- Canada

- /

- Retail REITs

- /

- TSX:FCR.UN

Could First Capital REIT’s (TSX:FCR.UN) Streamlined Structure Signal a Shift in Long-Term Strategic Priorities?

Reviewed by Sasha Jovanovic

- First Capital Real Estate Investment Trust recently announced that its Board of Trustees has unanimously approved a proposed internal reorganization to simplify the company’s structure by eliminating a subsidiary and streamlining real property holdings through partnerships and trusts, subject to unitholder and regulatory approvals.

- The reorganization is designed to significantly reduce complexity in accounting, legal, and income tax compliance without changing the company’s overall business strategy or operations.

- We’ll explore how this proposed structural simplification could influence First Capital’s investment narrative for both shareholders and potential investors.

Find companies with promising cash flow potential yet trading below their fair value.

What Is First Capital Real Estate Investment Trust's Investment Narrative?

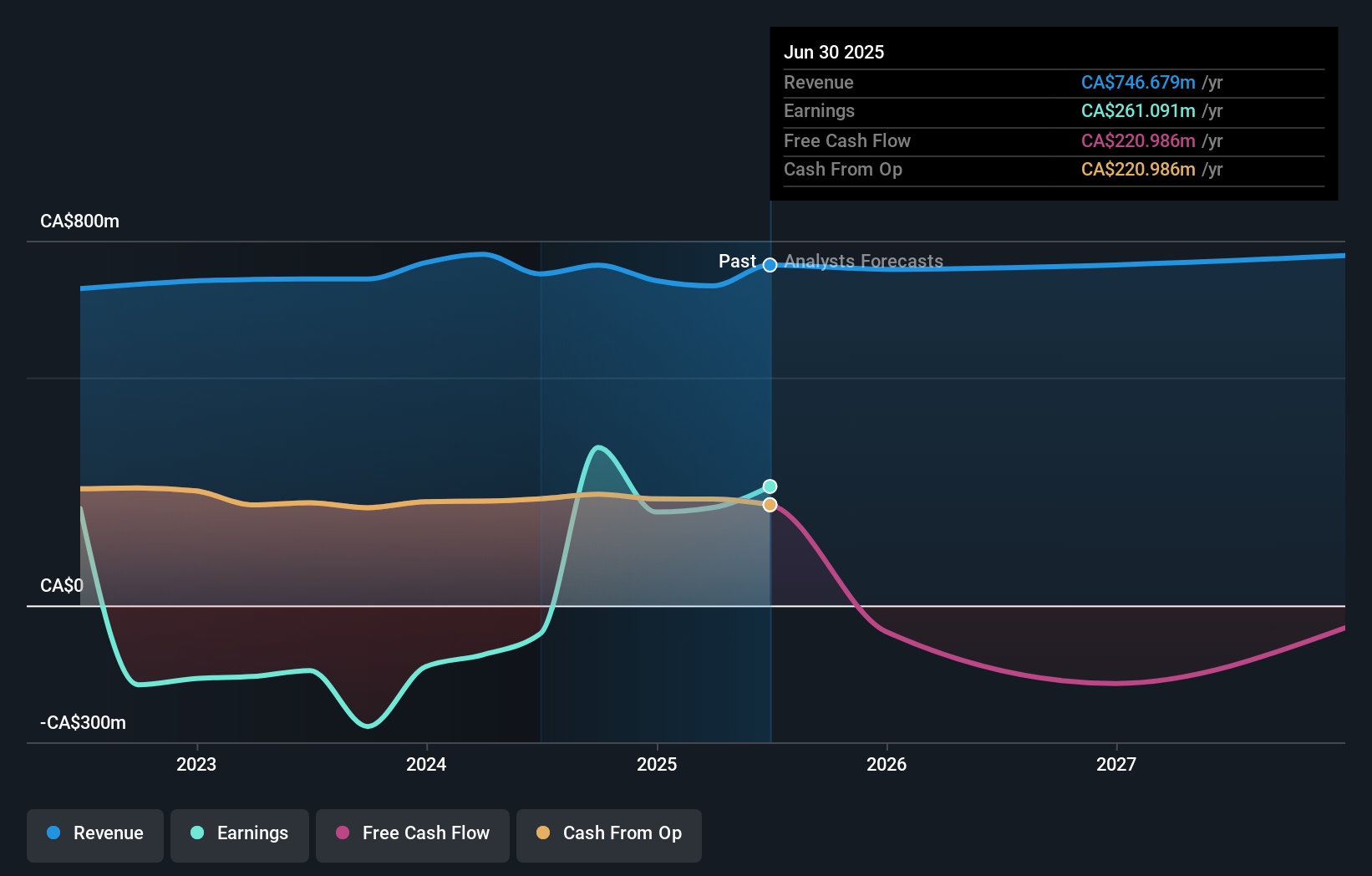

For investors considering First Capital REIT, the key story has been steady performance and value versus peers, underpinned by stable distributions and asset growth ambitions. The recent internal reorganization announcement could add a new dimension to this narrative, aiming to simplify legal and tax reporting while keeping day-to-day operations and strategy unchanged. In the short term, it appears unlikely to have a significant effect on the biggest catalysts, such as ongoing income generation, real estate development partnerships, and recurring distributions. However, if the structural changes deliver on reduced complexity and cost, they could incrementally improve financial flexibility and risk oversight. The most important risks, like limited dividend stability and modest revenue growth, still remain, and the latest move does not fundamentally shift those factors yet. Investors need to stay mindful of how execution of this plan could impact both valuation and operational efficiency down the road.

Yet, the uncertain outlook for dividend sustainability is something investors should keep in mind. First Capital Real Estate Investment Trust's shares have been on the rise but are still potentially undervalued by 13%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on First Capital Real Estate Investment Trust - why the stock might be worth over 5x more than the current price!

Build Your Own First Capital Real Estate Investment Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Capital Real Estate Investment Trust research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free First Capital Real Estate Investment Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Capital Real Estate Investment Trust's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FCR.UN

First Capital Real Estate Investment Trust

First Capital Real Estate Investment Trust, with $9.4 billion in assets acquires, develops, owns and operates open-air grocery-anchored shopping centres in neighbourhoods with the strongest demographics in Canada.

Average dividend payer and fair value.

Market Insights

Community Narratives