- Canada

- /

- Residential REITs

- /

- TSXV:SRES

Is Now The Time To Put Sun Residential Real Estate Investment Trust (CVE:SRES) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Sun Residential Real Estate Investment Trust (CVE:SRES), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Sun Residential Real Estate Investment Trust with the means to add long-term value to shareholders.

See our latest analysis for Sun Residential Real Estate Investment Trust

How Fast Is Sun Residential Real Estate Investment Trust Growing Its Earnings Per Share?

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So it's no surprise that some investors are more inclined to invest in profitable businesses. In previous twelve months, Sun Residential Real Estate Investment Trust's EPS has risen from US$0.013 to US$0.015. That's a fair increase of 9.6%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While Sun Residential Real Estate Investment Trust did well to grow revenue over the last year, EBIT margins were dampened at the same time. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

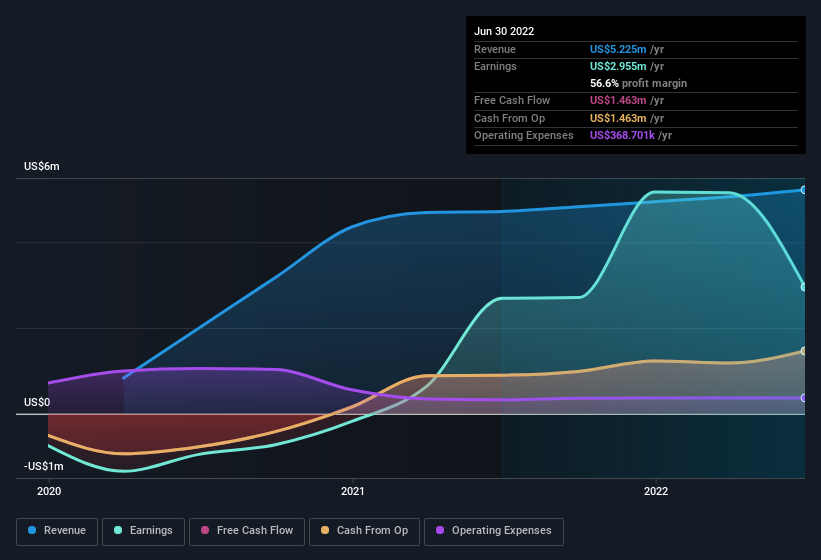

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since Sun Residential Real Estate Investment Trust is no giant, with a market capitalisation of CA$18m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Sun Residential Real Estate Investment Trust Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. For companies with market capitalisations under US$200m, like Sun Residential Real Estate Investment Trust, the median CEO pay is around US$186k.

The Sun Residential Real Estate Investment Trust CEO received total compensation of only US$56k in the year to December 2021. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Sun Residential Real Estate Investment Trust Worth Keeping An Eye On?

One positive for Sun Residential Real Estate Investment Trust is that it is growing EPS. That's nice to see. To add to this, the modest CEO compensation should tell investors that the directors have an active interest in delivering the best for shareholders. So based on its merits, the stock deserves further research, if not an addition to your watchlist. We don't want to rain on the parade too much, but we did also find 4 warning signs for Sun Residential Real Estate Investment Trust (2 are concerning!) that you need to be mindful of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:SRES

Sun Residential Real Estate Investment Trust

An unincorporated open-ended real estate investment trust established pursuant to a declaration of trust dated January 22, 2019, as amended and restated on March 22, 2019 and November 4, 2020.

Moderate average dividend payer.

Market Insights

Community Narratives