As we navigate the early months of 2025, the Canadian market is experiencing shifts driven by rising government bond yields and political changes, which have introduced some uncertainty but also potential opportunities for investors. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial, making it an opportune time to explore three lesser-known Canadian companies that could offer promising prospects amid these evolving conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Amerigo Resources | 14.04% | 7.04% | 11.73% | ★★★★★☆ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 19.37% | 188.55% | ★★★★★☆ |

| Corby Spirit and Wine | 65.79% | 7.46% | -5.76% | ★★★★☆☆ |

| Queen's Road Capital Investment | 12.65% | 16.00% | 17.29% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Centerra Gold (TSX:CG)

Simply Wall St Value Rating: ★★★★★★

Overview: Centerra Gold Inc. is a gold mining company involved in the acquisition, exploration, development, and operation of gold and copper properties across North America, Turkey, and internationally with a market capitalization of CA$1.78 billion.

Operations: Centerra Gold generates revenue primarily from its Öksüt, Mount Milligan, and Molybdenum segments, contributing $559.44 million, $460.21 million, and $232.42 million respectively.

Centerra Gold, a promising player in the mining sector, is currently trading at 83% below its estimated fair value. This debt-free company reported a net income of US$132.89 million for the first nine months of 2024, marking a turnaround from a loss of US$52.51 million last year. The recent buyback plan saw Centerra repurchase over 5.3 million shares for US$33.9 million, indicating confidence in its valuation and future prospects despite forecasting an operational loss between US$5 to $15 million for the year. Recent drilling activities at Cherry Creek could potentially enhance its resource base further.

- Unlock comprehensive insights into our analysis of Centerra Gold stock in this health report.

Gain insights into Centerra Gold's historical performance by reviewing our past performance report.

Freehold Royalties (TSX:FRU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Freehold Royalties Ltd. specializes in acquiring and managing royalty interests in crude oil, natural gas, natural gas liquids, and potash properties across Western Canada and the United States, with a market cap of CA$2.20 billion.

Operations: The company generates revenue primarily from its oil and gas exploration and production segment, totaling CA$312.68 million. Its market capitalization stands at approximately CA$2.20 billion, reflecting its scale in the industry.

Freehold Royalties, a Canadian oil and gas royalty company, seems to be navigating its small cap status with strategic financial maneuvers. The firm recently raised CAD 150 million through a follow-on equity offering, suggesting active capital management. Despite a net debt to equity ratio of 22.7%, which is satisfactory by industry standards, the company reported negative earnings growth of -4.1% over the past year, contrasting with an industry average decline of -20.2%. Additionally, Freehold's interest payments are well covered at 13.7 times EBIT, indicating robust financial health despite recent shareholder dilution concerns.

- Click here and access our complete health analysis report to understand the dynamics of Freehold Royalties.

Examine Freehold Royalties' past performance report to understand how it has performed in the past.

Winpak (TSX:WPK)

Simply Wall St Value Rating: ★★★★★★

Overview: Winpak Ltd. manufactures and distributes packaging materials and related packaging machines across the United States, Canada, and Mexico, with a market cap of CA$2.85 billion.

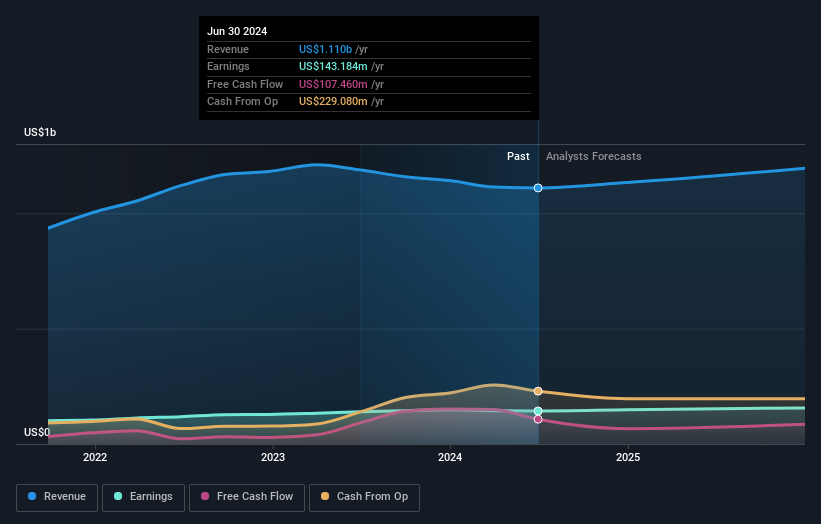

Operations: Winpak generates revenue primarily from three segments: Flexible Packaging ($592.07 million), Rigid Packaging and Flexible Lidding ($494.74 million), and Packaging Machinery ($34.58 million).

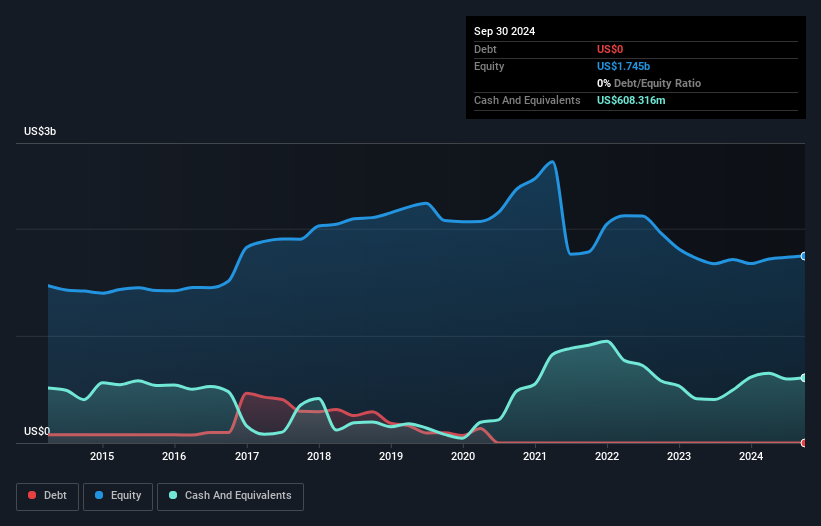

Winpak, a notable player in the packaging sector, showcases a blend of financial stability and growth potential. The company has been debt-free for five years, highlighting robust financial health. Over the past year, earnings grew by 2.3%, trailing behind the industry's 10.3% pace but still indicating positive momentum with an average annual growth of 7.6% over five years. Recently trading at 31% below its estimated fair value suggests room for appreciation. Winpak's recent buyback of nearly two million shares underscores confidence in its future prospects and supports shareholder value through strategic capital allocation initiatives like special dividends (C$3 per share).

- Delve into the full analysis health report here for a deeper understanding of Winpak.

Evaluate Winpak's historical performance by accessing our past performance report.

Taking Advantage

- Unlock more gems! Our TSX Undiscovered Gems With Strong Fundamentals screener has unearthed 45 more companies for you to explore.Click here to unveil our expertly curated list of 48 TSX Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winpak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WPK

Winpak

Manufactures and distributes packaging materials and related packaging machines in the United States, Canada, and Mexico.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives