- Canada

- /

- Oil and Gas

- /

- TSXV:LGN

TSX's Top Undervalued Small Caps With Insider Action In November 2024

Reviewed by Simply Wall St

In the wake of a decisive U.S. election, markets have experienced a significant rally, with the S&P 500 and TSX reaching new highs as uncertainty diminishes and investors anticipate potential policy shifts. As Canadian small-cap stocks navigate this evolving landscape, identifying those with strong fundamentals and insider action can present unique opportunities for investors seeking to capitalize on market dynamics.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| AutoCanada | NA | 0.1x | 43.64% | ★★★★★★ |

| Calfrac Well Services | 11.4x | 0.2x | 37.09% | ★★★★★☆ |

| Trican Well Service | 8.2x | 0.9x | 15.47% | ★★★★☆☆ |

| Rogers Sugar | 15.4x | 0.6x | 48.27% | ★★★★☆☆ |

| Nexus Industrial REIT | 3.5x | 3.5x | 19.34% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 13.2x | 3.5x | 44.28% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -41.38% | ★★★★☆☆ |

| Coveo Solutions | NA | 3.8x | 37.27% | ★★★★☆☆ |

| Hemisphere Energy | 6.0x | 2.3x | -217.79% | ★★★☆☆☆ |

| European Residential Real Estate Investment Trust | NA | 2.2x | -96.11% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

European Residential Real Estate Investment Trust (TSX:ERE.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: European Residential Real Estate Investment Trust focuses on owning and managing a portfolio of residential properties across Europe, with a market capitalization of approximately CA$0.89 billion.

Operations: The primary revenue stream for the company is derived from investment properties, with recent revenues reaching €97.04 million. The gross profit margin has seen a gradual increase, reaching 78.68% in the latest period. Operating expenses have fluctuated but recently stood at €8.36 million, impacting net income outcomes significantly due to non-operating expenses such as interest and other financial costs.

PE: -4.5x

European Residential Real Estate Investment Trust, a small Canadian player, faces challenges with declining earnings and interest payments not well-covered by earnings. Despite this, insider confidence is evident as they have been purchasing shares since early 2024. Recent strategic dispositions aim to streamline operations, with proceeds funding a special cash distribution of €0.75 per unit. However, the company plans to halve its monthly distributions post-disposition closure in early 2025 to align with its reduced portfolio size.

Lassonde Industries (TSX:LAS.A)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Lassonde Industries is a Canadian company primarily engaged in the production and marketing of non-alcoholic beverages, with a market capitalization of CA$1.48 billion.

Operations: Lassonde Industries generates revenue primarily from non-alcoholic beverages, with the latest figure reaching CA$2.47 billion. The company's cost of goods sold (COGS) was CA$1.81 billion, resulting in a gross profit of CA$657.66 million for the most recent period. The gross profit margin has shown fluctuations, with the latest at 26.65%.

PE: 11.9x

Lassonde Industries, a Canadian company with a small market capitalization, has shown promising financial growth and insider confidence. They reported third-quarter sales of C$668 million, up from C$583 million the previous year, with net income rising to C$29.65 million. Earnings per share increased to C$4.35 from C$3.56. The company is investing US$200 million in a new U.S. facility to enhance efficiency and competitiveness, indicating potential for future growth despite relying on external borrowing for funding needs.

- Click here and access our complete valuation analysis report to understand the dynamics of Lassonde Industries.

Gain insights into Lassonde Industries' past trends and performance with our Past report.

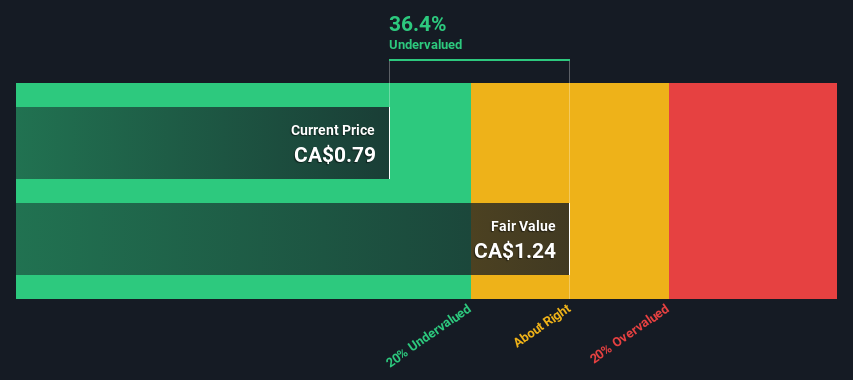

Logan Energy (TSXV:LGN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Logan Energy is engaged in the exploration and production of oil and gas, with a market capitalization of CA$150.75 million.

Operations: Logan Energy's revenue primarily stems from its oil and gas exploration and production activities, with the latest reported revenue at CA$90.27 million. The company has experienced fluctuating net income margins, reaching -0.60% in recent periods, while gross profit margins have varied from 70.71% to 54.92%. Operating expenses and cost of goods sold significantly impact financial performance, with notable costs in general and administrative expenses as well as depreciation and amortization expenses.

PE: -455.0x

Logan Energy, a small Canadian energy firm, has recently demonstrated insider confidence with directors and employees subscribing to approximately C$5 million in their latest equity offering. Despite relying on external borrowing for funding, Logan's revenue surged to C$24.35 million in Q2 2024 from C$13.4 million the previous year, turning a net profit of C$0.416 million from a loss of C$3.86 million previously. With production guidance set at 8,700 BOE/d for 2024 and revenue forecasted to grow by 46% annually, the company shows potential amidst its financial challenges.

- Take a closer look at Logan Energy's potential here in our valuation report.

Evaluate Logan Energy's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click here to access our complete index of 25 Undervalued TSX Small Caps With Insider Buying.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LGN

Logan Energy

Engages in the exploration, development and production of crude oil and natural gas properties.

Mediocre balance sheet with limited growth.

Market Insights

Community Narratives