- Canada

- /

- Residential REITs

- /

- TSX:KMP.UN

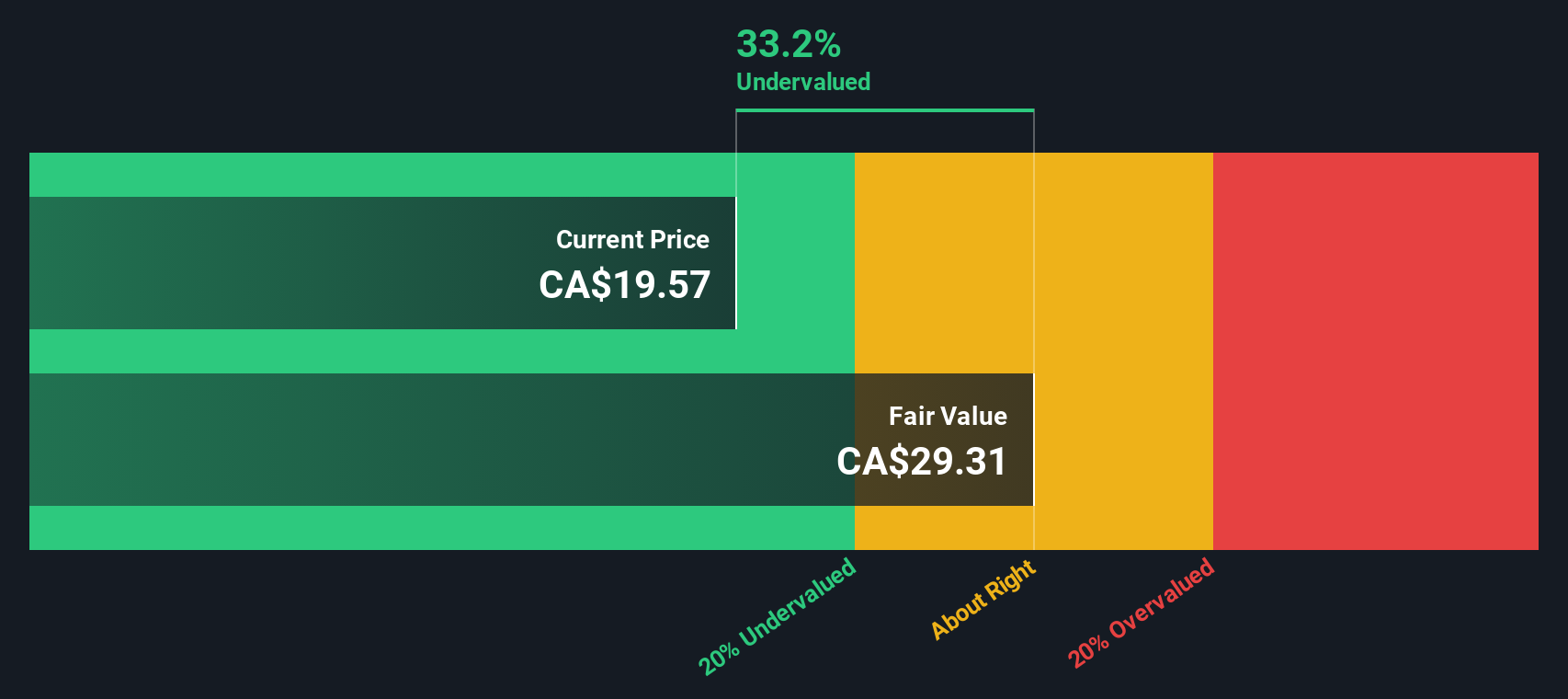

Killam Apartment REIT (TSX:KMP.UN): Is This Undervalued Stock Trading Below Its True Worth?

Reviewed by Kshitija Bhandaru

See our latest analysis for Killam Apartment REIT.

Over the past year, Killam Apartment REIT’s share price has been relatively resilient, though not immune to wider market slowdowns. Its latest 12-month total shareholder return stands at -6%. Investors who held on over the past three years have still seen rewarding gains of nearly 35%. At present, there is little evidence of strong momentum in either direction, which suggests the market is in wait-and-see mode as valuation and fundamentals remain steady.

If you’re considering your next move, this could be a good moment to broaden your horizons and discover fast growing stocks with high insider ownership

As the shares trade sideways, investors are left weighing the numbers to decide if Killam Apartment REIT is undervalued at current levels or if the market is already factoring in future growth prospects. Is now the time to buy, or is everything already priced in?

Price-to-Earnings of 3.9x: Is it justified?

Killam Apartment REIT is currently trading at a price-to-earnings (P/E) ratio of 3.9x, a level that stands out when viewed alongside its last close price of CA$18.02. This ratio suggests the market is valuing the company's earnings at a significant discount compared to industry peers.

The price-to-earnings ratio measures what investors are willing to pay for each dollar of a company's earnings. For residential REITs like Killam, it provides insight into how the market views current profit levels relative to the sector as well as expectations for future growth.

A P/E of 3.9x is notably below typical figures for the broader Global Residential REITs industry, where the average is 20.5x. When compared to its direct peers, which average 6.5x, Killam still looks attractively priced. This significant gap could reflect skepticism around recent earnings quality or doubts about the sustainability of current profits, especially in light of large one-off gains and slower forecast revenue growth.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 3.9x (UNDERVALUED)

However, growth risks remain, including muted annual revenue expansion and a sizeable discount to analyst targets. This reflects market caution about future performance.

Find out about the key risks to this Killam Apartment REIT narrative.

Another View: Discounted Cash Flow Analysis

Taking a different perspective, our SWS DCF model also considers Killam Apartment REIT to be undervalued. The model estimates fair value at CA$27.83, which is about 35% above the current price. This points to greater upside potential than the earnings multiple alone might indicate. However, is this a sign of hidden value or are there risks limiting the share price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Killam Apartment REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Killam Apartment REIT Narrative

If you see the numbers differently or want to dive deeper into your own analysis, building a personal narrative is quick and straightforward. Do it your way.

A great starting point for your Killam Apartment REIT research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for Your Next Move?

Smart investors don't wait for opportunity to knock twice. Use the power of Simply Wall Street's tools to spot fresh stocks with unique potential before others catch on.

- Unlock the potential of steady passive income when you act now, starting with these 19 dividend stocks with yields > 3% which offers attractive yields above 3%.

- Spot future leaders in artificial intelligence and be among the first to consider these 24 AI penny stocks as these set new standards in fast-evolving industries.

- Find strong bargains that the market still overlooks by reviewing these 901 undervalued stocks based on cash flows using powerful cash flow analytics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Killam Apartment REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KMP.UN

Killam Apartment REIT

Killam Apartment REIT, based in Halifax, Nova Scotia, is one of Canada's largest residential real estate investment trusts, owning, operating, managing and developing a $5.5 billion portfolio of apartments and manufactured home communities.

Undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives