- Canada

- /

- Metals and Mining

- /

- TSXV:FYL

Discover 3 TSX Penny Stocks With Market Caps Over CA$8M

Reviewed by Simply Wall St

The Canadian market has recently experienced fluctuations in bond yields, with the benchmark 10-year Treasury yield reaching a six-month high before retreating, influenced by U.S. inflation data and economic growth indicators. Amid these conditions, investors are reminded of the significant role earnings play in driving stock-market direction, particularly as interest rates pressure valuations. While the term 'penny stocks' might seem outdated, these investments continue to offer potential for growth and value discovery when backed by strong financials. In this context, we explore three penny stocks that stand out for their financial strength and potential within the Canadian market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.45 | CA$985.56M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.18 | CA$388.78M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.465 | CA$14.32M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.41 | CA$123.54M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$669.36M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.35 | CA$229.35M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$29.82M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.17M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$179.61M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.03 | CA$137.56M | ★★★★★☆ |

Click here to see the full list of 935 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Finlay Minerals (TSXV:FYL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Finlay Minerals Ltd. is engaged in the acquisition and exploration of base and precious metal deposits in northern British Columbia, Canada, with a market cap of CA$8.41 million.

Operations: Finlay Minerals Ltd. does not report any revenue segments as it focuses on acquiring and exploring base and precious metal deposits in northern British Columbia, Canada.

Market Cap: CA$8.41M

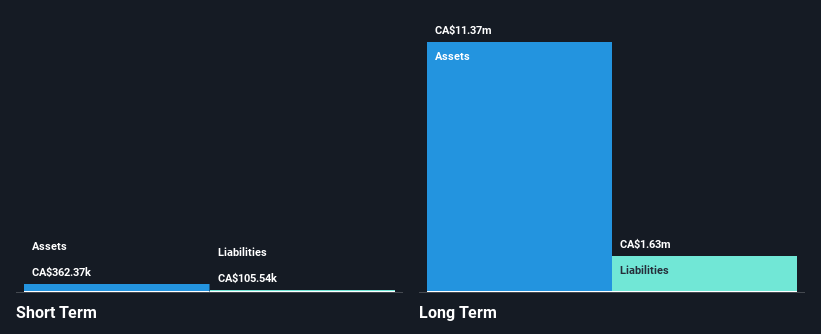

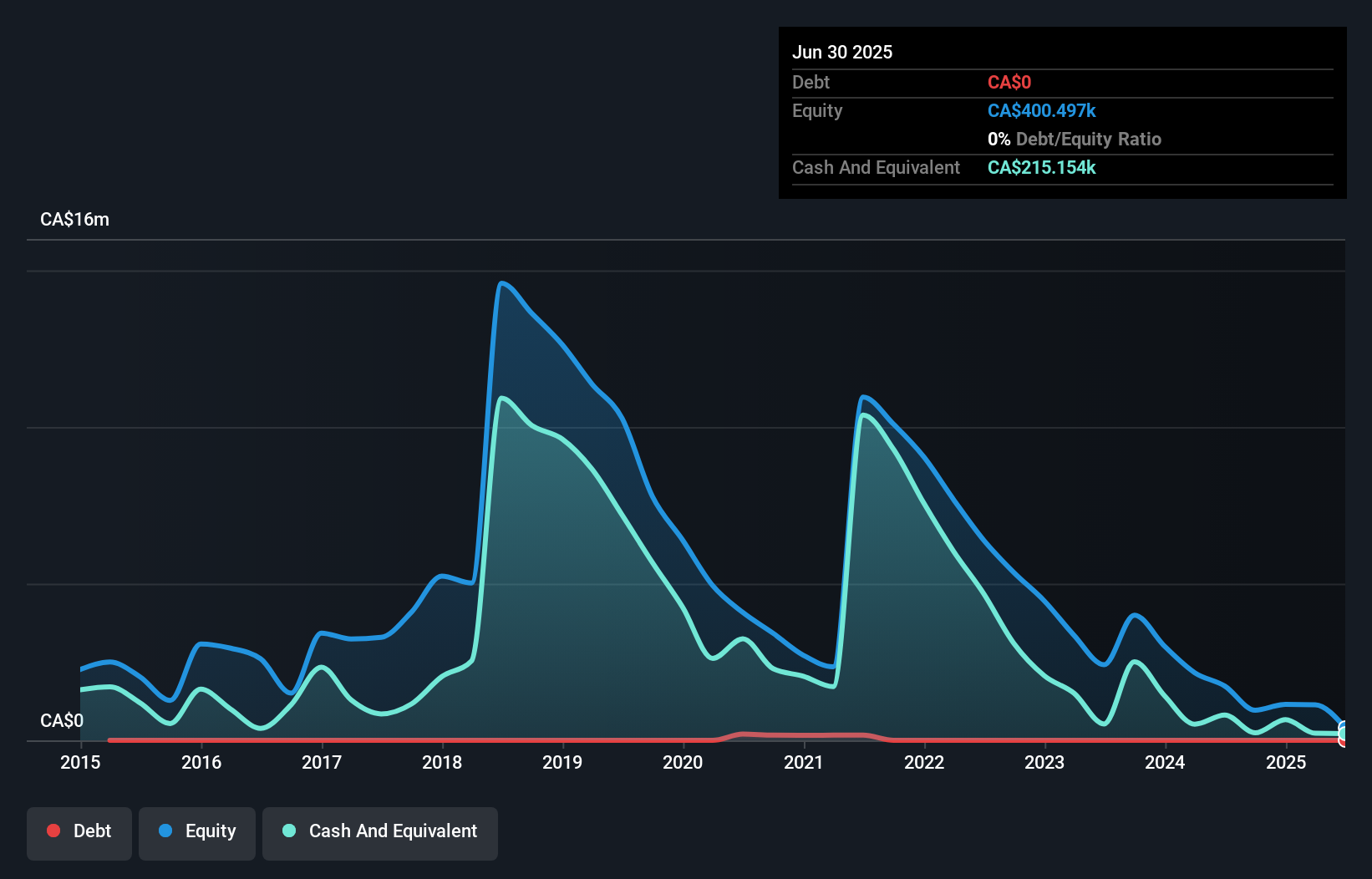

Finlay Minerals Ltd., with a market cap of CA$8.41 million, remains pre-revenue as it focuses on exploration in northern British Columbia. The company has no debt and maintains a cash runway exceeding three years, providing financial stability for ongoing projects. Recent developments include the 100% ownership of the PIL Property and promising assay results from its SAY property, revealing high-grade copper and silver mineralization. This includes significant chip samples from the East Breccia Zone and AG Zone expansion efforts. Finlay's management and board are experienced, supporting strategic exploration plans for 2025 despite historical losses.

- Dive into the specifics of Finlay Minerals here with our thorough balance sheet health report.

- Evaluate Finlay Minerals' historical performance by accessing our past performance report.

GoviEx Uranium (TSXV:GXU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GoviEx Uranium Inc. is a mineral resources company focused on the acquisition, exploration, and development of uranium properties in Africa, with a market cap of CA$40.63 million.

Operations: There are no revenue segments reported for GoviEx Uranium.

Market Cap: CA$40.63M

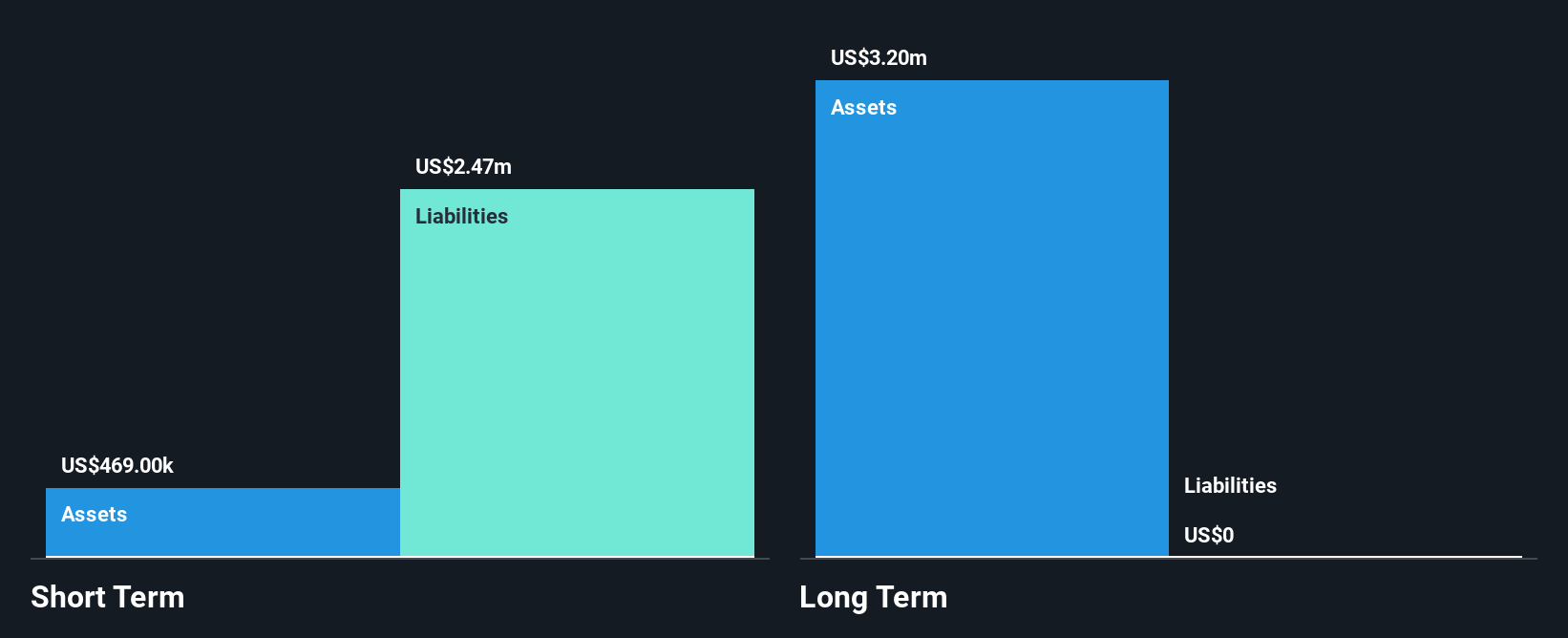

GoviEx Uranium Inc., with a market cap of CA$40.63 million, is pre-revenue and currently unprofitable, having experienced increased losses over the past five years. The company has no debt or long-term liabilities, but its cash runway is under a year if current spending trends persist. Its share price has shown high volatility recently and it was dropped from the S&P/TSX Venture Composite Index. Despite these challenges, GoviEx's management and board are seasoned, which may aid in navigating its strategic focus on uranium exploration in Africa amidst ongoing financial constraints.

- Jump into the full analysis health report here for a deeper understanding of GoviEx Uranium.

- Review our growth performance report to gain insights into GoviEx Uranium's future.

Legend Power Systems (TSXV:LPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Legend Power Systems Inc., along with its subsidiaries, offers onsite energy management technology in Canada and the United States, with a market cap of CA$30.58 million.

Operations: The company's revenue segment includes CA$1.87 million from the sale or installation of The Smartgate.

Market Cap: CA$30.58M

Legend Power Systems, with a market cap of CA$30.58 million, has been reducing losses over the past five years despite being unprofitable. Recent earnings showed sales of CA$1.87 million and a net loss of CA$3.3 million for 2024. The company is debt-free with short-term assets exceeding liabilities but faces going concern doubts from its auditor. A strategic partnership with Unity Electric aims to expand its SmartGATE platform in New York's commercial real estate market, potentially enhancing revenue opportunities amid financial challenges and limited cash runway that was recently bolstered by a private placement raising up to CA$1.53 million.

- Unlock comprehensive insights into our analysis of Legend Power Systems stock in this financial health report.

- Explore historical data to track Legend Power Systems' performance over time in our past results report.

Key Takeaways

- Reveal the 935 hidden gems among our TSX Penny Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:FYL

Finlay Minerals

Acquires and explores base and precious metal deposits in northern British Columbia, Canada.

Excellent balance sheet slight.

Market Insights

Community Narratives