- Canada

- /

- Residential REITs

- /

- TSX:KMP.UN

Will Diverging Sales and Net Income Trends Reshape Killam Apartment REIT's (TSX:KMP.UN) Narrative?

Reviewed by Simply Wall St

- On August 6, 2025, Killam Apartment REIT announced its second-quarter earnings, reporting sales of C$95.65 million compared to C$90.78 million a year earlier, while net income fell to C$33.13 million from C$114.45 million year-over-year.

- The contrast between higher revenues and a very large drop in net income highlights pressures from increased costs or non-operating items during the period.

- We will explore how the company’s substantial net income decline amid rising sales shapes expectations for Killam Apartment REIT’s investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Killam Apartment REIT's Investment Narrative?

To be a shareholder in Killam Apartment REIT, you have to believe in the resilience of residential rental real estate and focus on the company’s ability to grow rental income and distributions over time, despite choppier earnings periods. The latest earnings reveal higher sales but a very large drop in net income, suggesting that either higher operating costs, interest expenses, or significant non-recurring items weighed on profits this quarter. This is notable, as past analysis emphasized value, consistent dividends, and solid long-term profit growth as key strengths, while manageable debt service and earnings quality were highlighted as near-term risks. With the recent net income fall, risks tied to cost structures and the sustainability of high payout ratios come clearly into focus. The catalyst of stable monthly distributions remains, but investors may want to watch for further clarity on what drove the large swing in profitability, as it could shift sentiment or influence confidence in Killam’s current valuation and near-term outlook.

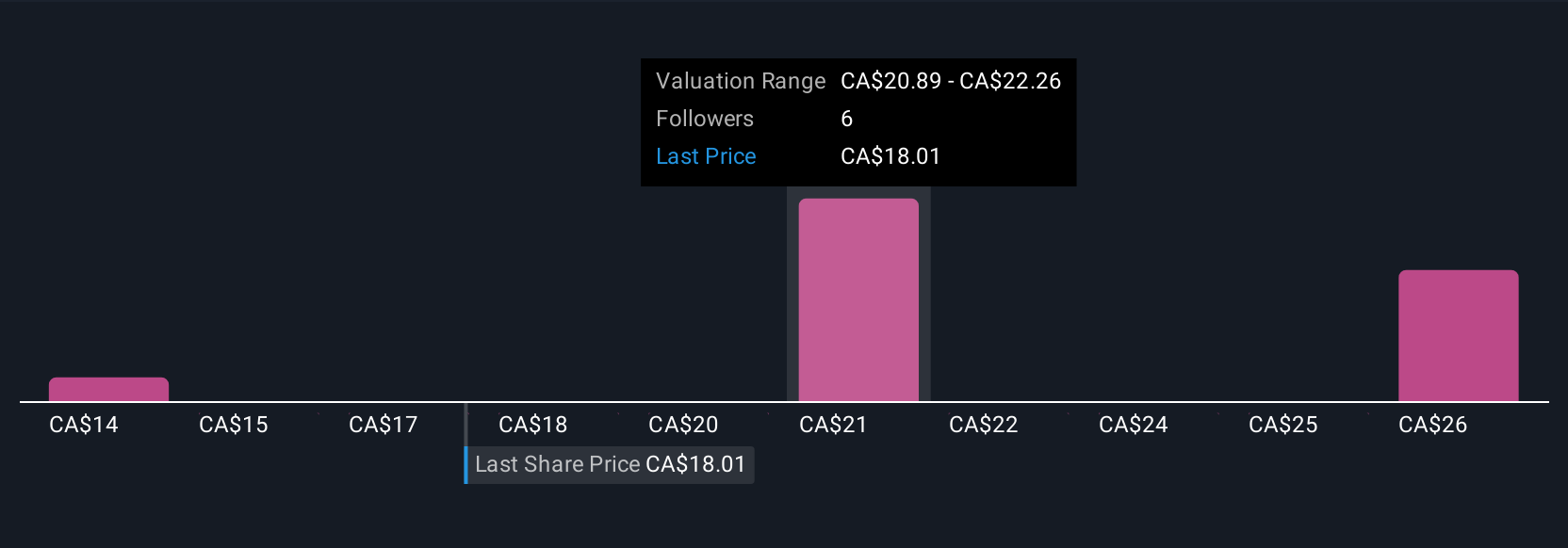

In contrast, not all income drivers are as reliable as they may first appear; investors should know the details. Despite retreating, Killam Apartment REIT's shares might still be trading 36% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Killam Apartment REIT - why the stock might be worth as much as 56% more than the current price!

Build Your Own Killam Apartment REIT Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Killam Apartment REIT research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Killam Apartment REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Killam Apartment REIT's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Killam Apartment REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KMP.UN

Killam Apartment REIT

Killam Apartment REIT, based in Halifax, Nova Scotia, is one of Canada's largest residential real estate investment trusts, owning, operating, managing and developing a $5.5 billion portfolio of apartments and manufactured home communities.

Undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives