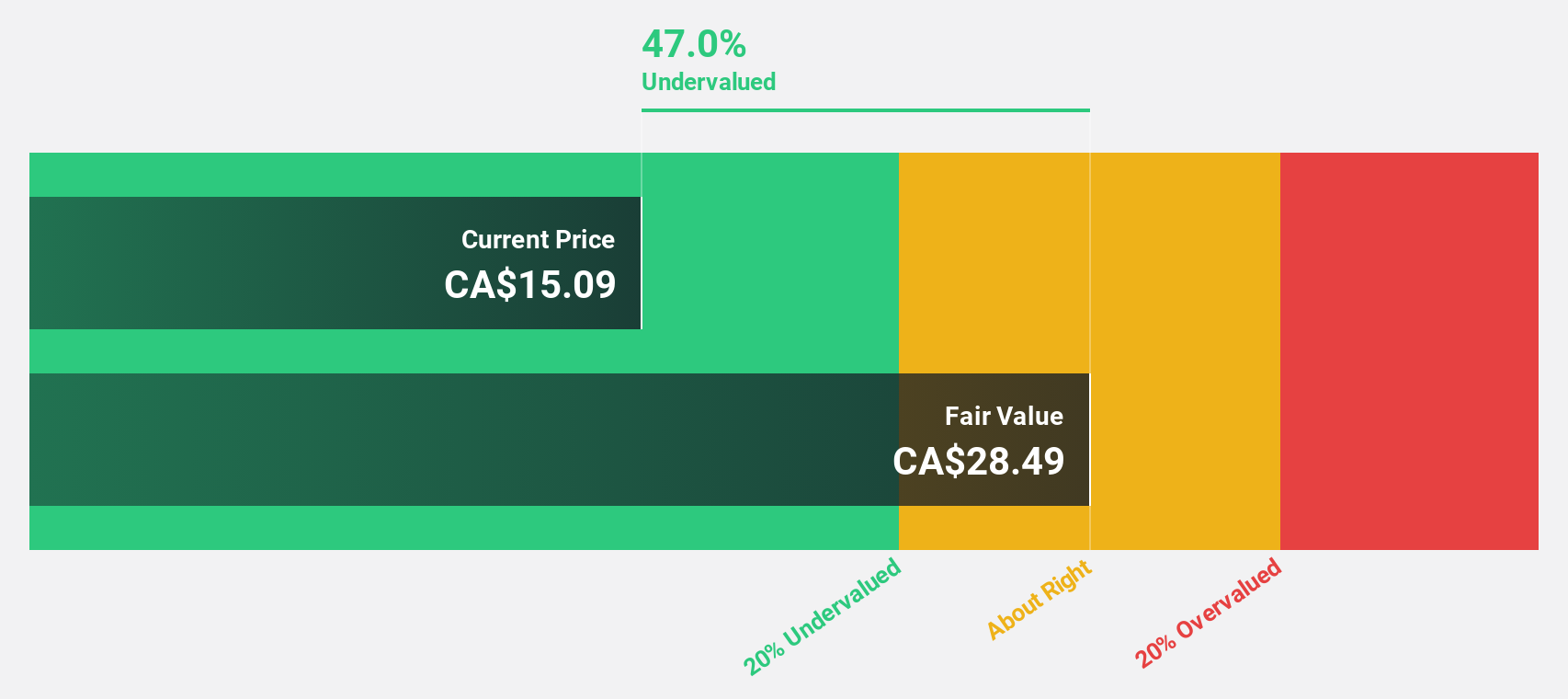

Estimated Discount To Fair Value: 49.4%

Black Diamond Group is trading at CA$14.4, significantly below its estimated fair value of CA$28.44, suggesting undervaluation based on cash flows. The company reported strong financial performance with third-quarter net income rising to CA$12.21 million from CA$7.37 million a year ago and earnings per share increasing accordingly. Despite high debt levels and recent insider selling, earnings are forecast to grow significantly at 21% annually, surpassing the Canadian market average growth rate of 12%.

- Our expertly prepared growth report on Black Diamond Group implies its future financial outlook may be stronger than recent results.

- Take a closer look at Black Diamond Group's balance sheet health here in our report.

i-80 Gold (TSX:IAU)

Overview: i-80 Gold Corp. is a mining company that focuses on the exploration, development, and production of gold, silver, and polymetallic deposits in the United States with a market cap of CA$1.74 billion.

Operations: The company's revenue is derived from its operations at Lone Tree ($19.45 million), Ruby Hill ($10.38 million), and Granite Creek ($67.30 million).

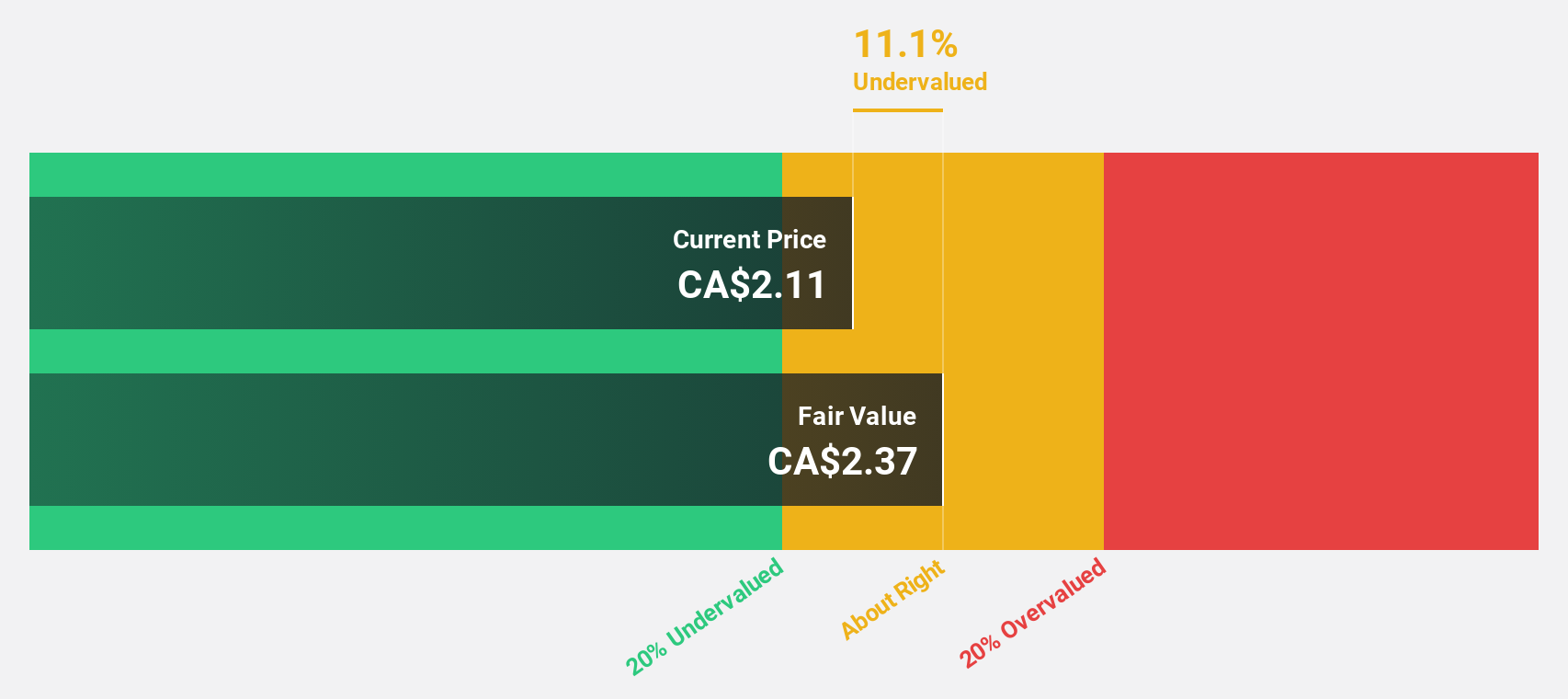

Estimated Discount To Fair Value: 11.1%

i-80 Gold is trading at CA$2.11, slightly below its estimated fair value of CA$2.37, indicating some undervaluation based on cash flows. The company reported increased sales for the third quarter at US$32.02 million but still experienced a net loss of US$41.87 million, though reduced from the previous year. Despite having less than a year's cash runway and past shareholder dilution, revenue growth is forecasted to outpace the Canadian market significantly over the next three years.

- Our comprehensive growth report raises the possibility that i-80 Gold is poised for substantial financial growth.

- Get an in-depth perspective on i-80 Gold's balance sheet by reading our health report here.

Summing It All Up

- Click through to start exploring the rest of the 24 Undervalued TSX Stocks Based On Cash Flows now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATZ

Aritzia

Designs, develops, and sells apparels and accessories for women in the United States and Canada.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion