- Canada

- /

- Specialty Stores

- /

- TSX:ATZ

How Strong U.S. Sales and Digital Expansion At Aritzia (TSX:ATZ) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Aritzia Inc. reported strong second-quarter fiscal 2026 results on October 9, 2025, with net revenue rising to CA$812.05 million and net income reaching CA$66.3 million, and raised its full-year revenue outlook to CA$3.3 billion to CA$3.35 billion, anticipating continued growth led by robust U.S. performance, digital channels, and new boutique openings.

- Operational changes such as relocating U.S. fulfillment and launching an international e-commerce platform contributed to margin improvement and mitigated tariff impacts, highlighting Aritzia's ability to adapt in a shifting retail landscape.

- We'll examine how Aritzia's robust U.S. sales and digital gains influence its investment narrative and future revenue growth outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Aritzia Investment Narrative Recap

To be an Aritzia shareholder, you need to believe in the company's ability to drive consistent growth by expanding its footprint in the United States, growing digital sales, and opening new boutiques. The latest results reinforce that U.S. sales and e-commerce are powering growth, but also signal that U.S. tariffs remain the most important short-term risk. The strong digital and retail gains offset some of this risk, but exposure to shifting tariff policies will continue to matter.

Among recent company announcements, the raised revenue outlook for fiscal 2026 stands out, reflecting management’s confidence in double-digit comparable sales growth and new boutique openings. This upgrade is anchored by continued strength in U.S. markets, which management says is driving both quarter-to-date momentum and long-term expectations for the rest of the year. In contrast, investors should be aware that ongoing cost pressures from tariffs could impact Aritzia’s margins, especially as expansion accelerates...

Read the full narrative on Aritzia (it's free!)

Aritzia's narrative projects CA$4.3 billion revenue and CA$534.0 million earnings by 2028. This requires 13.8% yearly revenue growth and a CA$299.7 million earnings increase from CA$234.3 million today.

Uncover how Aritzia's forecasts yield a CA$95.27 fair value, a 11% upside to its current price.

Exploring Other Perspectives

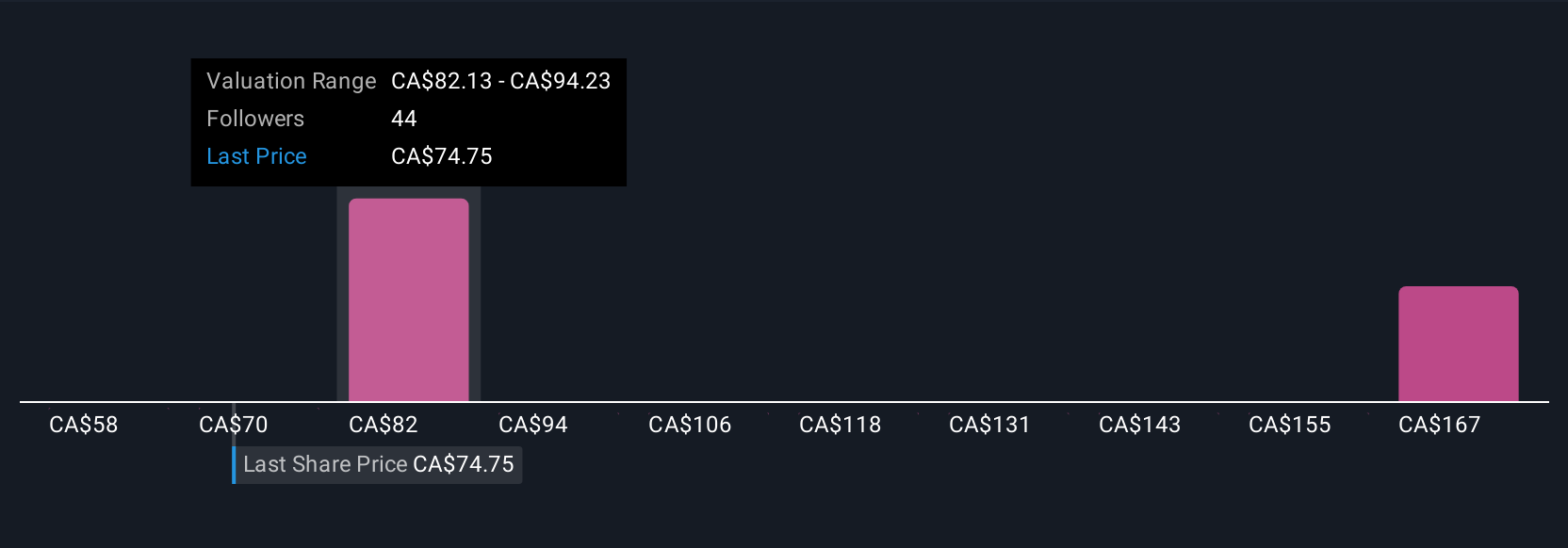

Eight members of the Simply Wall St Community estimate Aritzia’s fair value between CA$57.92 and CA$174.44. Views differ widely, while the current analyst narrative highlights U.S. growth as a major revenue driver for the company’s future results.

Explore 8 other fair value estimates on Aritzia - why the stock might be worth over 2x more than the current price!

Build Your Own Aritzia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aritzia research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Aritzia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aritzia's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATZ

Aritzia

Designs, develops, and sells apparels and accessories for women in the United States and Canada.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives