- Canada

- /

- Residential REITs

- /

- TSX:MRG.UN

Exploring 3 Undervalued Small Caps In Global With Insider Activity

Reviewed by Simply Wall St

In recent weeks, global markets have experienced volatility, with small- and mid-cap indexes facing significant declines amid U.S. Treasury market fluctuations and renewed tariff threats from the Trump administration. Despite these challenges, U.S. business activity showed signs of improvement in May, as indicated by rising Purchasing Managers' Index readings in both the services and manufacturing sectors. In this environment, identifying small-cap stocks with potential value often involves looking at companies with strong fundamentals that can weather economic uncertainties and benefit from insider activity signaling confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Nexus Industrial REIT | 6.4x | 2.8x | 20.54% | ★★★★★☆ |

| Lion Rock Group | 4.9x | 0.4x | 49.53% | ★★★★☆☆ |

| AKVA group | 15.5x | 0.7x | 46.73% | ★★★★☆☆ |

| Sing Investments & Finance | 7.2x | 3.7x | 40.22% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.5x | 1.8x | 9.92% | ★★★★☆☆ |

| Eastnine | 18.5x | 8.9x | 39.16% | ★★★★☆☆ |

| Cloetta | 16.0x | 1.2x | 44.11% | ★★★☆☆☆ |

| Absolent Air Care Group | 23.1x | 1.8x | 47.79% | ★★★☆☆☆ |

| Italmobiliare | 11.8x | 1.6x | -215.06% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.3x | 0.4x | -41.79% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

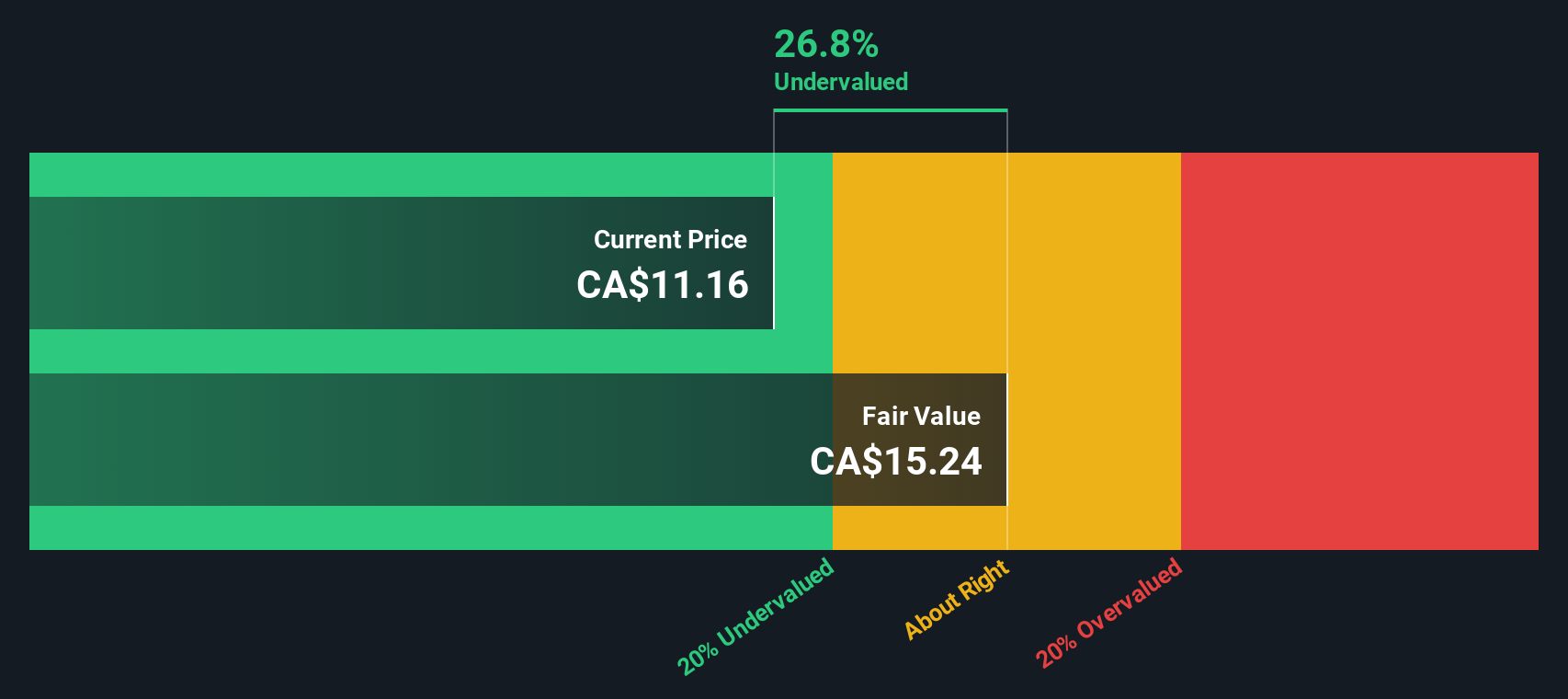

Atrium Mortgage Investment (TSX:AI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Atrium Mortgage Investment operates in the financial services sector, primarily focusing on mortgage lending, with a market capitalization of CA$0.48 billion.

Operations: The company's revenue primarily stems from its financial services in the mortgage sector, with a recent figure of CA$58.07 million. Over the analyzed periods, the gross profit margin has shown variations, reaching 87.02% in June 2023 before adjusting to 85.09% by March 2025. Operating expenses have fluctuated around CA$1-2 million, impacting overall profitability but remaining within a manageable range relative to gross profits.

PE: 11.0x

Atrium Mortgage Investment, a smaller player in the market, recently reported Q1 2025 earnings with revenue of C$21.96 million and net income of C$11.9 million, slightly down from the previous year. Despite facing high debt levels and relying on external borrowing, insider confidence is evident as Robert Goodall acquired 21,850 shares for approximately C$250K in March 2025. The company consistently pays monthly dividends of C$0.0775 per share, reinforcing its commitment to returning value to shareholders amidst modest growth forecasts and executive changes.

- Click here to discover the nuances of Atrium Mortgage Investment with our detailed analytical valuation report.

Understand Atrium Mortgage Investment's track record by examining our Past report.

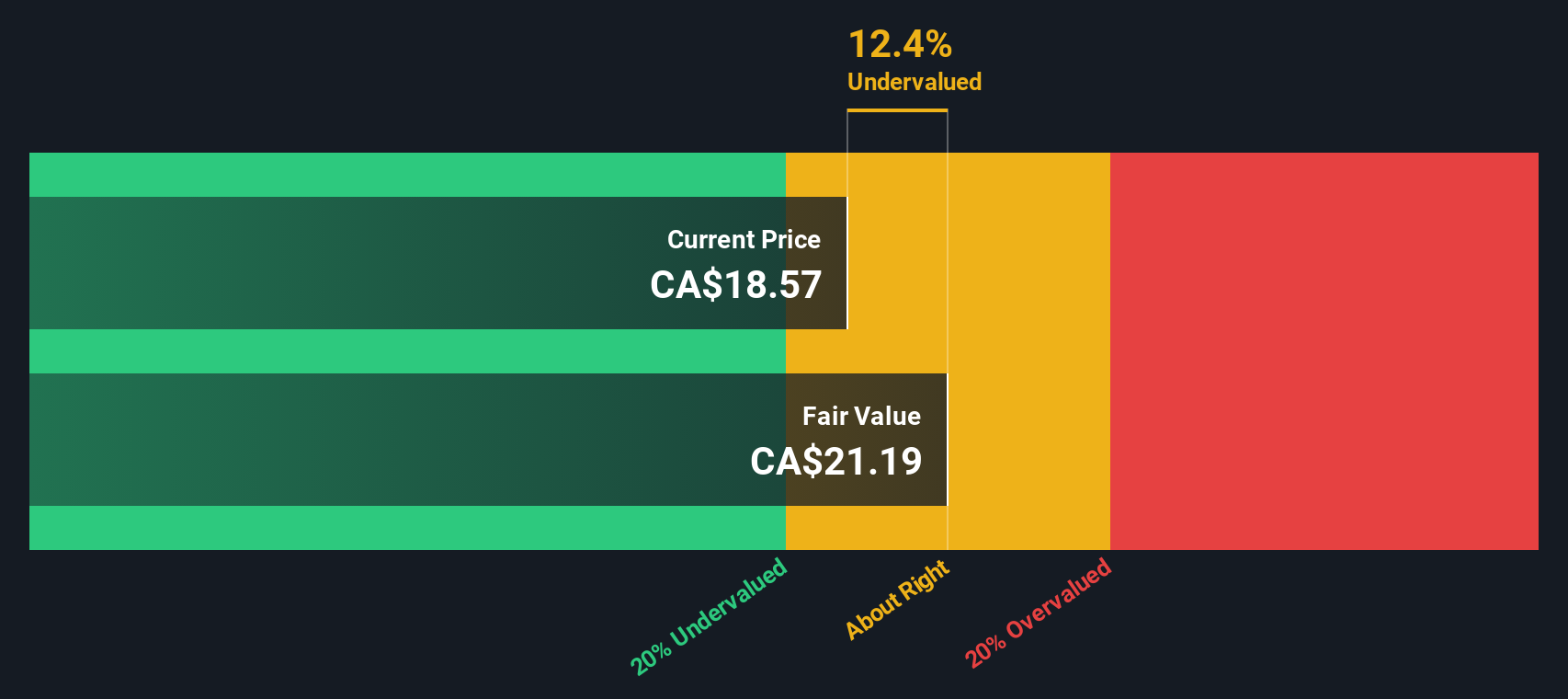

Morguard North American Residential Real Estate Investment Trust (TSX:MRG.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Morguard North American Residential Real Estate Investment Trust operates in the multi-suite residential real estate sector, focusing on acquiring and managing properties across North America, with a market capitalization of approximately CA$1.06 billion.

Operations: Morguard North American Residential Real Estate Investment Trust generates revenue primarily from its multi-suite residential real estate segment, with the most recent reported revenue at CA$354.87 million. The company's cost of goods sold (COGS) is CA$168.05 million, resulting in a gross profit of CA$186.82 million and a gross profit margin of 52.64%. Operating expenses are recorded at CA$22.50 million, while non-operating expenses stand at CA$50.12 million, impacting net income figures significantly over various periods.

PE: 5.5x

Morguard North American Residential Real Estate Investment Trust, a smaller player in the real estate sector, has shown insider confidence with recent share purchases. From January 1 to January 11, 2025, they repurchased 584,992 shares for CAD 10.14 million. In Q1 2025, sales rose to CAD 90.27 million from CAD 84.76 million the previous year; net income increased to CAD 38.07 million from CAD 25.73 million despite lower profit margins and reliance on external borrowing for funding needs.

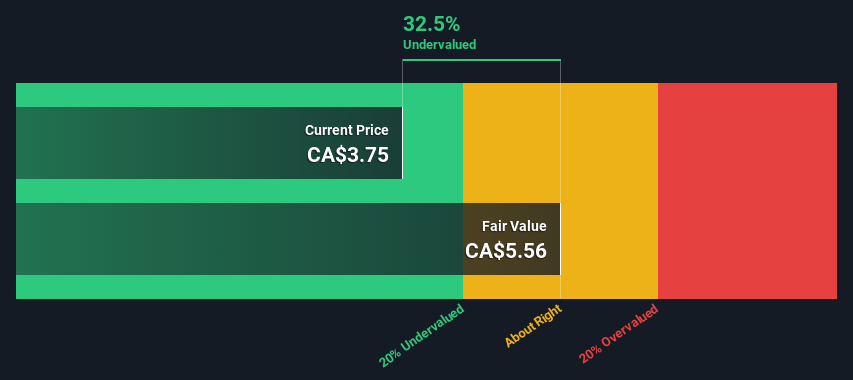

Plaza Retail REIT (TSX:PLZ.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Plaza Retail REIT focuses on owning, developing, and managing retail real estate properties across Canada, with a market capitalization of approximately CA$0.44 billion.

Operations: Plaza Retail REIT generates revenue primarily through its leasing operations, with a recent quarterly revenue of CA$126.11 million. The company's cost structure includes the cost of goods sold (COGS) and operating expenses, which were CA$47.54 million and CA$12.29 million respectively in the latest quarter, impacting its net income margin which was 19.78%. Over time, Plaza Retail REIT's gross profit margin has shown variability, with a recent figure of 62.31%.

PE: 17.0x

Plaza Retail REIT, a smaller player in the market, shows potential for value-focused investors. They recently reported Q1 2025 sales of C$31.14 million, up from C$29.57 million the previous year, though net income slightly dipped to C$9.3 million from C$9.4 million. Insider confidence is evident with an independent director purchasing 18,370 shares worth approximately C$69,806 in April 2025, increasing their holdings by nearly 27%. However, reliance on external borrowing poses risks despite consistent monthly distributions of $0.02333 per unit (C$0.28 annualized).

Summing It All Up

- Gain an insight into the universe of 180 Undervalued Global Small Caps With Insider Buying by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MRG.UN

Morguard North American Residential Real Estate Investment Trust

The REIT is an unincorporated, open-ended real estate investment trust established under and governed by the laws of the Province of Ontario.

Established dividend payer slight.

Market Insights

Community Narratives