- Canada

- /

- Retail REITs

- /

- TSX:SRU.UN

Should You Reconsider SmartCentres REIT After 10% Jump and New Developments in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with SmartCentres Real Estate Investment Trust? You are definitely not alone. With this REIT, today's conversation is less about chasing headline hype and more about making a reasonable call—hold tight, add more, or take some profits. The stock has been quietly rewarding patient investors, climbing 2.0% over the last week, 10.0% since the start of the year, and delivering a total 81.7% return over five years. That is an impressive long-term trajectory, even as the real estate sector faces changing consumer habits and interest rate uncertainty.

Part of the recent uptick in price tracks alongside positive news momentum. New development agreements and lease announcements have improved sentiment, giving the market more confidence that SmartCentres can weather volatility and possibly even thrive. These developments further support the idea that the trust remains nimble and relevant in a shifting commercial property market. While not every piece of news has made waves, it is clear investors are paying attention when SmartCentres goes on the front foot.

Valuation-wise, this real estate trust is scoring a 4 out of 6 on our value scale. This means it appears undervalued in most, but not all, of the checks that matter. So, is this enough to make it a buy, or do those two tougher metrics mean you should pause? Let’s break down how the main valuation methods stack up for SmartCentres, and then dig into an even smarter way to understand what you are really getting for your dollar.

Approach 1: SmartCentres Real Estate Investment Trust Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) analysis projects a company’s future cash flows, here based on adjusted funds from operations, and discounts them back to today’s value. This helps estimate what the business is truly worth in current terms.

For SmartCentres Real Estate Investment Trust, current free cash flow stands at CA$359.40 million. Analyst estimates project steady growth, reaching CA$461.34 million by 2035, with intermediate figures from both analyst consensus and systematic forecasts. These cash flows, all in Canadian dollars, are then discounted to account for time and risk, giving a present-value perspective on the REIT’s earning power.

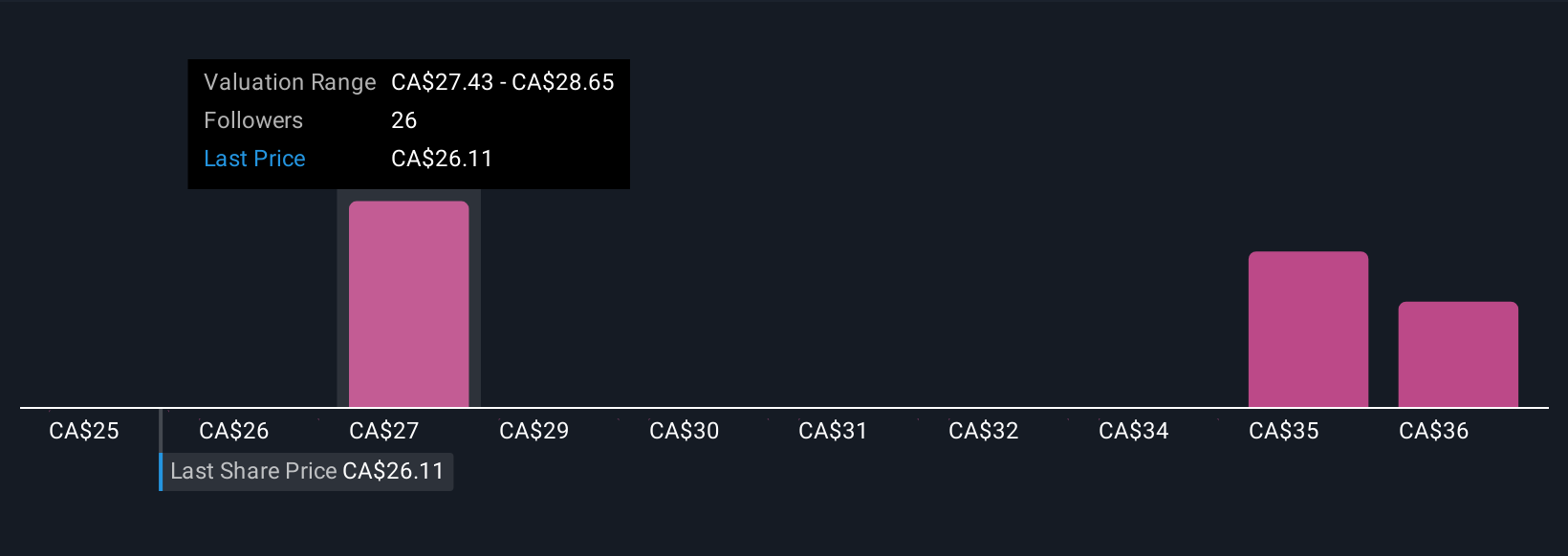

Based on this approach, the DCF model calculates an intrinsic value of CA$38.33 per share. With the current market price sitting about 29.4% below that estimate, the stock appears to be significantly undervalued based on its projected ability to generate cash.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SmartCentres Real Estate Investment Trust is undervalued by 29.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

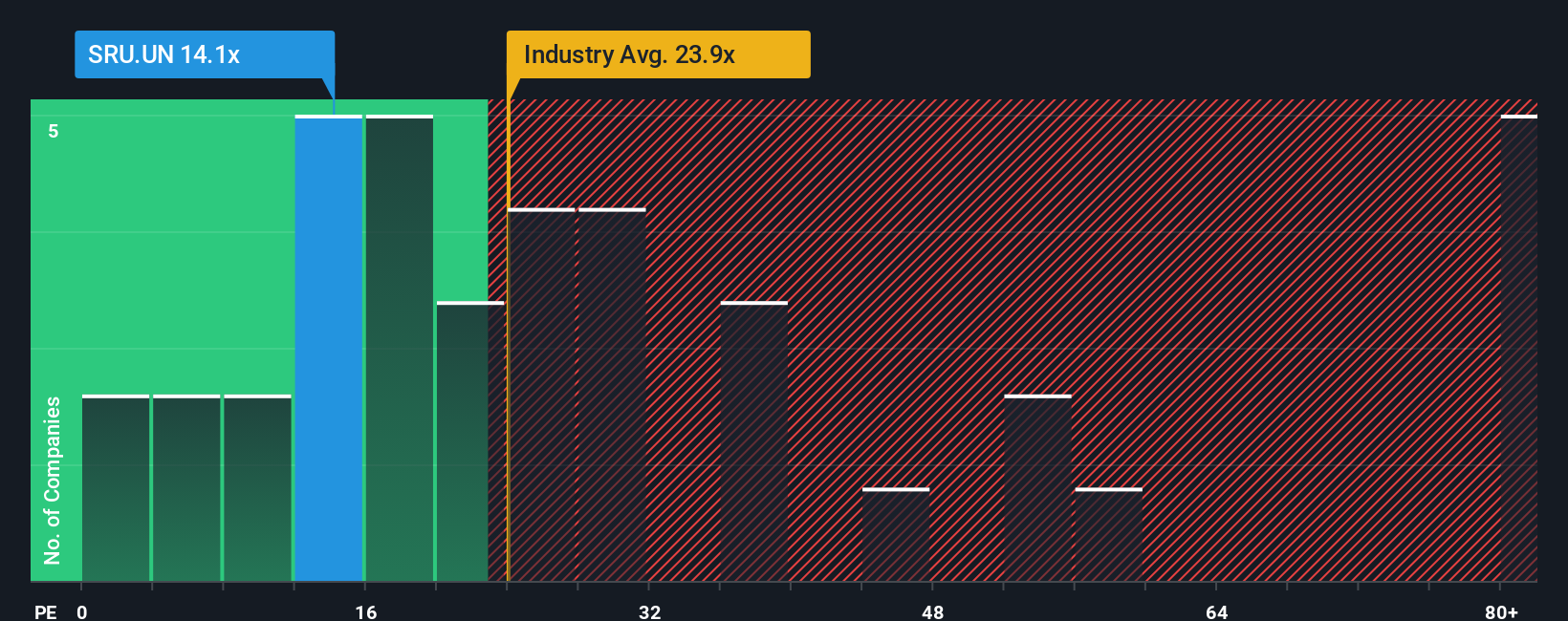

Approach 2: SmartCentres Real Estate Investment Trust Price vs Earnings

For profitable real estate investment trusts like SmartCentres, the price-to-earnings (PE) ratio is a popular tool for investors. It lets you see how much you are paying for every dollar of earnings, making it easier to compare value across companies that turn a steady profit.

The “right” PE ratio depends on several factors. Companies with stronger growth outlooks and lower risk often justify a higher PE, while firms facing headwinds or uncertainty typically trade on lower multiples. This context is important when weighing up whether SmartCentres’ current PE makes sense.

Right now, SmartCentres sports a PE ratio of 17.0x. That sits slightly above the retail REIT industry average of 16.5x, but just below the peer group’s average of 18.3x. At first glance, this puts the stock in a reasonable range compared to similar businesses but does not necessarily signal a clear bargain or expensive territory.

Simply Wall St’s “Fair Ratio” digs deeper than simple averages. It reflects what the company’s PE should be, factoring in growth, profit margins, size, and risk. This makes for a more tailored and accurate benchmark, since two companies in the same industry may have very different prospects or risk profiles.

Given all these factors, SmartCentres’ current PE is closely aligned with its fair value multiple. That suggests the stock’s price is neither stretched nor discounted based on what you are getting for your money, after accounting for the specifics of the business.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SmartCentres Real Estate Investment Trust Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company, a way to connect your outlook, assumptions, and expectations for SmartCentres Real Estate Investment Trust to the numbers that drive value, such as fair value estimates, future revenue, and profit margins.

Narratives make investment decisions more meaningful by linking the company’s real-world story to its financial forecast and, ultimately, to a fair value estimate. On Simply Wall St’s platform, millions of investors use Narratives within the Community page as a straightforward tool to compare their own view with others and monitor how their thinking might affect a buy or sell decision by comparing fair value to the market price.

What makes Narratives powerful is that they are automatically updated when new events occur, such as key news or earnings releases, ensuring your perspective always reflects the latest information. For example, one SmartCentres Narrative might predict high future growth and assign a much higher fair value than the current price, while another takes a more cautious view and sees the stock as fairly valued already. This shows how different outlooks lead to different investment calls.

Do you think there's more to the story for SmartCentres Real Estate Investment Trust? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SRU.UN

SmartCentres Real Estate Investment Trust

SmartCentres is one of Canada’s largest fully integrated REITs, with a best-in-class and growing mixed-use portfolio featuring 197 strategically located properties in communities across the country.

6 star dividend payer and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)