- Canada

- /

- Healthtech

- /

- TSX:VHI

3 Growth Companies With High Insider Ownership On The TSX

Reviewed by Simply Wall St

In the last week, the Canadian market has remained flat, but over the past year, it has experienced a notable rise of 23%, with earnings forecasted to grow by 16% annually. In this environment, growth companies with high insider ownership on the TSX can be particularly appealing as they often indicate strong confidence from those closest to the business and may offer potential alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| Allied Gold (TSX:AAUC) | 17.7% | 82.7% |

| Artemis Gold (TSXV:ARTG) | 30% | 60.7% |

| Almonty Industries (TSX:AII) | 17.7% | 60.7% |

| VersaBank (TSX:VBNK) | 13.3% | 30.4% |

| Enterprise Group (TSX:E) | 39.8% | 50.7% |

| Aya Gold & Silver (TSX:AYA) | 10.2% | 94.3% |

| Aritzia (TSX:ATZ) | 16.1% | 59.7% |

| Profound Medical (TSX:PRN) | 12.2% | 58.8% |

| CHAR Technologies (TSXV:YES) | 10.7% | 58.3% |

Let's explore several standout options from the results in the screener.

Aritzia (TSX:ATZ)

Simply Wall St Growth Rating: ★★★★★☆

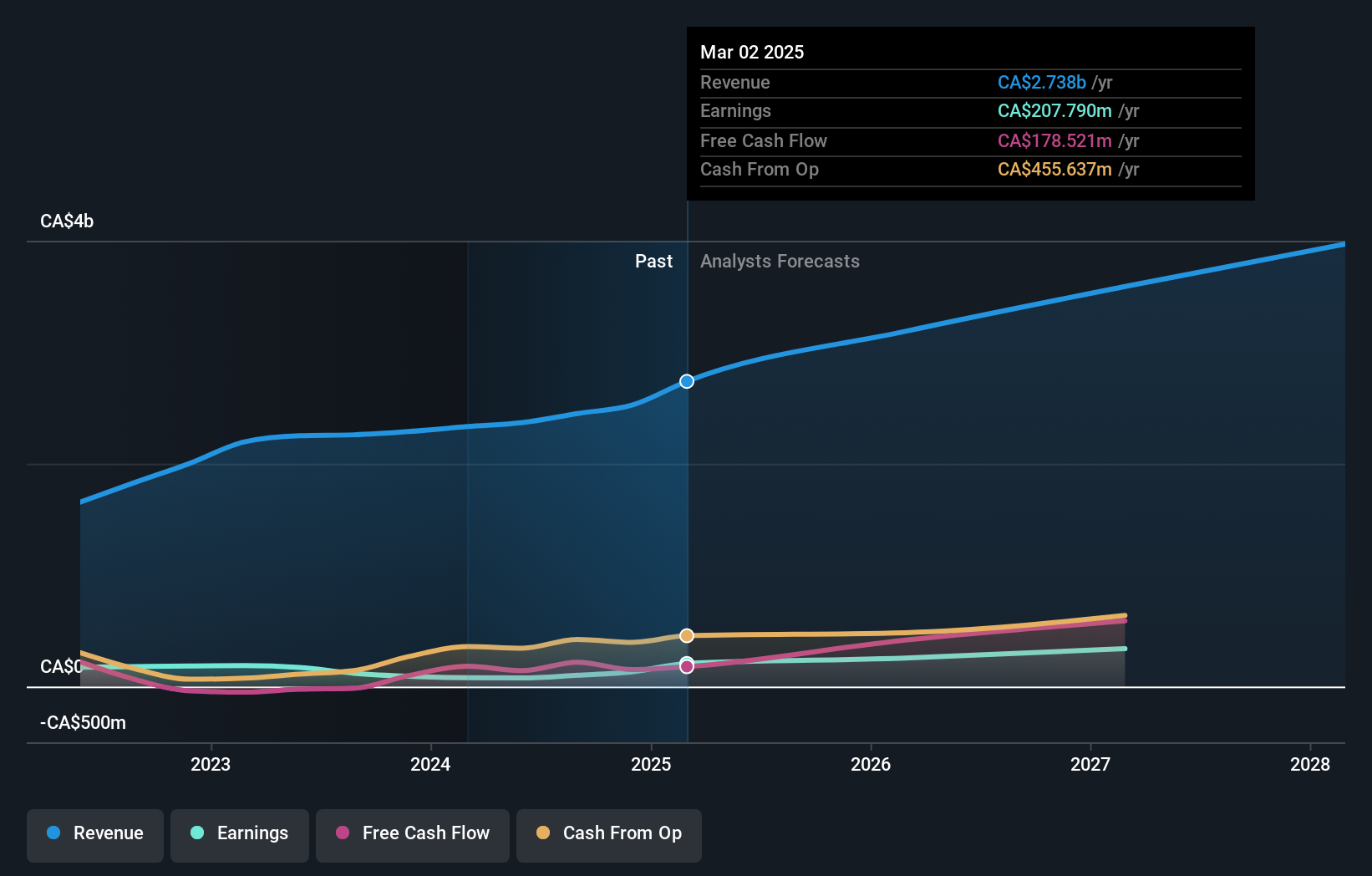

Overview: Aritzia Inc., along with its subsidiaries, designs, develops, and sells apparel and accessories for women in the United States and Canada, with a market cap of CA$6.55 billion.

Operations: The company's revenue is primarily derived from its apparel segment, which generated CA$2.45 billion.

Insider Ownership: 16.1%

Return On Equity Forecast: 28% (2027 estimate)

Aritzia's earnings are forecast to grow significantly at 59.7% annually, outpacing the Canadian market. Despite recent shareholder dilution, the company shows strong financial performance with Q2 sales increasing to C$615.66 million and net income improving from a loss to C$18.25 million year-over-year. Aritzia anticipates fiscal year revenue growth of 9% to 11%, reaching up to C$2.60 billion, although insider trading activity remains limited recently with no substantial buybacks executed.

- Unlock comprehensive insights into our analysis of Aritzia stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Aritzia shares in the market.

TerraVest Industries (TSX:TVK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TerraVest Industries Inc. is a company that manufactures and sells goods and services across various sectors, including energy, agriculture, mining, and transportation in Canada and the United States, with a market cap of CA$2.31 billion.

Operations: The company's revenue segments include Service (CA$201.78 million), Processing Equipment (CA$117.58 million), Compressed Gas Equipment (CA$243.77 million), and HVAC and Containment Equipment (CA$292.90 million).

Insider Ownership: 21.1%

Return On Equity Forecast: N/A (2027 estimate)

TerraVest Industries is trading below its estimated fair value and has seen a significant 43.6% earnings growth over the past year, with forecasts suggesting continued strong earnings growth of 20.6% annually, outpacing the Canadian market. Despite recent shareholder dilution and high debt levels, revenue is expected to grow faster than the market at 11.8% per year. Insider activity shows more shares bought than sold recently, and it was added to the S&P Global BMI Index in September 2024.

- Navigate through the intricacies of TerraVest Industries with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that TerraVest Industries is priced higher than what may be justified by its financials.

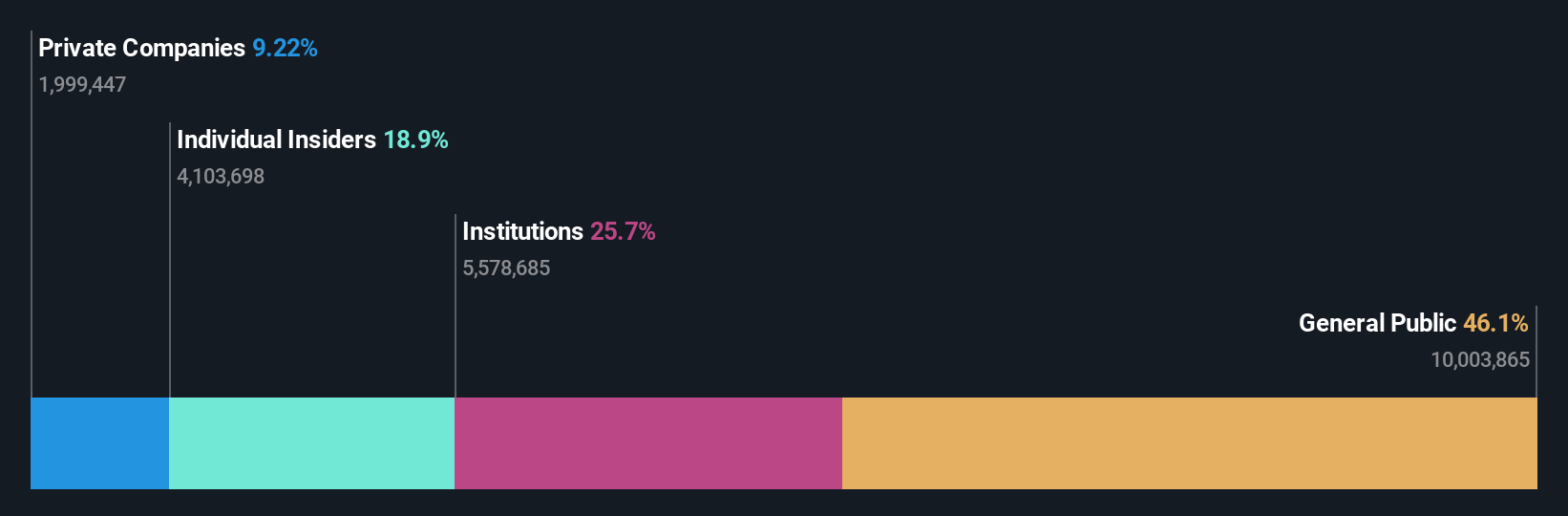

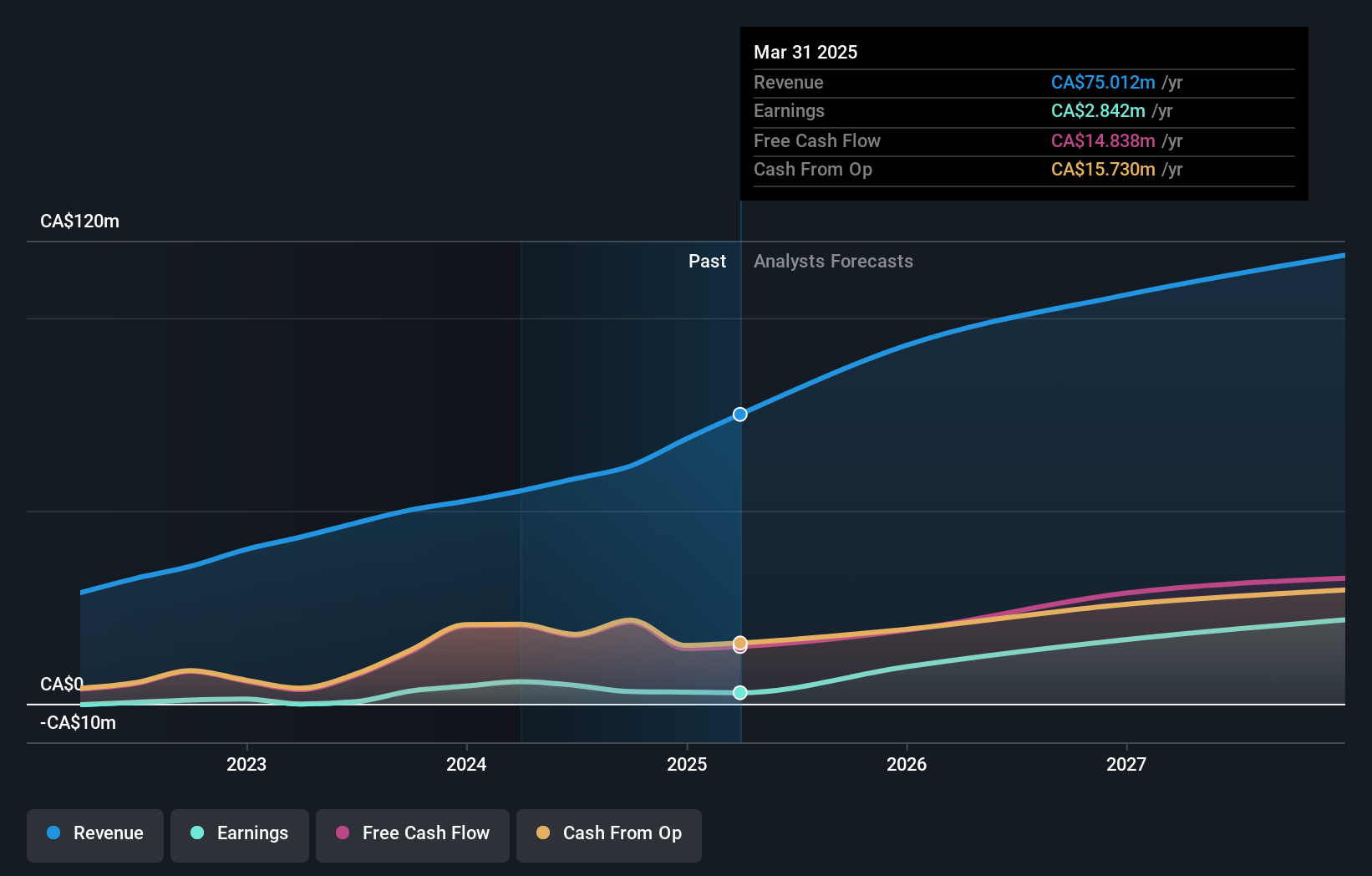

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. offers technology solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally with a market cap of CA$610.74 million.

Operations: The company generates revenue of CA$61.61 million from its Healthcare Software segment.

Insider Ownership: 14.7%

Return On Equity Forecast: N/A (2027 estimate)

Vitalhub is trading at a significant discount to its estimated fair value, with earnings forecasted to grow substantially faster than the Canadian market at 111.9% annually. Despite recent shareholder dilution and large one-off items impacting financial results, revenue growth is expected to outpace the market at 19.8% per year. The company has expanded its credit facilities with The Bank of Nova Scotia, increasing its borrowing capacity to C$65 million for enhanced financial flexibility.

- Delve into the full analysis future growth report here for a deeper understanding of Vitalhub.

- According our valuation report, there's an indication that Vitalhub's share price might be on the expensive side.

Key Takeaways

- Take a closer look at our Fast Growing TSX Companies With High Insider Ownership list of 34 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VHI

Vitalhub

Provides technology solutions for health and human service providers in Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally.

Flawless balance sheet with reasonable growth potential.