- Canada

- /

- Metals and Mining

- /

- TSX:AAUC

October 2024 TSX Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

In the last week, the Canadian market has stayed flat, but it has shown impressive growth over the past year with a 21% increase and earnings forecasted to grow by 15% annually. In this environment, identifying growth companies with strong insider ownership can be particularly appealing as it often indicates confidence in long-term business prospects.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 11.8% | 70.7% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.2% | 17.1% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 76.5% |

| VersaBank (TSX:VBNK) | 13.3% | 30.4% |

| Aritzia (TSX:ATZ) | 18.9% | 60.4% |

| Allied Gold (TSX:AAUC) | 17.7% | 73% |

| Ivanhoe Mines (TSX:IVN) | 12.3% | 70.1% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Alpha Cognition (CNSX:ACOG) | 17% | 69.5% |

Let's explore several standout options from the results in the screener.

Allied Gold (TSX:AAUC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Allied Gold Corporation, along with its subsidiaries, is engaged in the exploration and production of mineral deposits in Africa and has a market cap of CA$981.04 million.

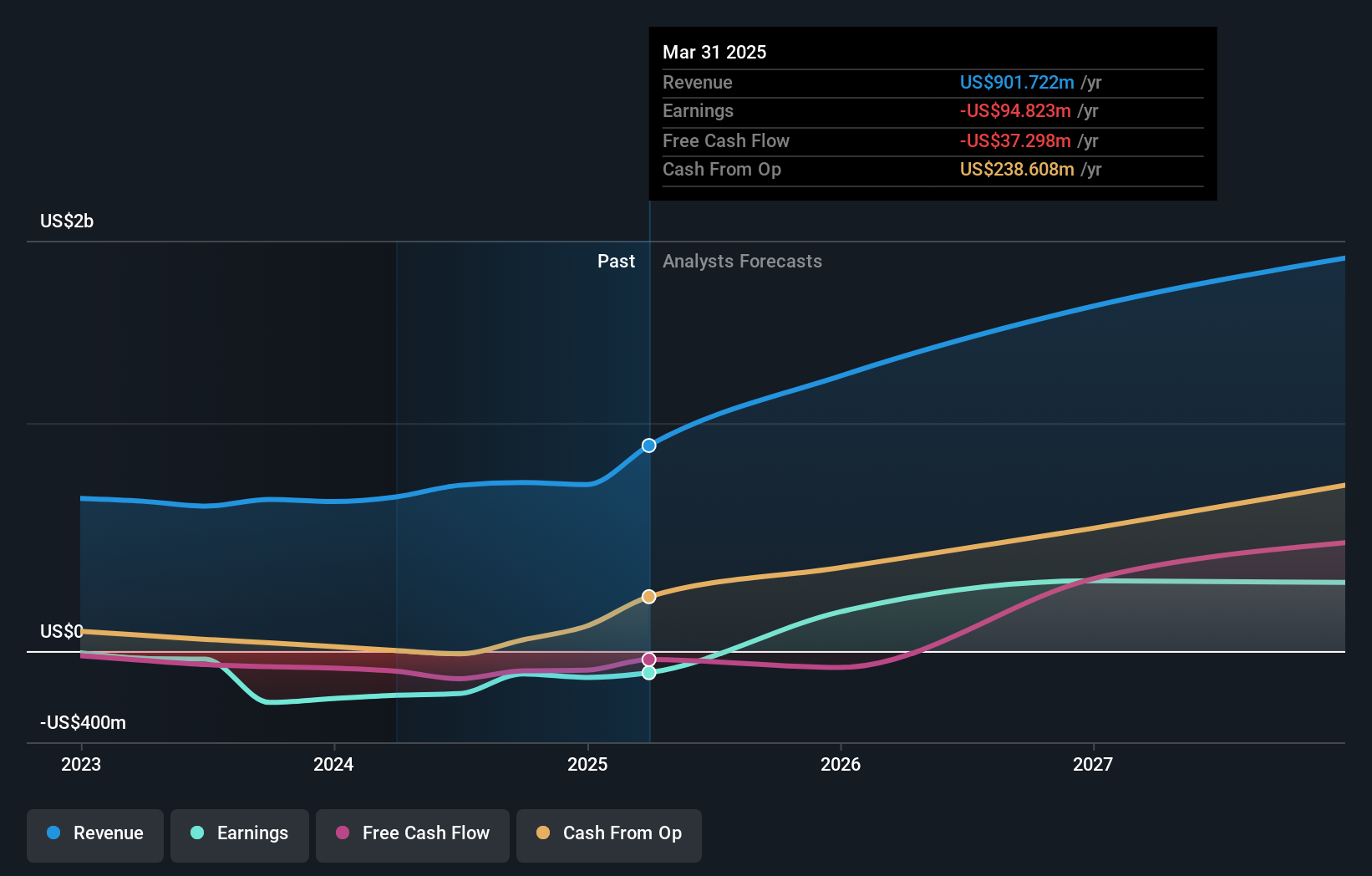

Operations: The company's revenue segments include $142.03 million from the Agbaou Mine, $193.93 million from the Bonikro Mine, and $391.07 million from the Sadiola Mine.

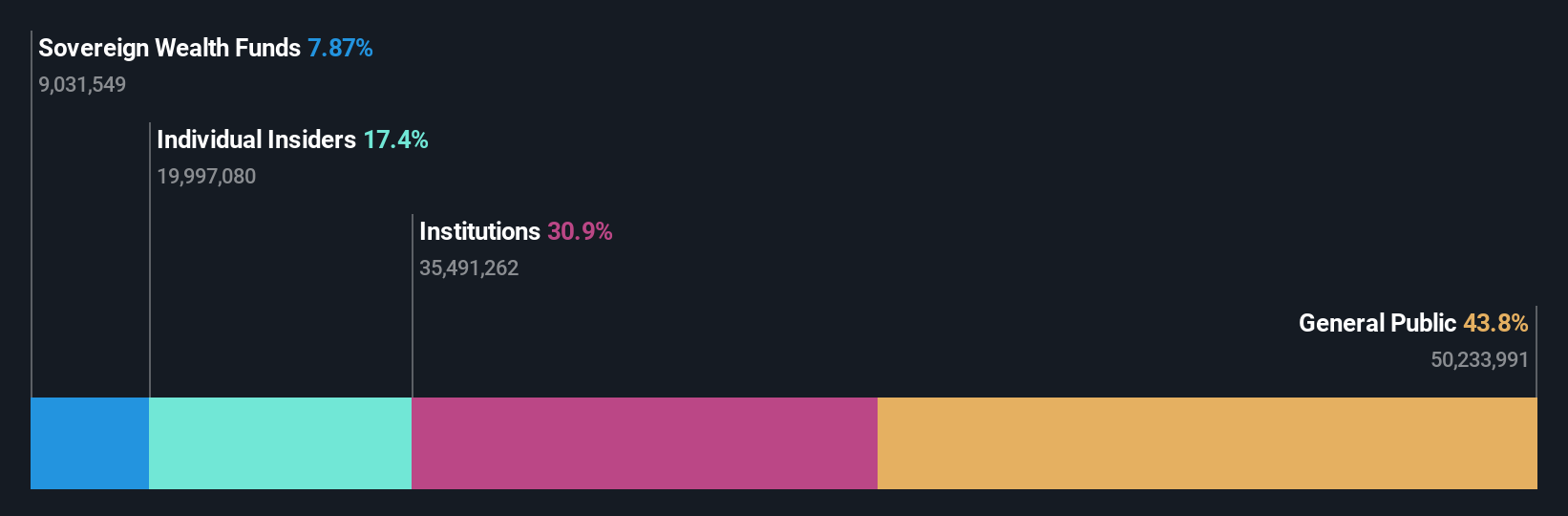

Insider Ownership: 17.7%

Allied Gold is poised for significant growth, with expected annual revenue increases over 21.5% and profitability within three years, surpassing market averages. Despite recent shareholder dilution due to a CAD 192.2 million equity offering, the stock trades at a substantial discount to its estimated fair value. The Sadiola Gold Mine expansion aims to boost production significantly by 2028, supported by a $400 million investment in new infrastructure and processing capabilities, enhancing long-term operational capacity.

- Click here to discover the nuances of Allied Gold with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of Allied Gold shares in the market.

Aritzia (TSX:ATZ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc., along with its subsidiaries, designs, develops, and sells apparel and accessories for women in the United States and Canada, with a market cap of CA$5.74 billion.

Operations: The company's revenue is primarily generated from its apparel segment, amounting to CA$2.37 billion.

Insider Ownership: 18.9%

Aritzia is positioned for significant earnings growth, expected to outpace the Canadian market at 60.4% annually over the next three years. Despite trading significantly below its estimated fair value, recent insider selling and a decline in profit margins from 7.5% to 3.3% may raise concerns. Revenue is forecasted to grow between 8% and 12%, with fiscal year projections reaching up to C$2.62 billion, showcasing robust revenue expansion potential despite slower growth compared to earnings forecasts.

- Take a closer look at Aritzia's potential here in our earnings growth report.

- Our valuation report unveils the possibility Aritzia's shares may be trading at a premium.

Nuvei (TSX:NVEI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nuvei Corporation offers payment technology solutions to merchants and partners across various regions including North America, Europe, the Middle East and Africa, Latin America, and the Asia Pacific, with a market cap of CA$6.47 billion.

Operations: The company's revenue primarily comes from providing payment technology solutions to merchants and partners, totaling $1.31 billion.

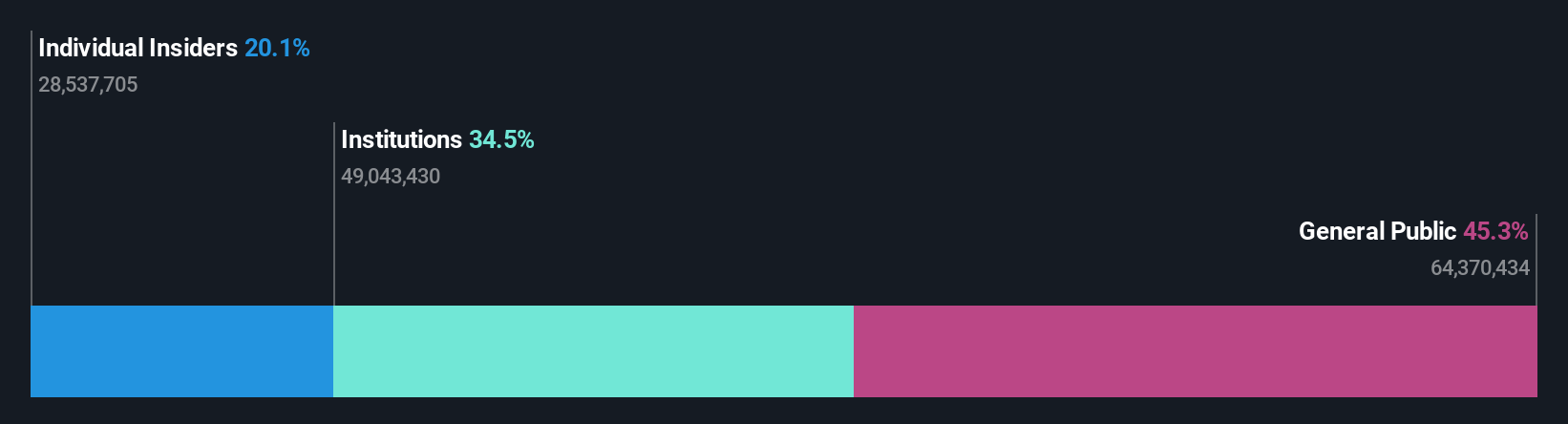

Insider Ownership: 20.1%

Nuvei's strategic expansion in the APAC region, highlighted by its partnership with JCB International, strengthens its position in a rapidly growing market. Despite recent earnings showing a decline in net income to US$3.47 million for Q2 2024, revenue increased to US$345.48 million. Insider ownership remains high without substantial selling or buying activity over three months. Revenue is expected to grow at 12.6% annually, outpacing the Canadian market average of 7%.

- Click to explore a detailed breakdown of our findings in Nuvei's earnings growth report.

- Our valuation report here indicates Nuvei may be overvalued.

Where To Now?

- Click this link to deep-dive into the 34 companies within our Fast Growing TSX Companies With High Insider Ownership screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAUC

Very undervalued with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026