- Canada

- /

- Retail REITs

- /

- TSX:CHP.UN

Does Choice Properties Real Estate Investment Trust (TSE:CHP.UN) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Choice Properties Real Estate Investment Trust (TSE:CHP.UN), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Choice Properties Real Estate Investment Trust with the means to add long-term value to shareholders.

Check out our latest analysis for Choice Properties Real Estate Investment Trust

How Fast Is Choice Properties Real Estate Investment Trust Growing Its Earnings Per Share?

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. Which is why EPS growth is looked upon so favourably. It is awe-striking that Choice Properties Real Estate Investment Trust's EPS went from CA$0.92 to CA$3.54 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Our analysis has highlighted that Choice Properties Real Estate Investment Trust's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. It was a year of stability for Choice Properties Real Estate Investment Trust as both revenue and EBIT margins remained have been flat over the past year. While this doesn't ring alarm bells, it may not meet the expectations of growth-minded investors.

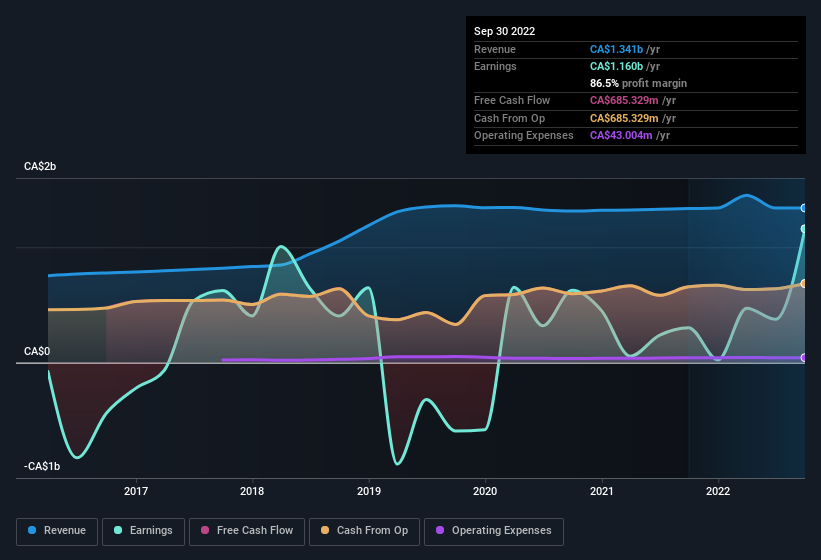

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Choice Properties Real Estate Investment Trust's balance sheet strength, before getting too excited.

Are Choice Properties Real Estate Investment Trust Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that, in the last year, insiders sold CA$85k worth of shares. But that's far less than the CA$4.6m insiders spent purchasing stock. This adds to the interest in Choice Properties Real Estate Investment Trust because it suggests that those who understand the company best, are optimistic. We also note that it was the President & CEO, Rael Diamond, who made the biggest single acquisition, paying CA$1.5m for shares at about CA$14.38 each.

The good news, alongside the insider buying, for Choice Properties Real Estate Investment Trust bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at CA$26m. That's a lot of money, and no small incentive to work hard. Despite being just 0.2% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Choice Properties Real Estate Investment Trust's CEO, Rael Diamond, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Choice Properties Real Estate Investment Trust with market caps between CA$5.5b and CA$16b is about CA$6.4m.

Choice Properties Real Estate Investment Trust's CEO took home a total compensation package worth CA$3.5m in the year leading up to December 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Choice Properties Real Estate Investment Trust Deserve A Spot On Your Watchlist?

Choice Properties Real Estate Investment Trust's earnings have taken off in quite an impressive fashion. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Choice Properties Real Estate Investment Trust belongs near the top of your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Choice Properties Real Estate Investment Trust (at least 1 which is significant) , and understanding these should be part of your investment process.

Keen growth investors love to see insider buying. Thankfully, Choice Properties Real Estate Investment Trust isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Choice Properties Real Estate Investment Trust, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CHP.UN

Choice Properties Real Estate Investment Trust

Choice Properties is a leading Real Estate Investment Trust that creates enduring value through the ownership, operation and development of high-quality commercial and residential properties.

Established dividend payer and fair value.

Market Insights

Community Narratives