- Canada

- /

- Retail REITs

- /

- TSX:REI.UN

Does RioCan’s Recent 3% Share Price Rise Signal a Fair Value in 2025?

Reviewed by Bailey Pemberton

If you are trying to decide what to do with RioCan Real Estate Investment Trust, you are definitely not alone. With a last close at $19.04, plenty of investors are weighing their options, especially after watching RioCan's share price steadily grow. Over the past week, the stock nudged up 0.7%, building on a 2.0% gain in the past month. That performance becomes even more interesting when you zoom out: up 3.3% year-to-date, 2.4% for the past year, and an impressive 21.9% over three years. If you have been holding on even longer, the five-year return stands at a remarkable 70.4%.

Much of this upward momentum reflects a broader shift in how the market views top Canadian REITs in the wake of stabilizing economic conditions, as well as growing demand for urban commercial properties. While there have not been any major catalysts in the form of blockbuster news, investors are clearly reassessing RioCan’s risk profile and that is showing up in the share price.

But is RioCan still undervalued at these levels? Using our six valuation checks, RioCan earns a value score of 3, meaning it is undervalued in three out of six key areas. In a moment, we will dig into each of these valuation methods, outlining exactly where RioCan stacks up and where the stock might present value or potential risk. Stick around, because after we break down the numbers, we will also look at a smarter way to think about valuation that often gets overlooked.

Why RioCan Real Estate Investment Trust is lagging behind its peers

Approach 1: RioCan Real Estate Investment Trust Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating RioCan’s future adjusted funds from operations, then discounting those cash flows back to today’s value in CA$. This approach gives investors a sense of what the business is truly worth, based on its ability to generate free cash flow over time.

Currently, RioCan generates last twelve months free cash flow (FCF) of CA$544.3 Million. Analysts provide firm estimates for up to five years, with projected FCF for the year ending 2027 at CA$436.2 Million. In addition, Simply Wall St extrapolates future cash flows up to 10 years, incorporating expectations for a gradually declining FCF. The main focus remains on these near-term and medium-term projections.

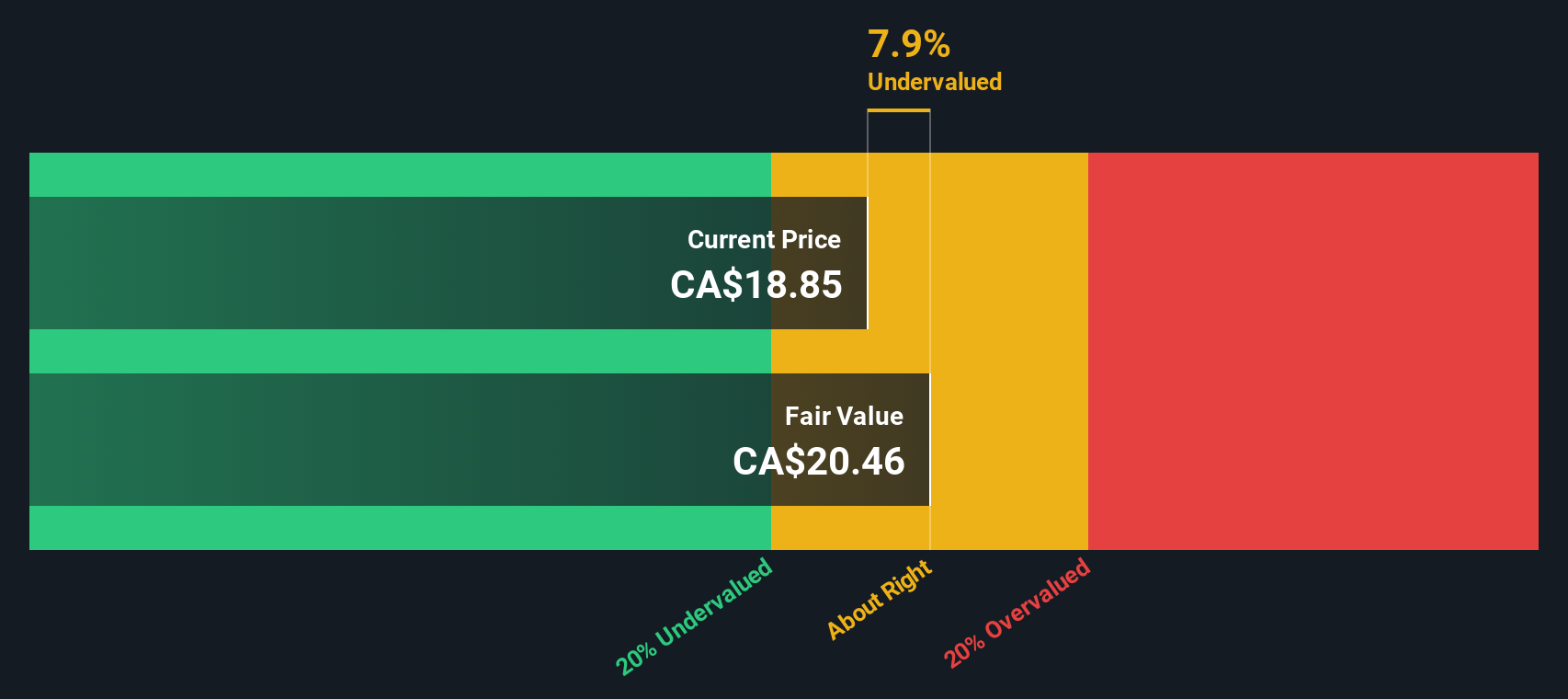

The DCF analysis results in an estimated intrinsic value of CA$20.40 per share. Compared to the recent share price of CA$19.04, this suggests the stock is trading at a 6.7% discount to its calculated fair value. While this signals mild undervaluation, the gap is not dramatic.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out RioCan Real Estate Investment Trust's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: RioCan Real Estate Investment Trust Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like RioCan Real Estate Investment Trust because it relates the company’s share price to its actual earnings, providing a clear measure of market expectations. It is especially useful for companies with stable, predictable earnings streams, as is typical for established real estate investment trusts.

When evaluating what makes a PE ratio “fair,” it is important to consider both growth prospects and risk. Companies expected to grow their earnings faster than average or those seen as lower risk often trade at higher PE ratios. Conversely, slower expected growth or elevated risks may warrant a lower ratio.

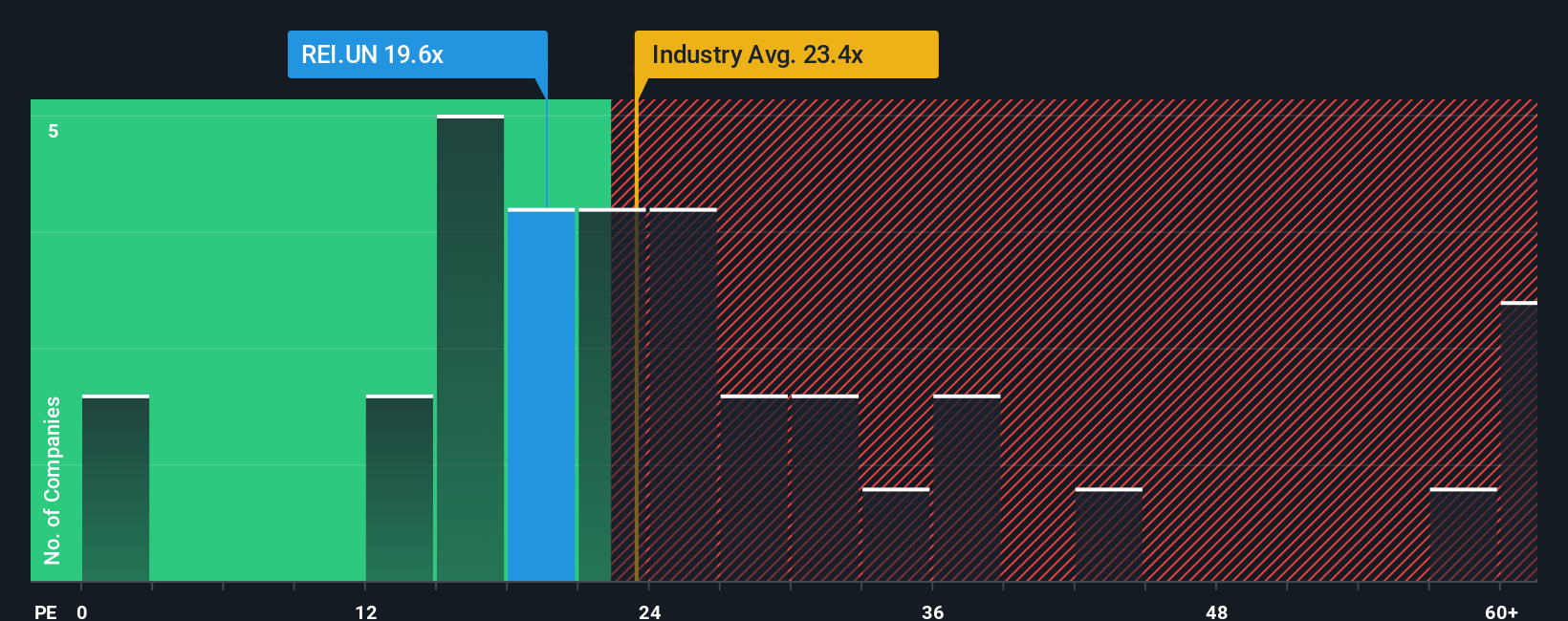

RioCan currently trades at a PE ratio of 19.8x. This stands above both the average for its retail REIT peers at 17.3x and the broader industry average of 16.4x. At first glance, this premium could suggest overvaluation, but standard comparisons do not factor in company-specific growth or business quality.

To address this, Simply Wall St calculates a proprietary "Fair Ratio" of 21.0x for RioCan. This metric considers a blend of factors such as RioCan’s expected earnings growth, profit margins, market cap, and risk profile, providing a more tailored view than simply comparing against peer or industry averages.

When stacked up, RioCan’s current PE of 19.8x is only marginally below its Fair Ratio of 21.0x. This signals that shares are trading almost exactly where they should be, with no meaningful discount or premium based on these fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your RioCan Real Estate Investment Trust Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your story, your practical perspective on a company’s future, which goes beyond the numbers to incorporate your own fair value assumptions, revenue expectations, and profit margin forecasts. Narratives help you tie together RioCan’s business story, your financial forecast, and the resulting fair value in a simple flow.

On Simply Wall St’s Community page, Narratives are an accessible and easy-to-use tool, trusted by millions of investors, that allow you to see how your convictions compare to others. They empower you to make confident buy or sell decisions by highlighting whether RioCan’s Fair Value, based on your forecast, is above or below the current price. Narratives update dynamically as new information appears, so your investment thesis can always reflect the latest earnings or news.

For example, with RioCan Real Estate Investment Trust, some investors may forecast rapid rental growth and predict a fair value over CA$24 per share, while the most cautious expect a value near CA$16. Narratives ensure your decisions are grounded in both data and conviction, making it easy to act when opportunity arises.

Do you think there's more to the story for RioCan Real Estate Investment Trust? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:REI.UN

RioCan Real Estate Investment Trust

RioCan meets the everyday shopping needs of Canadians through the ownership, management and development of necessity-based and mixed-use properties in densely populated communities.

Solid track record average dividend payer.

Market Insights

Community Narratives