- Canada

- /

- Residential REITs

- /

- TSX:HOM.UN

Exploring Global Undervalued Small Caps With Insider Action In October 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of economic uncertainties and a U.S. government shutdown, small-cap stocks have shown resilience, with the Russell 2000 Index outperforming larger indices amid expectations of potential rate cuts. In this environment, identifying promising small-cap opportunities often involves looking for companies that not only demonstrate solid fundamentals but also exhibit insider activity that may signal confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Aurelia Metals | 9.5x | 1.4x | 28.74% | ★★★★★★ |

| Bytes Technology Group | 17.4x | 4.4x | 11.88% | ★★★★☆☆ |

| East West Banking | 3.2x | 0.8x | 18.28% | ★★★★☆☆ |

| Nickel Asia | 21.9x | 2.3x | 42.07% | ★★★★☆☆ |

| BWP Trust | 10.0x | 13.1x | 13.74% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 42.60% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.7x | 1.8x | 21.17% | ★★★★☆☆ |

| Sagicor Financial | 7.1x | 0.4x | -71.64% | ★★★★☆☆ |

| Cettire | NA | 0.4x | 9.52% | ★★★☆☆☆ |

| Far East Orchard | 10.4x | 3.4x | 8.85% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

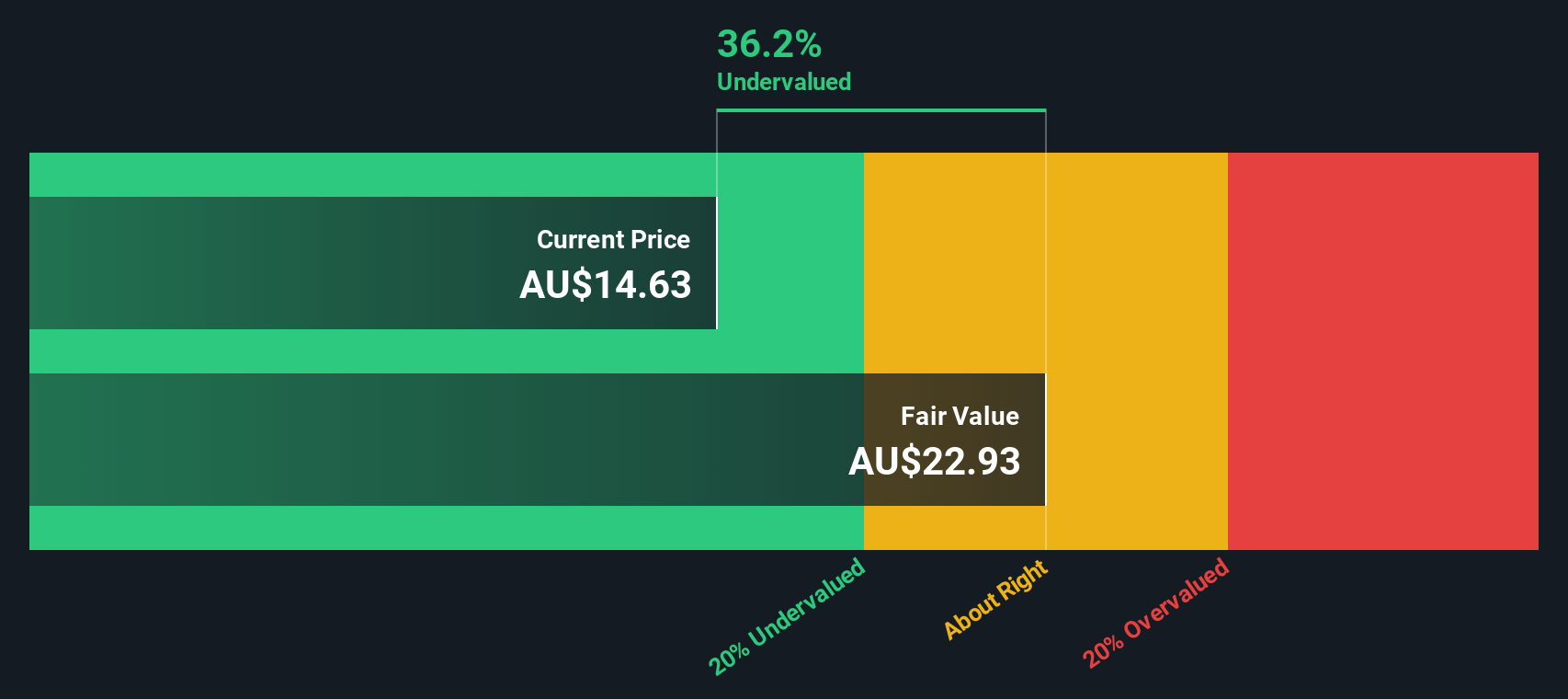

Domino's Pizza Enterprises (ASX:DMP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Domino's Pizza Enterprises operates a network of pizza restaurants and franchises across multiple countries, with a market capitalization of A$5.85 billion.

Operations: Domino's Pizza Enterprises generates revenue primarily from its restaurant operations, with a recent figure of A$2.30 billion. The company has seen fluctuations in its net income margin, which decreased to -0.16% as of the latest period. Gross profit margin has shown variability, reaching 32.04% recently, reflecting changes in cost management and pricing strategies over time.

PE: -341.0x

Domino's Pizza Enterprises, a smaller company in its sector, has faced challenges with a net loss of A$3.7 million for the year ending June 2025, contrasting with last year's A$95.96 million profit. Despite this setback and reliance on external borrowing for funding, earnings are projected to grow by 31% annually. Insider confidence is evident as executives have recently increased their shareholdings. The departure of long-serving director Ms Lynda O'Grady marks a shift in leadership dynamics.

- Click here and access our complete valuation analysis report to understand the dynamics of Domino's Pizza Enterprises.

Understand Domino's Pizza Enterprises' track record by examining our Past report.

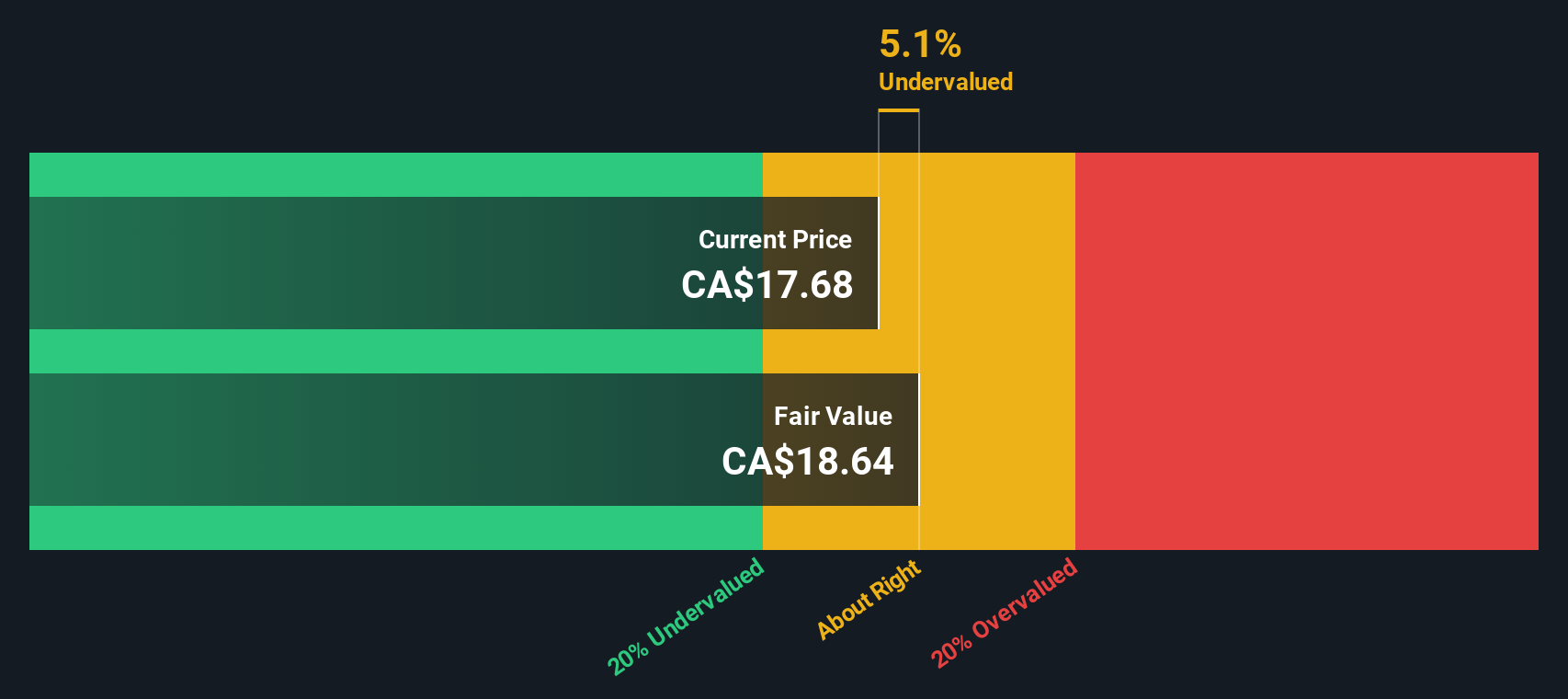

BSR Real Estate Investment Trust (TSX:HOM.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: BSR Real Estate Investment Trust focuses on owning and operating multi-family residential properties, with a market capitalization of approximately C$1.11 billion.

Operations: BSR Real Estate Investment Trust generates revenue primarily from its residential REIT segment, with recent quarterly revenue reported at $161.63 million. The company's cost of goods sold (COGS) was $77.94 million, resulting in a gross profit margin of 51.78%. Operating expenses are noted at $10.04 million, which includes general and administrative expenses of approximately $9.94 million. Non-operating expenses significantly impact the net income, which was recorded as a loss of -$62.79 million in the latest period analyzed.

PE: -6.7x

BSR Real Estate Investment Trust, a smaller player in the real estate sector, has demonstrated insider confidence with Graham Senst acquiring 10,000 shares for US$182,061 in September 2025. Despite facing financial challenges with interest payments not fully covered by earnings and reliance on external borrowing, BSR continues to pursue growth. Recent acquisitions like The Ownsby Apartments for $87.5 million highlight strategic expansion efforts in high-growth areas such as Celina, TX. Regular monthly dividends of $0.0467 per unit underscore its commitment to returning value to shareholders amidst these developments.

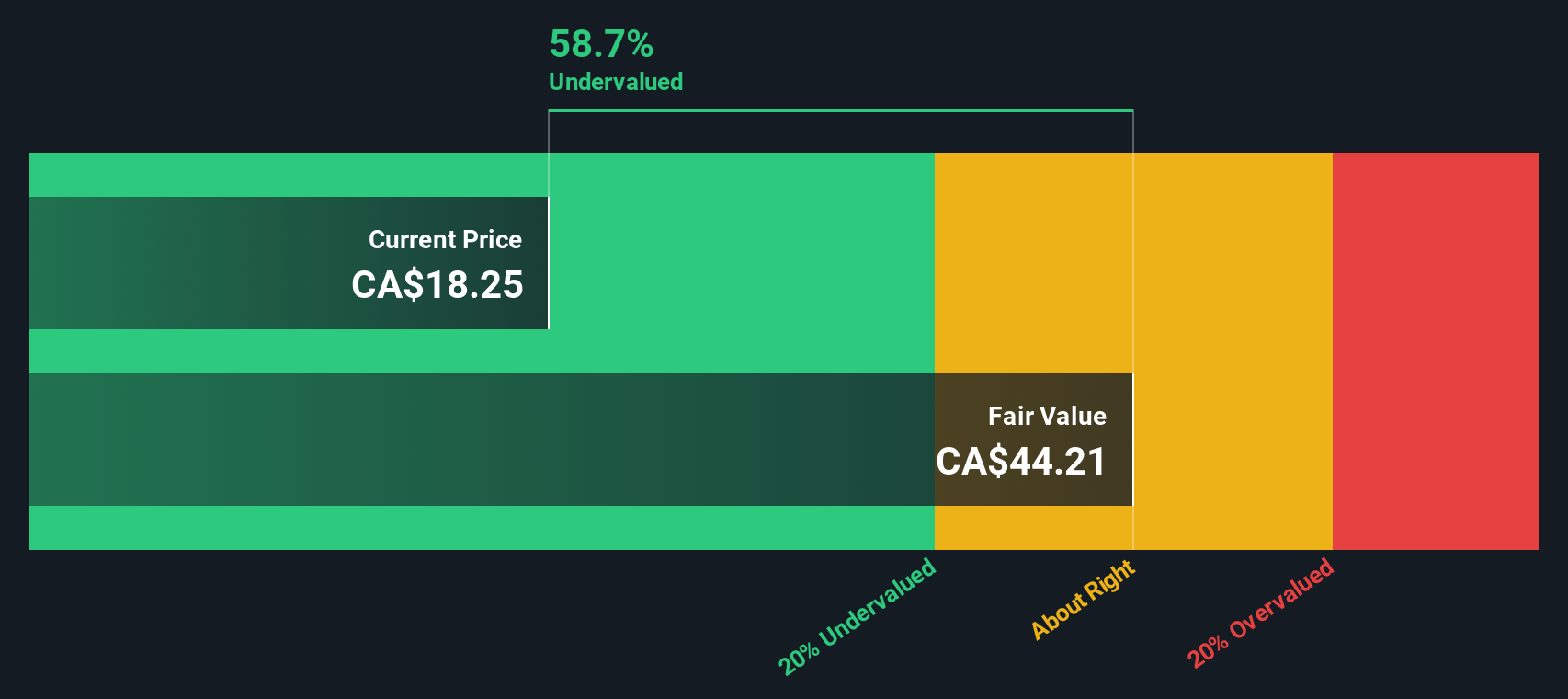

Flagship Communities Real Estate Investment Trust (TSX:MHC.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Flagship Communities Real Estate Investment Trust operates in the residential real estate sector, focusing on manufactured housing communities, with a market capitalization of approximately C$0.52 billion.

Operations: Flagship Communities Real Estate Investment Trust generates revenue primarily from its residential real estate investments, with the latest reported revenue at $96.83 million. The gross profit margin has shown variability, reaching 66.23% in recent periods, indicating efficiency in managing costs relative to revenue generation. Key expenses include operating expenses and non-operating costs, which have impacted net income margins over time.

PE: 3.9x

Flagship Communities Real Estate Investment Trust, a player in the manufactured housing sector, recently expanded by acquiring a 504-lot community in Kentucky. This move aligns with their strategy of targeting under-occupied properties with growth potential. Despite facing declining earnings forecasts of 45.9% annually over three years and interest payments not fully covered by earnings, insider confidence is evident as an individual increased their stake by purchasing 6,961 shares valued at approximately US$165,928. The REIT continues to distribute monthly dividends of US$0.0517 per unit, translating to an annual yield of US$0.62 per unit for investors seeking income opportunities amidst its growth initiatives and financial challenges.

Turning Ideas Into Actions

- Embark on your investment journey to our 110 Undervalued Global Small Caps With Insider Buying selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BSR Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HOM.UN

BSR Real Estate Investment Trust

An internally managed, unincorporated, open-ended real estate investment trust established pursuant to a declaration of trust under the laws of the Province of Ontario.

Fair value with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.