3 Undervalued Small Caps In Global With Recent Insider Buying

Reviewed by Simply Wall St

Amidst a backdrop of cautious Federal Reserve commentary and modest economic growth, U.S. small-cap stocks, as represented by the Russell 2000 Index, have experienced their first weekly decline since early August. This environment of tempered optimism and inflationary pressures presents a unique opportunity for investors to explore potentially undervalued small-cap companies with recent insider activity, which can be indicative of confidence in the company's future prospects despite broader market challenges.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 17.4x | 4.4x | 11.48% | ★★★★☆☆ |

| East West Banking | 3.2x | 0.8x | 16.49% | ★★★★☆☆ |

| Nickel Asia | 21.5x | 2.3x | 44.16% | ★★★★☆☆ |

| GDI Integrated Facility Services | 18.7x | 0.3x | 0.79% | ★★★★☆☆ |

| Cettire | NA | 0.3x | 29.18% | ★★★★☆☆ |

| BWP Trust | 10.0x | 13.1x | 13.52% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 45.05% | ★★★★☆☆ |

| Sagicor Financial | 7.2x | 0.4x | -74.20% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.7x | 1.8x | 19.45% | ★★★☆☆☆ |

| CVS Group | 45.5x | 1.3x | 37.56% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

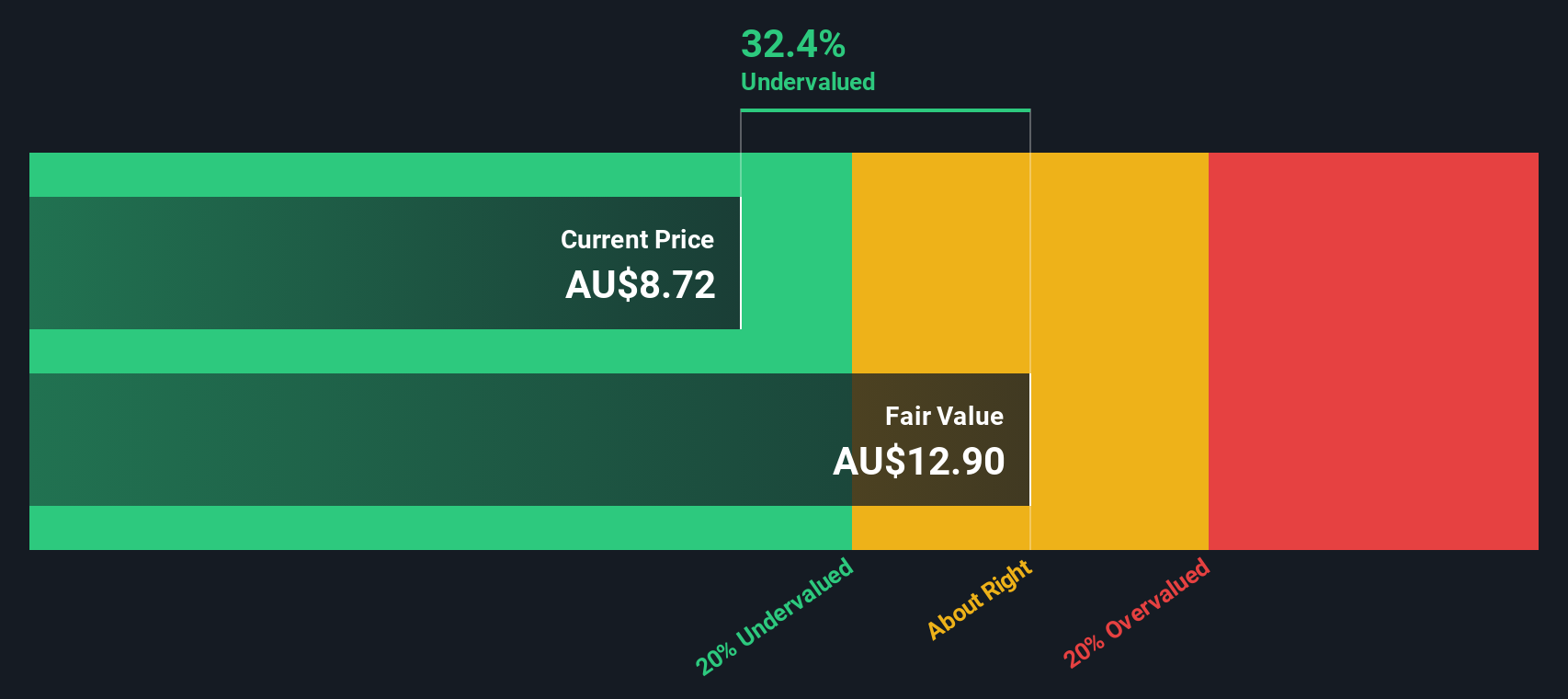

Magellan Financial Group (ASX:MFG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Magellan Financial Group is an Australian-based investment management firm specializing in global equity and infrastructure strategies, with a market capitalization of approximately A$3.5 billion.

Operations: The primary revenue stream for Magellan Financial Group comes from Investment Management Services, complemented by income from Partnerships & Investments and Corporate activities. The company's gross profit margin has shown variability, with recent figures around 81.28%. Operating expenses are primarily driven by General & Administrative costs, followed by Sales & Marketing and Depreciation & Amortization expenses.

PE: 10.3x

Magellan Financial Group, a smaller player in the financial sector, has recently completed a share buyback program, repurchasing 14.08 million shares for A$126.76 million since March 2022. This reflects insider confidence in its potential value. Despite a drop in revenue to A$318.95 million and net income to A$165.02 million for the year ending June 2025, Magellan is strategically positioning itself with refreshed branding and an updated dividend policy targeting an 80% payout of operating profit from fiscal year 2026 onward.

- Get an in-depth perspective on Magellan Financial Group's performance by reading our valuation report here.

Learn about Magellan Financial Group's historical performance.

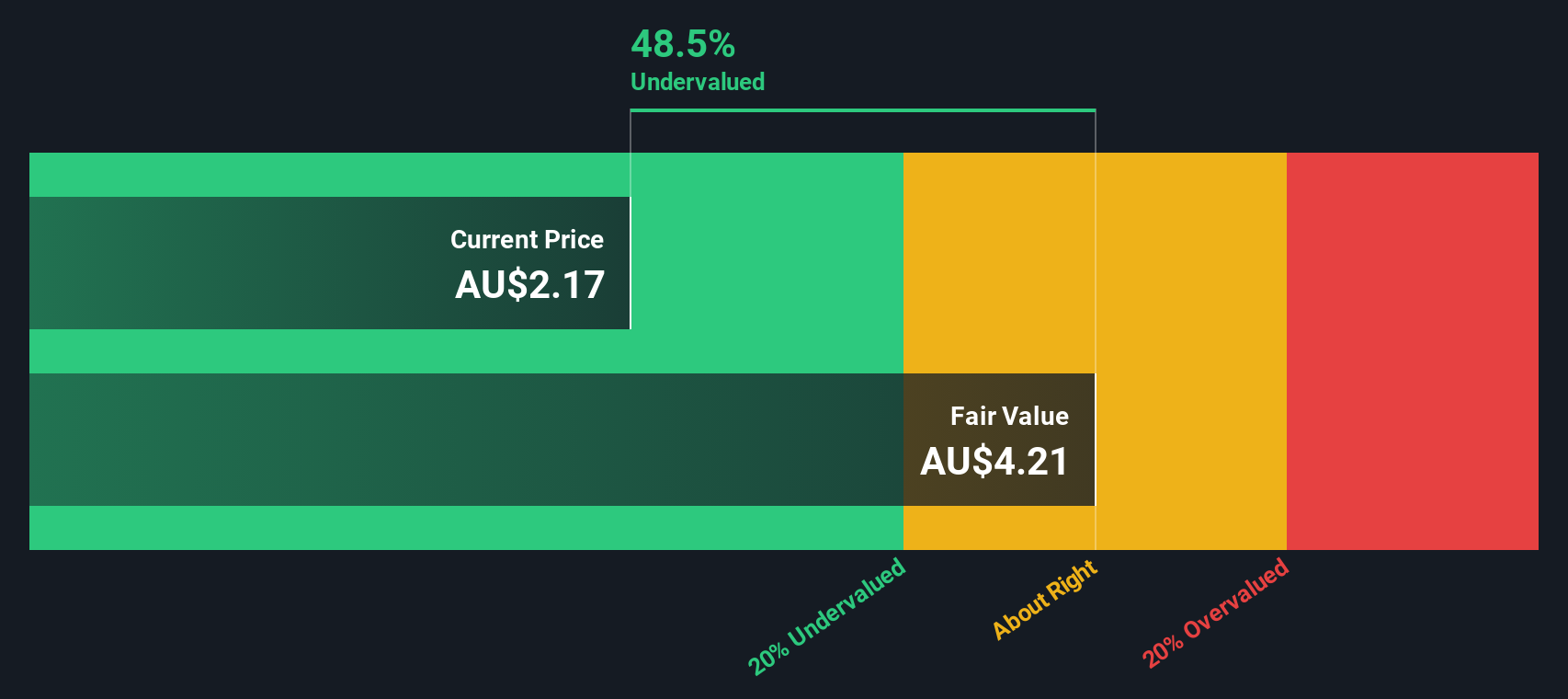

Navigator Global Investments (ASX:NGI)

Simply Wall St Value Rating: ★★★★★★

Overview: Navigator Global Investments operates as an investment management company primarily through its Lighthouse segment, with a market cap of approximately A$0.25 billion.

Operations: Navigator Global Investments generates revenue primarily through its Lighthouse segment, with costs of goods sold significantly impacting gross profit margins, which have shown variability over time. The company's net income margin has demonstrated a notable upward trend in recent periods, reaching 1.02% as of December 2024. Operating expenses include significant general and administrative costs, while non-operating expenses have fluctuated considerably, contributing to variations in net income outcomes.

PE: 5.8x

Navigator Global Investments, a smaller player in the asset management sector, has shown insider confidence with Lindsay Wright purchasing 100,000 shares for A$209,107 in August 2025. Despite relying entirely on external borrowing for funding and facing an expected annual earnings decline of 8.8% over the next three years, revenue is projected to grow by 13.67% annually. Recent financials reveal a revenue jump to US$365.79 million from US$276.28 million year-over-year and net income rising to US$119.36 million from US$66.31 million, indicating potential growth amidst leadership transitions as Roger Davis prepares to take over as Chair in November 2025.

- Click here to discover the nuances of Navigator Global Investments with our detailed analytical valuation report.

Gain insights into Navigator Global Investments' past trends and performance with our Past report.

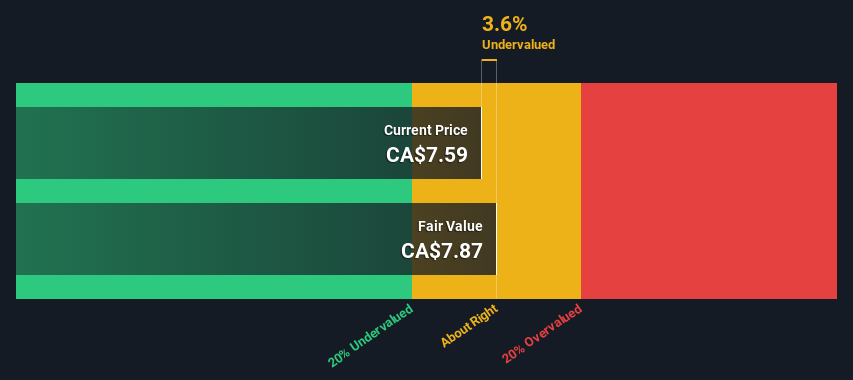

Artis Real Estate Investment Trust (TSX:AX.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Artis Real Estate Investment Trust is a diversified Canadian company primarily engaged in the ownership and management of commercial properties across Canada and the United States, with a market cap of CA$1.09 billion.

Operations: The company's revenue is primarily derived from its operations in Canada and the U.S., along with its Real Estate Investment Trust (REIT) activities. Over recent periods, the gross profit margin has shown variability, with a notable decrease to 34.37% by September 2024. Operating expenses are relatively low compared to revenue, but non-operating expenses have had a significant impact on net income margins, which have fluctuated widely into negative territory in recent quarters.

PE: -9.0x

Artis Real Estate Investment Trust, a smaller player in the real estate sector, has recently announced a merger with RFA Capital Holdings Inc., where Artis unit holders will own 68% of the combined entity. Despite reporting a net loss of C$23.49 million for Q2 2025 and facing challenges with interest coverage due to reliance on external borrowing, insider confidence is evident as management continues share repurchases. The company declared consistent monthly dividends, offering potential income stability amidst its evolving business landscape.

Where To Now?

- Access the full spectrum of 111 Undervalued Global Small Caps With Insider Buying by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AX.UN

Artis Real Estate Investment Trust

Artis is a diversified Canadian real estate investment trust with a portfolio of industrial, office and retail properties in Canada and the United States.

Second-rate dividend payer with low risk.

Market Insights

Community Narratives