- Canada

- /

- Residential REITs

- /

- TSX:BEI.UN

Does Boardwalk REIT’s Saskatoon High-Rise Purchase Signal a Strategic Shift in Portfolio Growth? (TSX:BEI.UN)

Reviewed by Sasha Jovanovic

- Boardwalk Real Estate Investment Trust recently completed the acquisition of the fully-occupied 639 Main Street high-rise community in Saskatoon, Saskatchewan for $39.0 million and reported that its strong third-quarter leasing activity kept occupancy at 97.8% with rising rents.

- This addition supports Boardwalk’s ongoing focus on investing in high-demand, affordable rental markets and aligns with its portfolio expansion strategy.

- We'll explore how the Saskatoon acquisition and robust occupancy performance impact Boardwalk REIT's long-term investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Boardwalk Real Estate Investment Trust's Investment Narrative?

For anyone looking at Boardwalk REIT, it often comes down to a belief in the long-term resilience of the Canadian multi-family rental market and the trust’s ability to identify high-occupancy, income-generating properties. The recent fully-occupied Saskatoon high-rise purchase directly supports Boardwalk’s focus on growing in affordable, undersupplied regions, and the reported 97.8% portfolio occupancy could make a positive near-term catalyst as investors watch for its effect heading into Q3 results. This acquisition, coming on the back of declining year-over-year earnings and recent price weakness, might slightly bolster confidence in Boardwalk’s operational performance and cash flow consistency. However, the overall financials still bear scrutiny, with questions lingering about net income pressure, an inexperienced management team, and historically unstable dividends. The market’s sharp discount to analyst price targets is persistent, yet the Saskatoon deal may start to shift expectations around growth and risks.

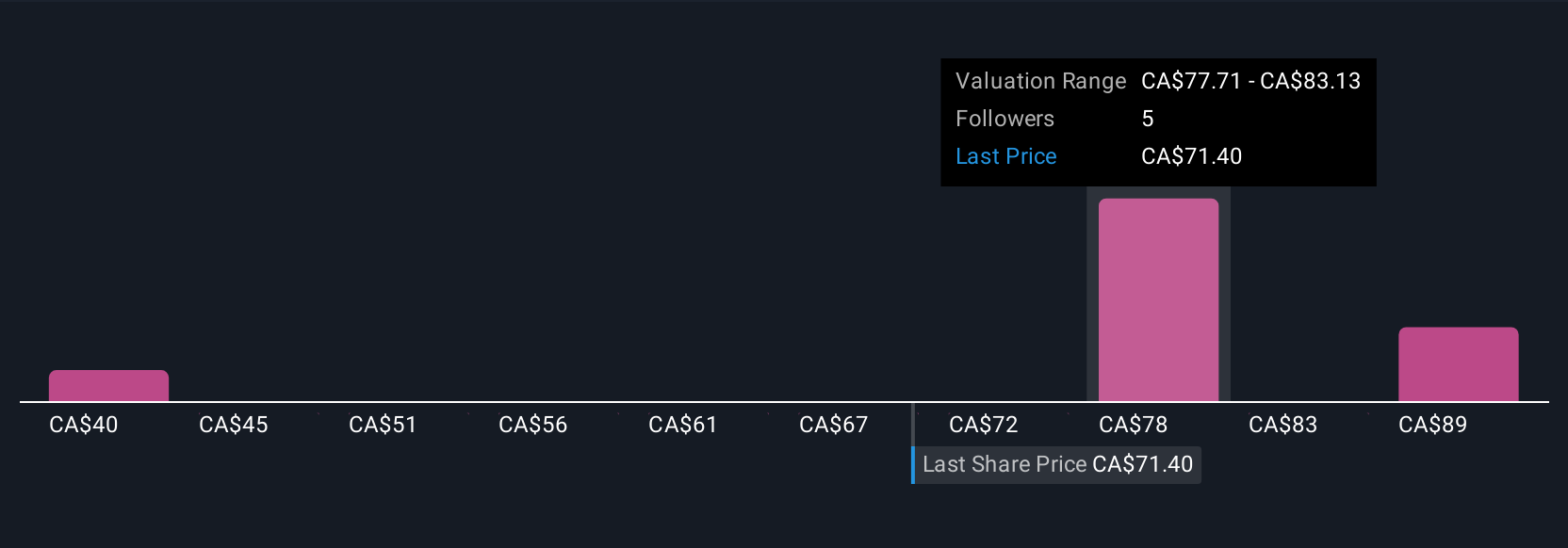

But the impact of one-off accounting items on earnings remains a caution flag investors shouldn't ignore. Despite retreating, Boardwalk Real Estate Investment Trust's shares might still be trading 29% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Boardwalk Real Estate Investment Trust - why the stock might be worth as much as 40% more than the current price!

Build Your Own Boardwalk Real Estate Investment Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boardwalk Real Estate Investment Trust research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Boardwalk Real Estate Investment Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boardwalk Real Estate Investment Trust's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boardwalk Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BEI.UN

Boardwalk Real Estate Investment Trust

Boardwalk REIT strives to be Canada's friendliest community provider and is a leading owner/operator of multi-family rental communities.

Undervalued with moderate risk.

Market Insights

Community Narratives