- Canada

- /

- Energy Services

- /

- TSX:PSI

Exploring 3 Undervalued Small Caps On TSX With Insider Buying In Canada

Reviewed by Simply Wall St

As the Canadian market navigates a period of economic transition, the cooling labor market and anticipated rate cuts by both the Federal Reserve and Bank of Canada present a potentially favorable environment for small-cap stocks on the TSX. In this context, identifying small-cap companies with strong fundamentals and insider buying can be an attractive strategy for investors looking to capitalize on potential growth opportunities amidst broader market shifts.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| AutoCanada | NA | 0.1x | 20.87% | ★★★★★★ |

| Parex Resources | 3.0x | 0.8x | 49.71% | ★★★★★☆ |

| Trican Well Service | 8.0x | 0.9x | 18.66% | ★★★★★☆ |

| Calfrac Well Services | 2.5x | 0.2x | 18.27% | ★★★★★☆ |

| Rogers Sugar | 15.3x | 0.6x | 48.64% | ★★★★☆☆ |

| Nexus Industrial REIT | 3.6x | 3.6x | 18.78% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 13.0x | 3.5x | 45.40% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -37.66% | ★★★★☆☆ |

| Hemisphere Energy | 6.0x | 2.3x | -216.79% | ★★★☆☆☆ |

| First National Financial | 13.7x | 3.9x | 42.88% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Primaris Real Estate Investment Trust (TSX:PMZ.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Primaris Real Estate Investment Trust focuses on the ownership, management, and development of its investment properties with a market capitalization of CA$1.55 billion.

Operations: The company generates revenue primarily through the ownership, management, and development of its investment properties, with a recent quarterly revenue of CA$457.86 million. Its cost structure includes significant components such as COGS and operating expenses. The gross profit margin has recently been recorded at 56.92%.

PE: 13.0x

Primaris Real Estate Investment Trust, a smaller player in the Canadian market, has shown potential for growth despite its reliance on external borrowing. Recent insider confidence is evident with Patrick Sullivan purchasing 20,000 shares valued at C$271,600 in September 2024. The trust's revenue is projected to grow by 7.87% annually. Although shareholder dilution occurred over the past year, Primaris completed a follow-on equity offering of C$69.59 million in October 2024 and maintains regular dividend distributions of C$0.07 per unit monthly.

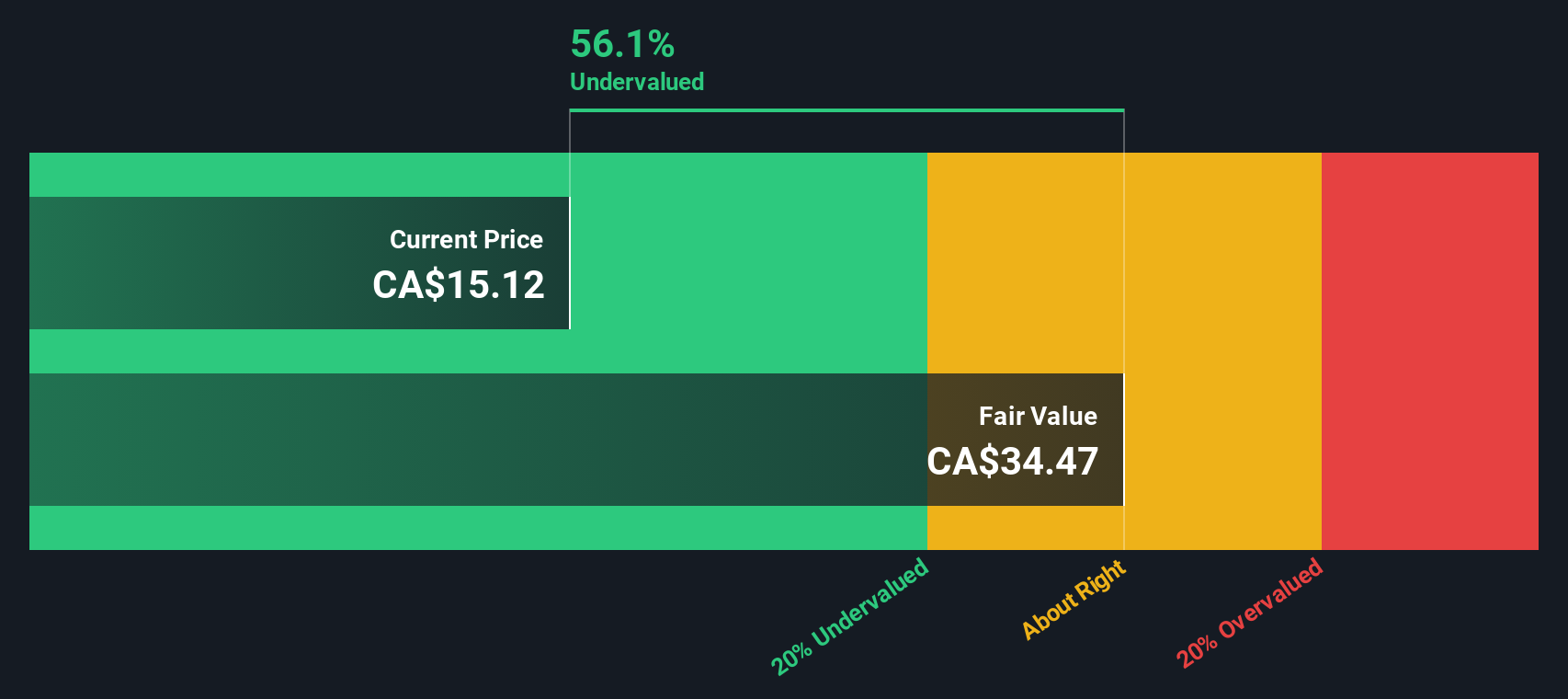

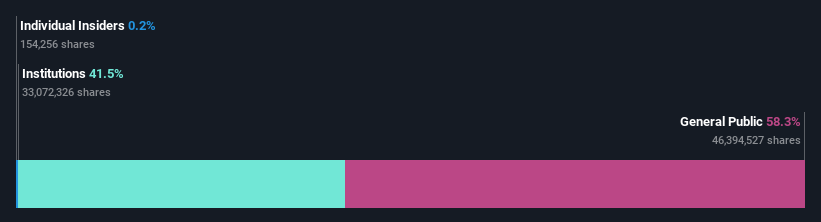

Pason Systems (TSX:PSI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Pason Systems is a company that provides specialized data management systems for drilling operations, with a market cap of CA$1.19 billion.

Operations: The primary revenue streams for the company are North America Drilling and International Drilling, with additional contributions from Solar and Energy Storage. The gross profit margin has experienced fluctuations, reaching 65.83% in the third quarter of 2023 before decreasing to 59.51% by mid-2024. Operating expenses have varied over time, with significant allocations towards research and development as well as general and administrative expenses.

PE: 9.5x

Pason Systems, a Canadian tech player in the oilfield services sector, showcases potential as an undervalued stock. Despite a forecasted 2.5% annual earnings decline over three years, its revenue is expected to grow by 10.96% annually. Recent insider confidence is evident with share repurchases totaling CAD 5.99 million from April to June 2024, hinting at perceived value by those close to the company. The addition of seasoned director James Bowzer strengthens leadership amidst these strategic moves.

- Click here to discover the nuances of Pason Systems with our detailed analytical valuation report.

Explore historical data to track Pason Systems' performance over time in our Past section.

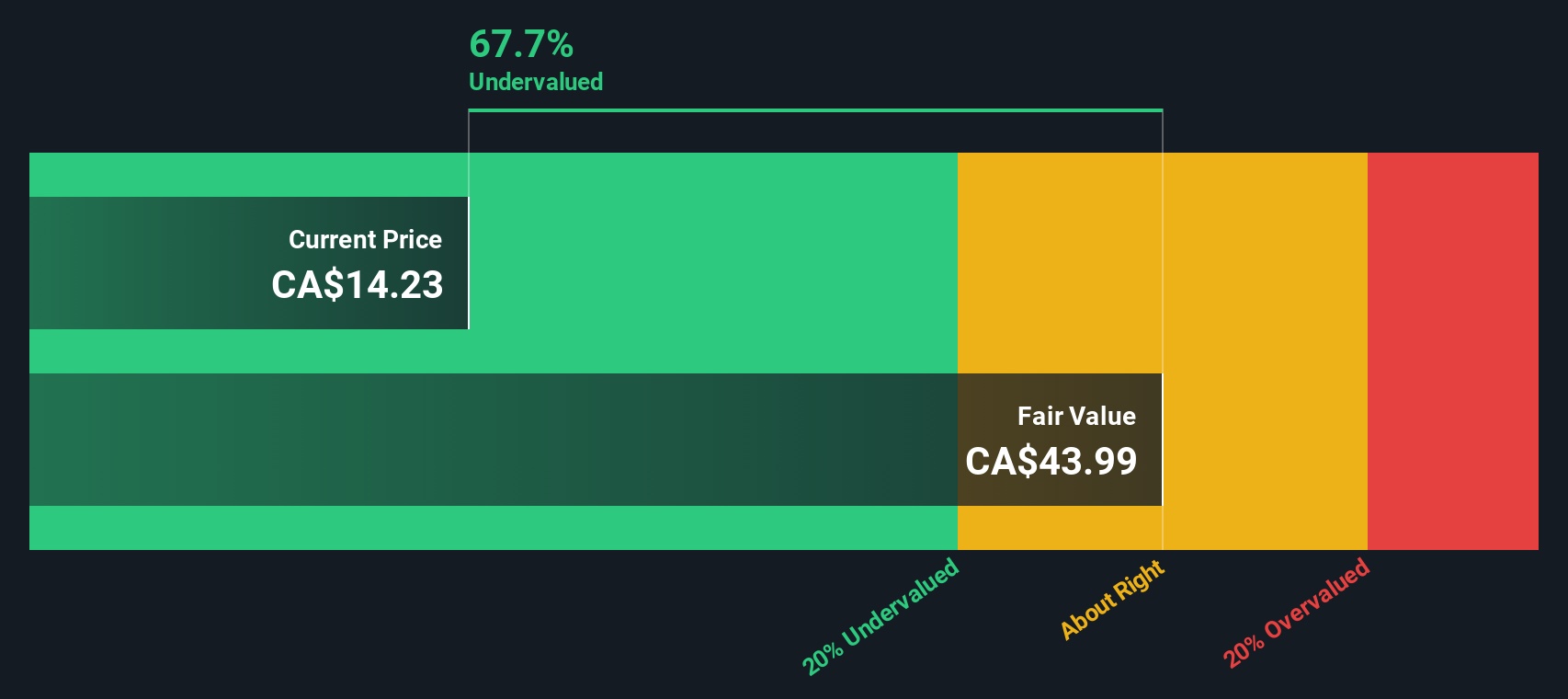

Parex Resources (TSX:PXT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Parex Resources is an oil and gas company focused on exploration and production, with a market cap of approximately C$3.67 billion.

Operations: The company's primary revenue stream is from oil and gas exploration and production, with recent quarterly revenues reaching $1.21 billion. Costs of goods sold have been reported at $314.67 million, contributing to a gross profit margin of 74.08%. Operating expenses include significant depreciation and amortization costs, most recently recorded at $215.76 million, impacting overall profitability.

PE: 3.0x

Parex Resources, a smaller player in Canada's energy sector, has shown insider confidence with President Imad Mohsen purchasing 23,915 shares valued at US$496,736. Despite challenges like declining earnings forecasts of 40.1% annually over the next three years and reduced profit margins from 44.2% to 26.2%, the company maintains steady production levels and offers a CAD0.385 dividend per share for Q4 2024. The reliance on external borrowing highlights funding risks but also potential growth opportunities in a volatile market environment.

- Unlock comprehensive insights into our analysis of Parex Resources stock in this valuation report.

Assess Parex Resources' past performance with our detailed historical performance reports.

Next Steps

- Access the full spectrum of 23 Undervalued TSX Small Caps With Insider Buying by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PSI

Pason Systems

Provides instrumentation and data management systems for drilling rigs in Canada, the United States, and internationally.

Flawless balance sheet and undervalued.