- Canada

- /

- Retail REITs

- /

- TSX:REI.UN

Do These 3 Checks Before Buying RioCan Real Estate Investment Trust (TSE:REI.UN) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see RioCan Real Estate Investment Trust (TSE:REI.UN) is about to trade ex-dividend in the next 4 days. You can purchase shares before the 30th of July in order to receive the dividend, which the company will pay on the 8th of August.

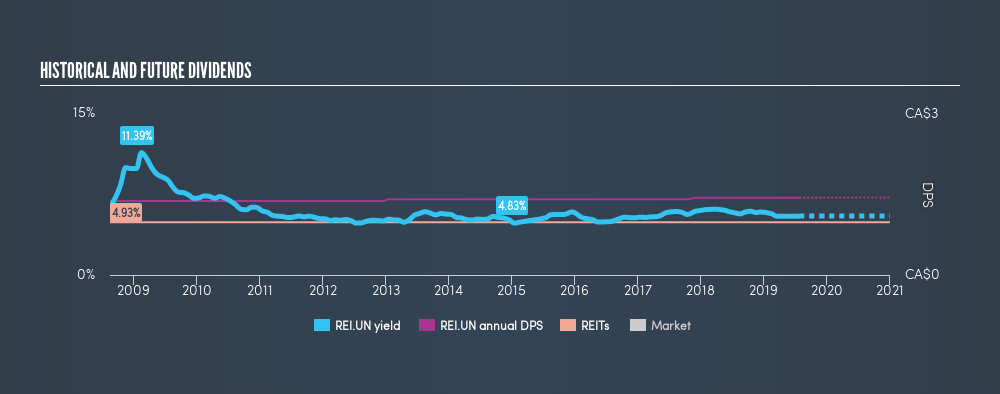

RioCan Real Estate Investment Trust's next dividend payment will be CA$0.12 per share, on the back of last year when the company paid a total of CA$1.44 to shareholders. Last year's total dividend payments show that RioCan Real Estate Investment Trust has a trailing yield of 5.5% on the current share price of CA$26.25. If you buy this business for its dividend, you should have an idea of whether RioCan Real Estate Investment Trust's dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

See our latest analysis for RioCan Real Estate Investment Trust

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. It paid out 78% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. We'd be worried about the risk of a drop in earnings. That said, REITs are often required by law to distribute all of their earnings, and it's not unusual to see a REIT with a payout ratio around 100%. We wouldn't read too much into this. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. RioCan Real Estate Investment Trust paid out more free cash flow than it generated - 112%, to be precise - last year, which we think is concerningly high. We're curious about why the company paid out more cash than it generated last year, since this can be one of the early signs that a dividend may be unsustainable.

While RioCan Real Estate Investment Trust's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were RioCan Real Estate Investment Trust to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. So we're not too excited that RioCan Real Estate Investment Trust's earnings are down 3.9% a year over the past five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last 10 years, RioCan Real Estate Investment Trust has lifted its dividend by approximately 0.6% a year on average.

Final Takeaway

Should investors buy RioCan Real Estate Investment Trust for the upcoming dividend? RioCan Real Estate Investment Trust had an average payout ratio, but its free cash flow was lower and earnings per share have been declining. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Curious about whether RioCan Real Estate Investment Trust has been able to consistently generate growth? Here's a chart of its historical revenue and earnings growth.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:REI.UN

RioCan Real Estate Investment Trust

RioCan meets the everyday shopping needs of Canadians through the ownership, management and development of necessity-based and mixed-use properties in densely populated communities.

Solid track record average dividend payer.

Market Insights

Community Narratives