- Canada

- /

- Energy Services

- /

- TSX:TVK

3 TSX Growth Companies With High Insider Ownership And 12% Revenue Growth

Reviewed by Simply Wall St

The Canadian market has shown resilience, remaining flat over the last week but boasting a 21% increase over the past year, with earnings projected to grow by 14% annually in the coming years. In this environment, growth companies with high insider ownership and notable revenue growth can offer valuable insights into potential investment opportunities.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 11.8% | 70.7% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.2% | 17.1% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 72.4% |

| Amerigo Resources (TSX:ARG) | 12% | 36.8% |

| Aritzia (TSX:ATZ) | 18.9% | 60.4% |

| Aya Gold & Silver (TSX:AYA) | 10.2% | 71.4% |

| Allied Gold (TSX:AAUC) | 17.7% | 72.9% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Alpha Cognition (CNSX:ACOG) | 17% | 69.5% |

We're going to check out a few of the best picks from our screener tool.

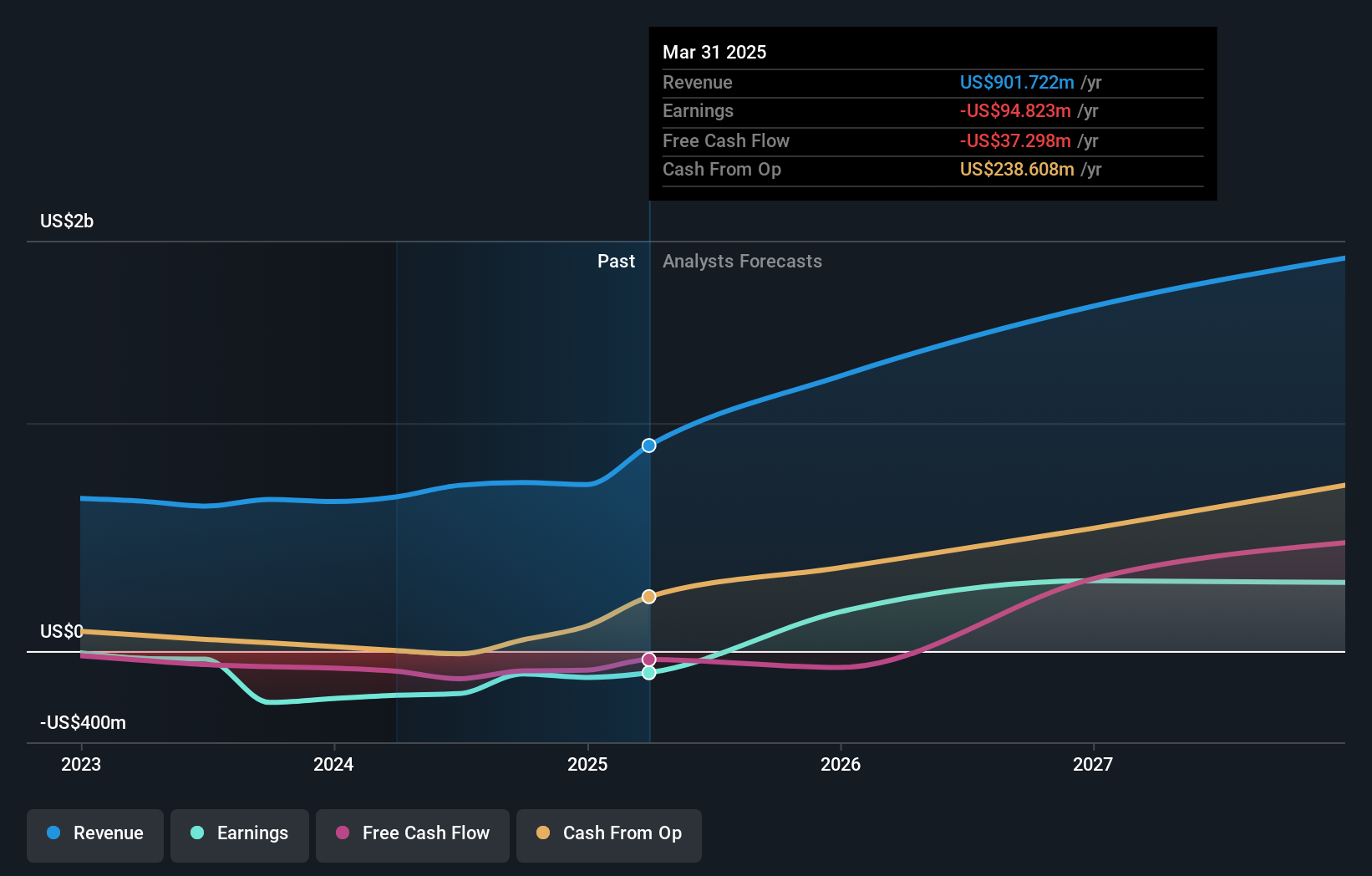

Allied Gold (TSX:AAUC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Allied Gold Corporation, with a market cap of CA$990.62 million, explores and produces mineral deposits in Africa through its subsidiaries.

Operations: The company's revenue segments include $142.03 million from the Agbaou Mine, $193.93 million from the Bonikro Mine, and $391.07 million from the Sadiola Mine.

Insider Ownership: 17.7%

Revenue Growth Forecast: 21.8% p.a.

Allied Gold Corporation, trading significantly below its fair value, is poised for substantial growth with revenue projected to increase by 21.8% annually, outpacing the Canadian market. Despite recent shareholder dilution through a CAD 192.2 million equity offering, the company is expected to become profitable within three years and achieve above-average market growth in earnings. The Sadiola Gold Mine expansion further supports Allied Gold's potential as a transformative project aimed at boosting production efficiency and output.

- Click here and access our complete growth analysis report to understand the dynamics of Allied Gold.

- Insights from our recent valuation report point to the potential undervaluation of Allied Gold shares in the market.

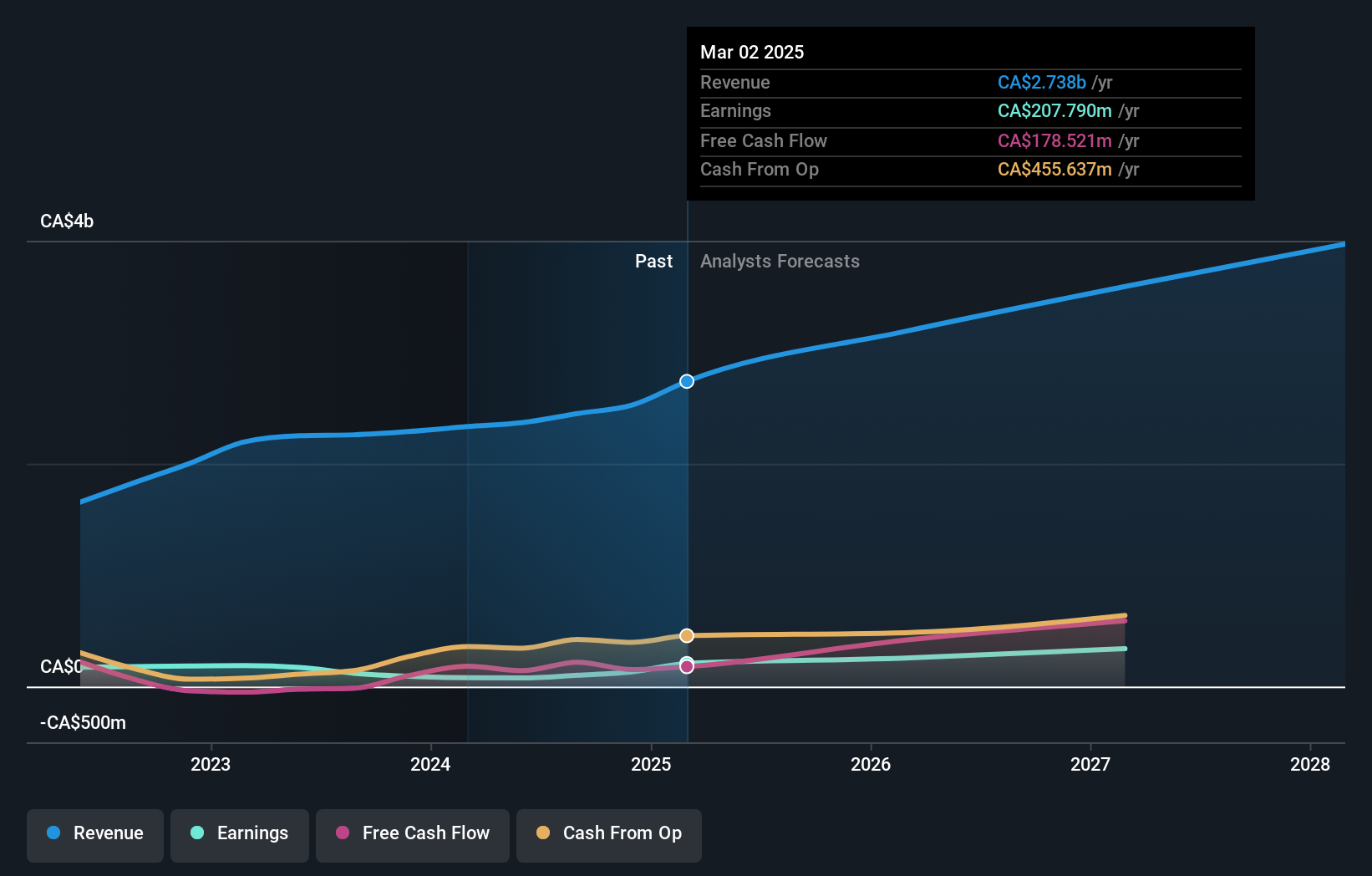

Aritzia (TSX:ATZ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc., along with its subsidiaries, designs, develops, and sells apparel and accessories for women in the United States and Canada, with a market cap of CA$5.71 billion.

Operations: The company generates revenue from its apparel segment, which amounted to CA$2.37 billion.

Insider Ownership: 18.9%

Revenue Growth Forecast: 12.1% p.a.

Aritzia, trading at a significant discount to its estimated fair value, anticipates robust earnings growth of 60.4% annually over the next three years, surpassing the Canadian market average. Despite recent shareholder dilution and declining profit margins from 7.5% to 3.3%, the company forecasts revenue growth between CAD 2.52 billion and CAD 2.62 billion for Fiscal Year 2025, indicating continued expansion potential despite slower-than-ideal revenue growth rates compared to ambitious benchmarks.

- Dive into the specifics of Aritzia here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Aritzia is trading beyond its estimated value.

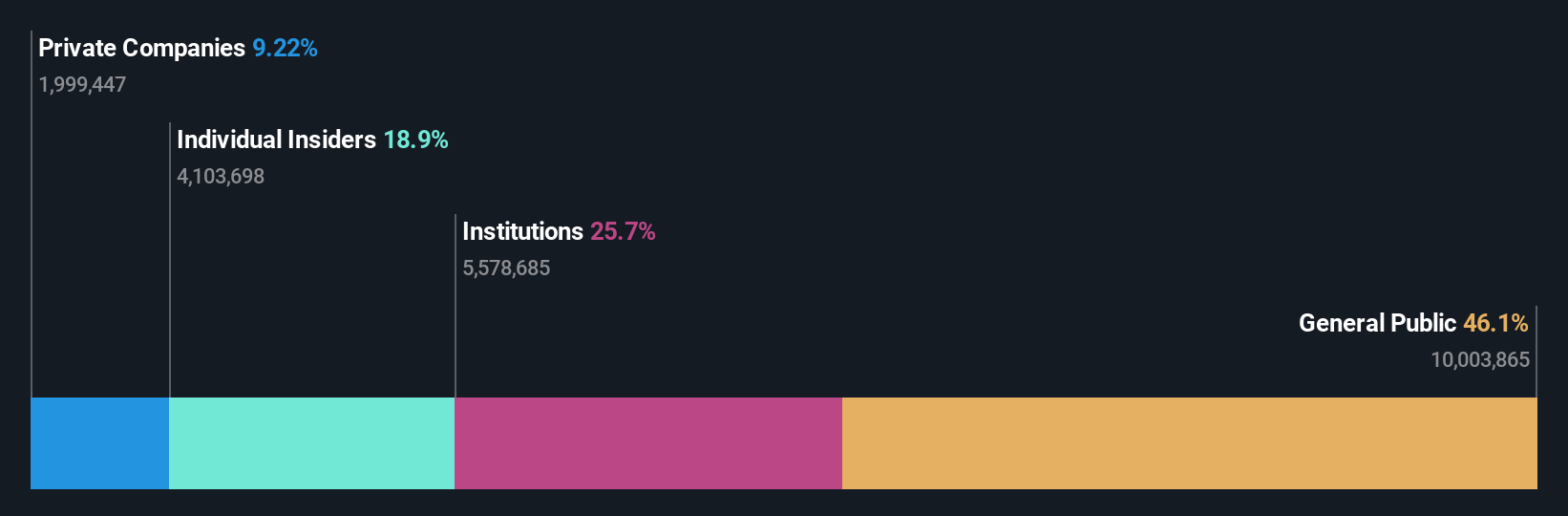

TerraVest Industries (TSX:TVK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TerraVest Industries Inc. manufactures and sells goods and services to the energy, agriculture, mining, transportation, and other markets in Canada and the United States with a market cap of CA$1.90 billion.

Operations: The company's revenue segments include Service (CA$201.78 million), Processing Equipment (CA$117.58 million), Compressed Gas Equipment (CA$243.77 million), and HVAC and Containment Equipment (CA$292.90 million).

Insider Ownership: 21.6%

Revenue Growth Forecast: 12.2% p.a.

TerraVest Industries, recently added to the S&P Global BMI Index, is projected to experience earnings growth of 21.1% annually, outpacing the Canadian market. Despite trading at a discount to its fair value estimate and strong past earnings growth, insider activity has shown more sales than purchases recently. The company faces challenges with high debt levels and shareholder dilution but continues to report solid revenue increases, reaching CAD 238.13 million in Q3 2024 from CAD 150.36 million a year earlier.

- Get an in-depth perspective on TerraVest Industries' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, TerraVest Industries' share price might be too optimistic.

Turning Ideas Into Actions

- Take a closer look at our Fast Growing TSX Companies With High Insider Ownership list of 35 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if TerraVest Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TVK

TerraVest Industries

Manufactures and sells goods and services to agriculture, mining, energy production and distribution, chemical, utilities, transportation and construction, and other markets in Canada, the United States, and internationally.

Solid track record with excellent balance sheet.