- Canada

- /

- Retail REITs

- /

- TSX:PMZ.UN

Undervalued Small Caps In Canada With Insider Buys For August 2024

Reviewed by Simply Wall St

The Canadian market has been experiencing a whirlwind of activity, with inflation moving closer to target and central banks signaling potential rate cuts in response to labor market concerns. This environment creates an intriguing backdrop for small-cap stocks, which often offer unique opportunities when broader market conditions are in flux. In this article, we will explore three undervalued small-cap stocks in Canada that have recently seen insider buying, providing insights into why these companies might be worth considering amidst the current economic landscape.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Dundee Precious Metals | 7.7x | 2.8x | 30.46% | ★★★★★★ |

| Nexus Industrial REIT | 2.6x | 3.2x | 26.24% | ★★★★★☆ |

| Bragg Gaming Group | NA | 1.3x | 37.69% | ★★★★★☆ |

| Primaris Real Estate Investment Trust | 10.7x | 2.9x | 46.84% | ★★★★★☆ |

| Trican Well Service | 8.2x | 1.0x | 5.25% | ★★★★☆☆ |

| Hemisphere Energy | 6.7x | 2.4x | 15.73% | ★★★★☆☆ |

| Russel Metals | 11.0x | 0.5x | 47.56% | ★★★★☆☆ |

| Guardian Capital Group | 10.4x | 4.0x | 38.78% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | -24.43% | ★★★★☆☆ |

| Sagicor Financial | 1.1x | 0.3x | -55.98% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

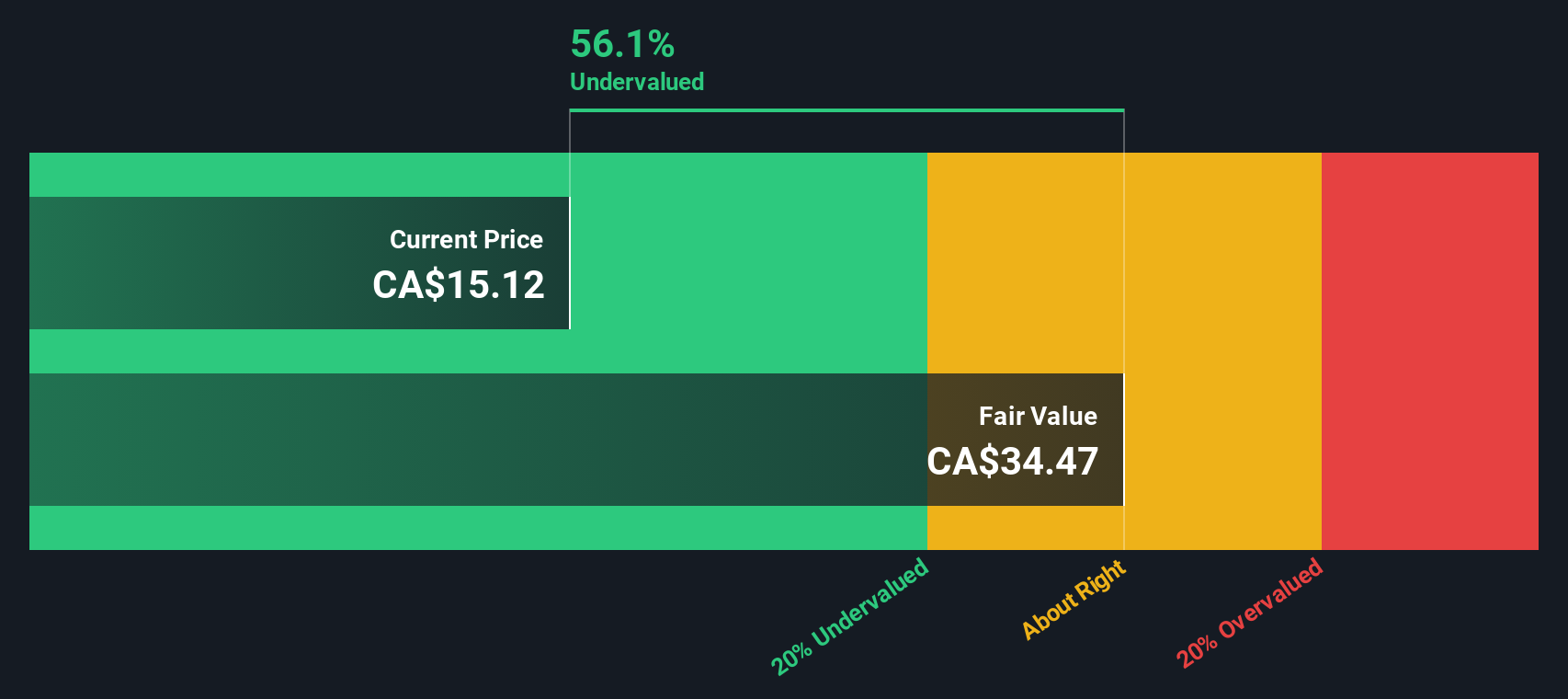

Dundee Precious Metals (TSX:DPM)

Simply Wall St Value Rating: ★★★★★★

Overview: Dundee Precious Metals is a mining company focused on gold and copper production, with operations primarily in Ada Tepe and Chelopech, and a market cap of approximately $2.05 billion CAD.

Operations: Dundee Precious Metals generates revenue primarily from its Ada Tepe and Chelopech segments, with recent quarterly revenues reaching $541.83 million. The company has shown a notable gross profit margin of 53.98% in the most recent period, reflecting efficient cost management against its COGS of $249.37 million.

PE: 7.7x

Dundee Precious Metals, a small Canadian mining company, has shown promising financial performance with Q2 2024 sales reaching US$156.84 million and net income of US$62.42 million. Despite forecasts of a 7.2% annual decline in earnings over the next three years, insider confidence is evident with significant share purchases in recent months. Additionally, the company declared a third-quarter dividend of US$0.04 per share and provided solid production guidance for 2024, indicating potential growth opportunities despite current challenges.

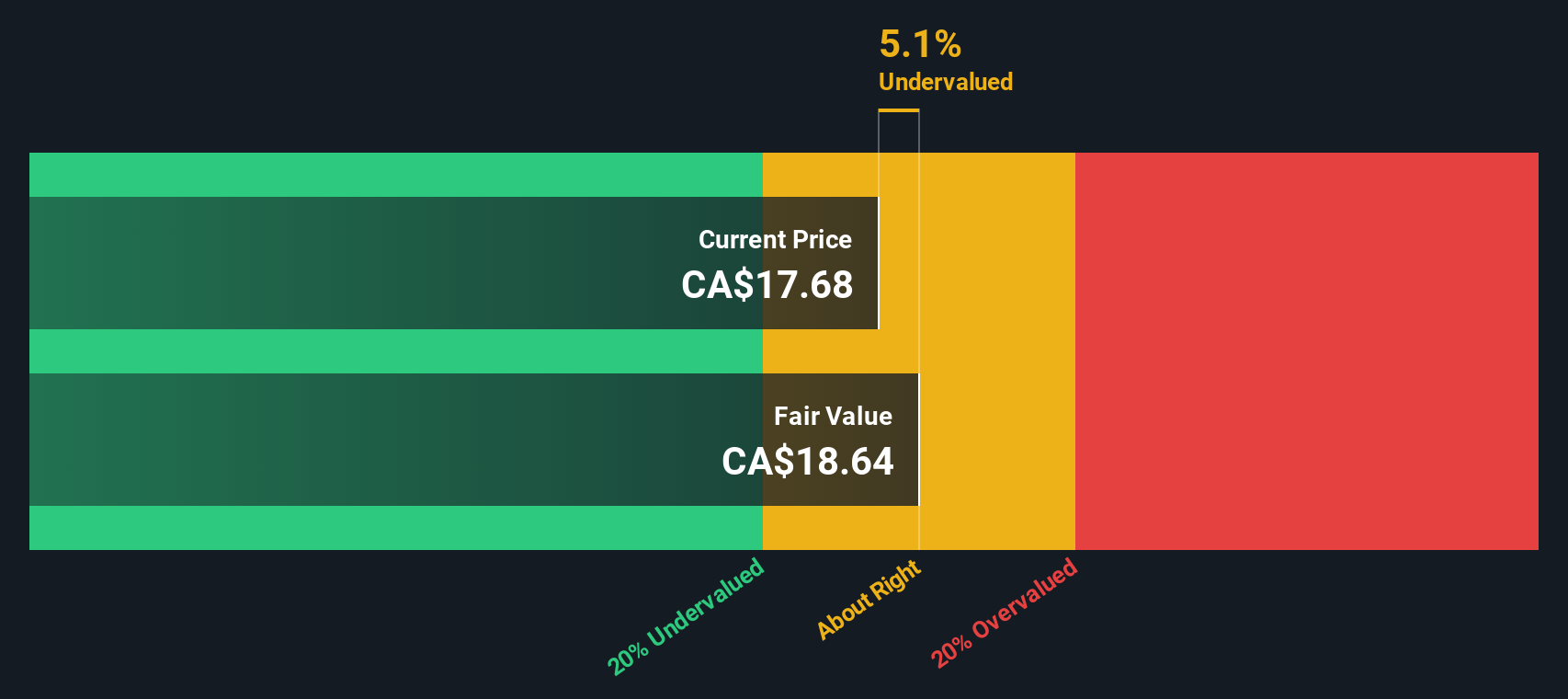

BSR Real Estate Investment Trust (TSX:HOM.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: BSR Real Estate Investment Trust primarily focuses on owning and managing multi-family residential properties in the United States, with a market cap of approximately CA$0.74 billion.

Operations: The company generates revenue primarily through its real estate operations, with recent figures showing $168.39 million in revenue and a gross profit margin of 55.62%. Key expenses include COGS at $74.73 million and operating expenses at $9.82 million, impacting net income significantly due to high non-operating expenses reaching $273.44 million, resulting in a net income of -$189.59 million for the latest period reported.

PE: -2.3x

BSR Real Estate Investment Trust (REIT) offers a compelling opportunity among Canadian small caps. Despite reporting a net loss of US$39.21 million for Q2 2024, the REIT's sales remained steady at US$37.28 million compared to the previous year. Insider confidence is evident with recent share purchases, indicating potential upside. Regular cash dividends of US$0.0433 per unit provide consistent income for investors, and strategic leadership changes aim to bolster governance and future performance.

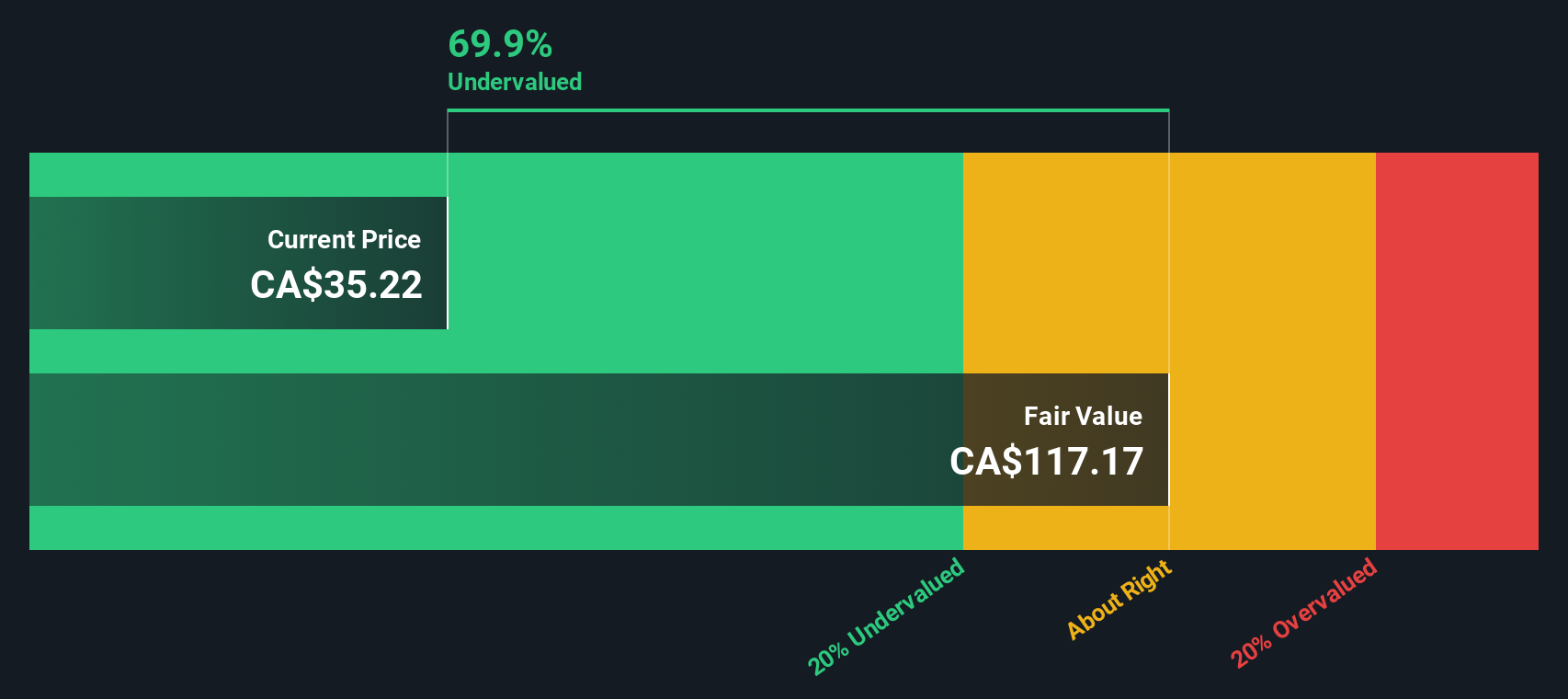

Primaris Real Estate Investment Trust (TSX:PMZ.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Primaris Real Estate Investment Trust focuses on the ownership, management, and development of its investment properties with a market cap of approximately CA$1.50 billion.

Operations: Primaris Real Estate Investment Trust generates revenue primarily through the ownership, management, and development of its investment properties. For the period ending June 30, 2024, it reported a gross profit margin of 56.92% and a net income margin of 26.69%.

PE: 10.7x

Primaris Real Estate Investment Trust, a Canadian small cap, has shown solid financial performance with Q2 2024 sales of C$120.01 million and net income of C$42.25 million, both up from last year. The company declared monthly distributions of C$0.07 per unit for August 2024, maintaining an annualized rate of C$0.84 per unit. Notably, insider confidence is evident with recent share purchases by key individuals over the past few months, signaling potential growth and stability ahead.

- Delve into the full analysis valuation report here for a deeper understanding of Primaris Real Estate Investment Trust.

Learn about Primaris Real Estate Investment Trust's historical performance.

Make It Happen

- Dive into all 30 of the Undervalued TSX Small Caps With Insider Buying we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PMZ.UN

Primaris Real Estate Investment Trust

Primaris is Canada’s only enclosed shopping centre focused REIT, with ownership interests primarily in leading enclosed shopping centres located in growing mid-sized markets.

Very undervalued with solid track record.