Stock Analysis

- Canada

- /

- Consumer Finance

- /

- TSX:GSY

High Insider Ownership Growth Stocks On TSX To Watch In June 2024

Reviewed by Simply Wall St

As the Canadian market navigates through a phase of economic stabilization and recovery, with central banks initiating rate cuts to foster growth, investors might find it opportune to focus on growth companies with high insider ownership. Such stocks often signal strong confidence from those who know the company best, aligning well with an environment where careful selection becomes key to leveraging market conditions.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Payfare (TSX:PAY) | 15% | 57.7% |

| goeasy (TSX:GSY) | 21.7% | 15.9% |

| Vox Royalty (TSX:VOXR) | 12.4% | 77.3% |

| Allied Gold (TSX:AAUC) | 22.5% | 68.2% |

| Aritzia (TSX:ATZ) | 19% | 51.2% |

| ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

| Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

| Ivanhoe Mines (TSX:IVN) | 13.1% | 65.3% |

| Artemis Gold (TSXV:ARTG) | 31.8% | 48.8% |

| Almonty Industries (TSX:AII) | 12.3% | 105% |

Let's review some notable picks from our screened stocks.

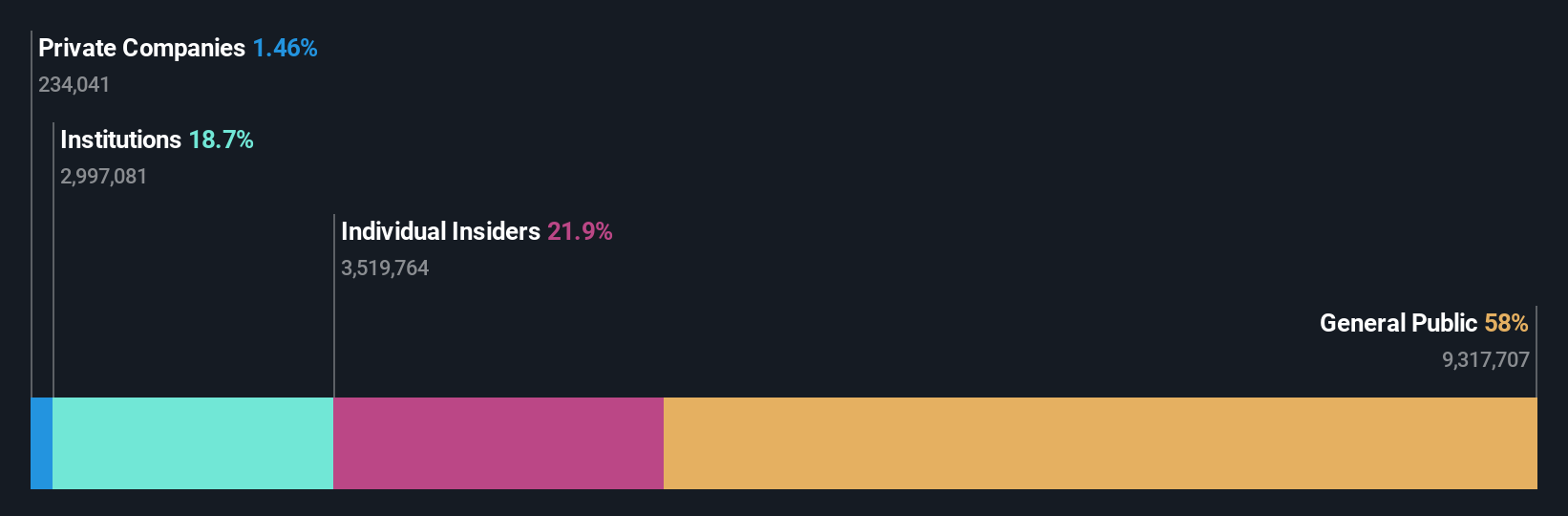

Aritzia (TSX:ATZ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc. operates in the United States and Canada, designing, developing, and selling women's apparel and accessories with a market capitalization of approximately CA$4.17 billion.

Operations: The company generates CA$2.33 billion from its apparel and accessories segment.

Insider Ownership: 19%

Earnings Growth Forecast: 51.2% p.a.

Aritzia, a Canadian retailer, reported a notable dip in net income to CAD 78.78 million from CAD 187.59 million year-over-year, with sales growing to CAD 2.33 billion. Despite this, the company anticipates revenue growth between 8% and 12% for fiscal 2025, reflecting robust market confidence. Aritzia's earnings are expected to surge by about 51% annually over the next three years, outpacing broader market projections significantly. Additionally, high insider ownership aligns leadership interests with shareholder gains despite recent profit margin contractions from 8.5% to 3.4%.

- Delve into the full analysis future growth report here for a deeper understanding of Aritzia.

- The analysis detailed in our Aritzia valuation report hints at an deflated share price compared to its estimated value.

goeasy (TSX:GSY)

Simply Wall St Growth Rating: ★★★★★☆

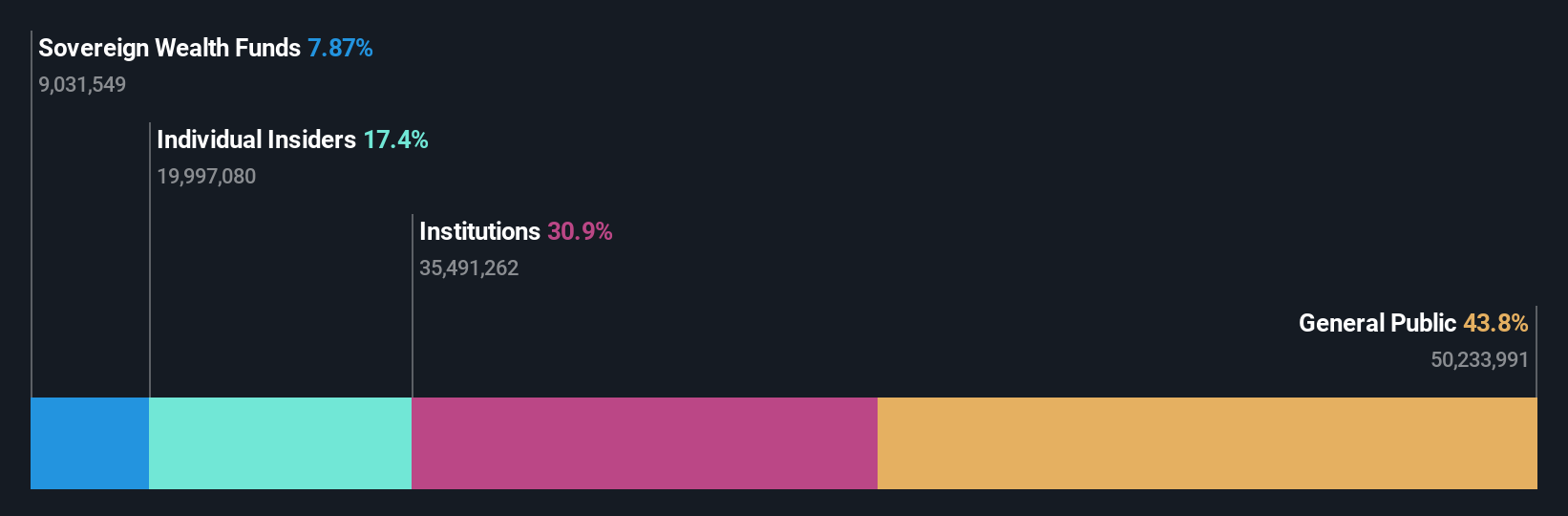

Overview: goeasy Ltd., operating under the easyhome, easyfinancial, and LendCare brands, offers non-prime leasing and lending services to Canadian consumers with a market capitalization of approximately CA$3.22 billion.

Operations: The company generates revenue through its easyhome and easyfinancial segments, with CA$153.99 million from leasing services and CA$1.17 billion from lending services.

Insider Ownership: 21.7%

Earnings Growth Forecast: 15.9% p.a.

goeasy Ltd., a Canadian financial services company, has shown strong growth with a 54.3% increase in earnings over the past year. Despite challenges in covering dividends with cash flows, insider activities have been modest with more shares bought than sold recently. The company is trading at 38.9% below its estimated fair value and anticipates revenue growth of 32.7% annually, outpacing the market significantly. Recent executive appointments aim to enhance strategic direction and operational efficiency across brands.

- Dive into the specifics of goeasy here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of goeasy shares in the market.

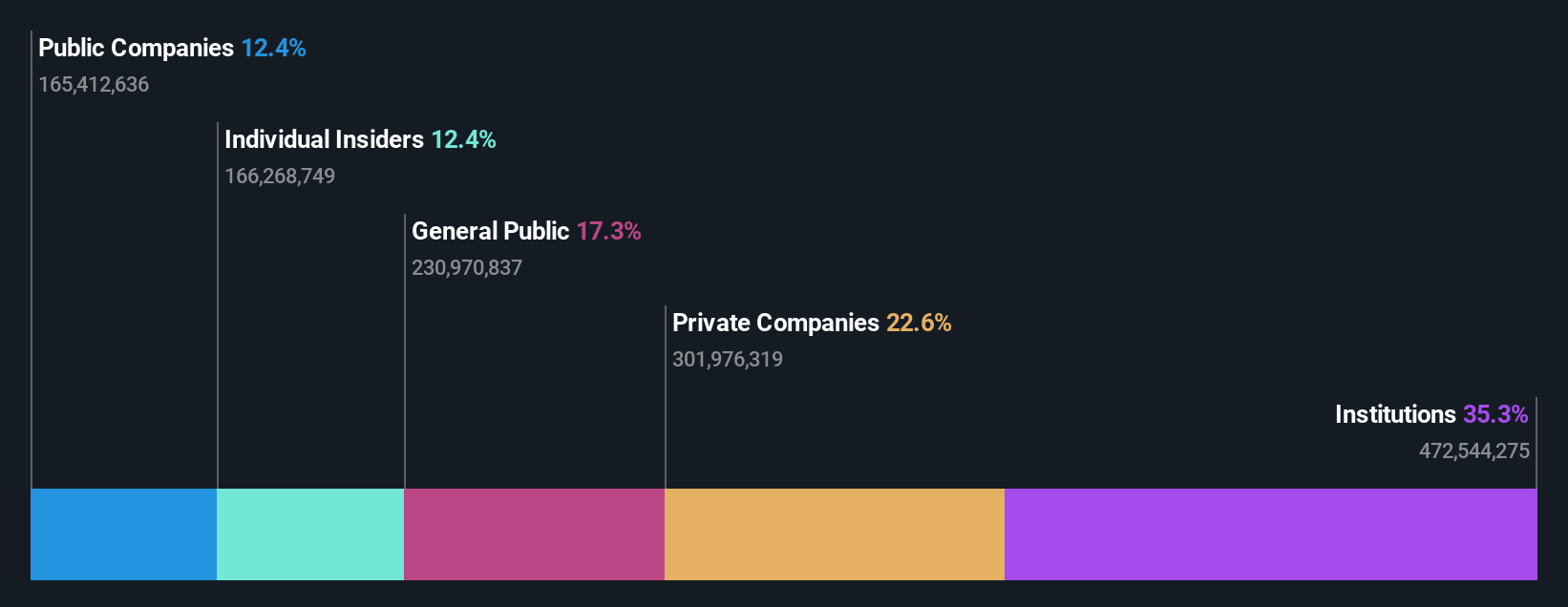

Ivanhoe Mines (TSX:IVN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. is a company focused on the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market capitalization of CA$23.26 billion.

Operations: The firm primarily focuses on the extraction and development of minerals and precious metals in Africa.

Insider Ownership: 13.1%

Earnings Growth Forecast: 65.3% p.a.

Ivanhoe Mines, a growth-focused mining company with significant insider ownership, recently announced the early and on-budget completion of its Phase 3 concentrator at the Kamoa-Kakula Copper Complex. This expansion is set to significantly increase copper production, positioning Ivanhoe as one of the world's largest copper producers. Despite a recent net loss in Q1 2024, Ivanhoe’s revenue and earnings are expected to grow substantially, driven by operational efficiencies and strategic acquisitions. Insider transactions have been balanced, indicating cautious optimism among insiders about the company’s future.

- Navigate through the intricacies of Ivanhoe Mines with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Ivanhoe Mines implies its share price may be too high.

Key Takeaways

- Delve into our full catalog of 30 Fast Growing TSX Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether goeasy is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GSY

goeasy

Provides non-prime leasing and lending services under the easyhome, easyfinancial, and LendCare brands to consumers in Canada.

High growth potential with proven track record and pays a dividend.