- Canada

- /

- Health Care REITs

- /

- TSX:NWH.UN

NorthWest Healthcare Properties REIT (TSX:NWH.UN): Evaluating Valuation Ahead of Q3 2025 Results Announcement

Reviewed by Kshitija Bhandaru

NorthWest Healthcare Properties Real Estate Investment Trust (TSX:NWH.UN) has announced it will release its third quarter 2025 financial results on November 11. A conference call will be held the next day for investors and analysts to review the update.

See our latest analysis for NorthWest Healthcare Properties Real Estate Investment Trust.

NorthWest Healthcare Properties REIT’s upcoming earnings update comes after a year of mixed momentum. The share price has gained 11.4% so far in 2025, but the one-year total shareholder return of 2.3% trails stronger rallies seen in the sector. Longer-term shareholders are still nursing larger losses, which hints at lingering caution even as the recent upward move sparks new interest in the stock’s recovery story.

If health sector results have your attention, you might enjoy discovering other leading names in the space. See the full list with our See the full list for free..

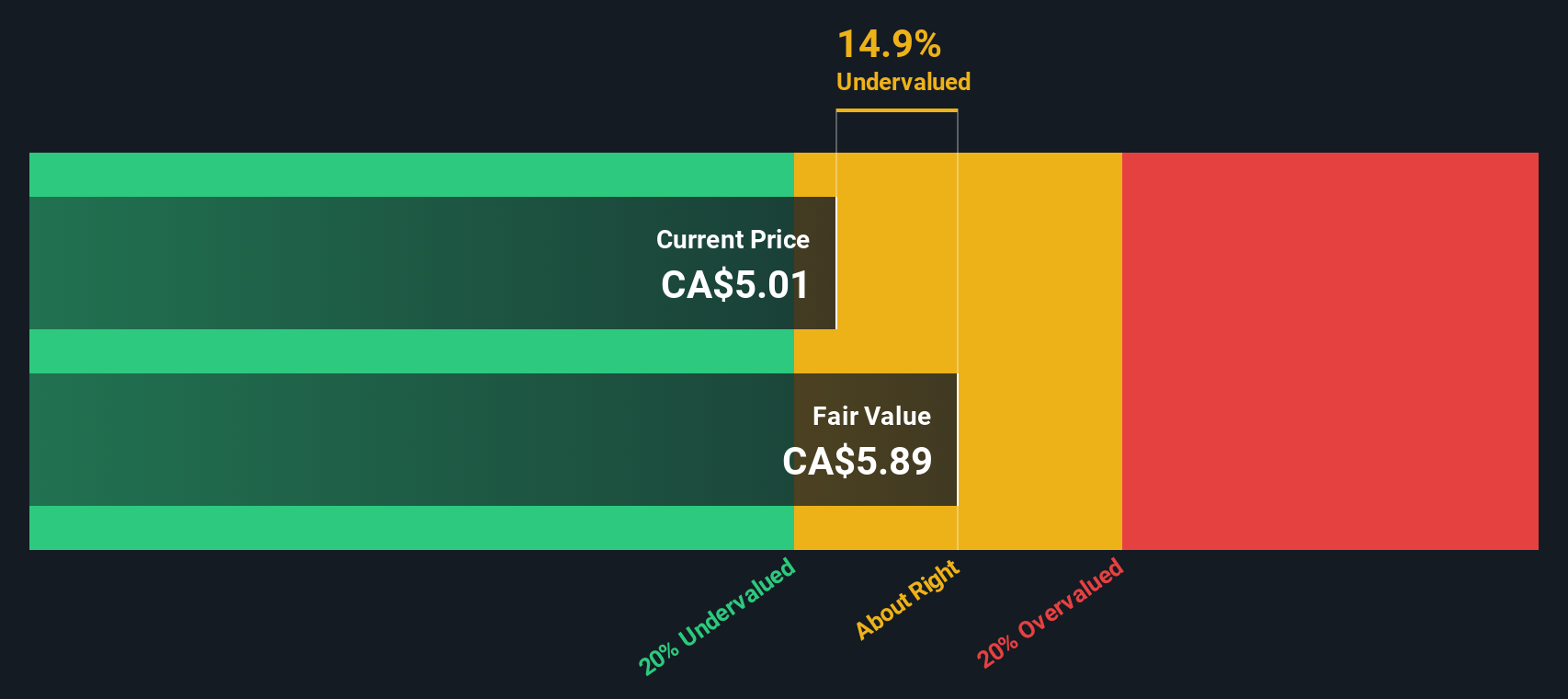

With recent gains but years of underperformance, is NorthWest Healthcare Properties REIT now trading at a meaningful discount, or is the market already factoring in all future growth prospects? Could this be a genuine buying opportunity, or not?

Price-to-Sales of 2.9x: Is it justified?

NorthWest Healthcare Properties REIT is currently trading at a price-to-sales (P/S) ratio of 2.9x, which positions it well below both the North American Health Care REITs industry average of 4.6x and the peer average of 4x. With a last close price of CA$4.97, the stock appears discounted relative to the revenues it generates.

The price-to-sales ratio measures how much investors are willing to pay per dollar of sales. For a real estate investment trust in the healthcare sector, this multiple signals how the market values the stability and growth prospects of its rental income, compared with industry standards.

The current P/S ratio implies that the market is pricing NorthWest Healthcare Properties REIT’s revenue streams more conservatively than its competitors. The company is valued even lower than what our estimate of a fair P/S ratio (4x) suggests. This is a level the market could eventually adjust closer towards, should conditions or perceptions improve.

Explore the SWS fair ratio for NorthWest Healthcare Properties Real Estate Investment Trust

Result: Price-to-Sales of 2.9x (UNDERVALUED)

However, revenue has declined over the past year, and profitability remains challenged. Both are potential headwinds that could affect the outlook despite apparent undervaluation.

Another View: DCF Analysis

Looking at NorthWest Healthcare Properties REIT through the perspective of our DCF model provides a similar story. The shares currently trade around CA$4.97, while our DCF estimate of fair value is CA$7.30, which may indicate substantial undervaluation. Could the market be overlooking a deeper recovery?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NorthWest Healthcare Properties Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NorthWest Healthcare Properties Real Estate Investment Trust Narrative

If you want to take a closer look or reach your own conclusions, you can build a personalized story from the data in just a few minutes. Do it your way.

A great starting point for your NorthWest Healthcare Properties Real Estate Investment Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio to just one opportunity. See how top investors spot trends, unlock value, and capture growth by expanding your search with these unique stock ideas:

- Capture reliable income with high-yield opportunities via these 19 dividend stocks with yields > 3%, offering robust returns over 3%. This can be a useful way to strengthen your passive income stream as markets shift.

- Tap into game-changing innovation while it’s still under the radar with these 24 AI penny stocks, which are shaping tomorrow’s industries through powerful artificial intelligence advancements.

- Position yourself to profit from overlooked value by targeting these 898 undervalued stocks based on cash flows, which may be trading at meaningful discounts based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NorthWest Healthcare Properties Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWH.UN

NorthWest Healthcare Properties Real Estate Investment Trust

Northwest provides investors with access to a portfolio of high-quality international healthcare real estate infrastructure comprised as at May 14, 2025, of interests in a diversified portfolio of 169 income-producing properties and 15.8 million square feet of gross leasable area located throughout major markets in North America, Brazil, Europe, and Australasia.

Undervalued average dividend payer.

Market Insights

Community Narratives