- Canada

- /

- Office REITs

- /

- TSX:AP.UN

Should Allied’s Deep Distribution Cut And Asset Sales Strategy Require Action From Allied Properties Real Estate Investment Trust (TSX:AP.UN) Investors?

Reviewed by Sasha Jovanovic

- Allied Properties Real Estate Investment Trust has cut its monthly distribution to $0.06 per unit starting with the December 2025 payout, as it continues selling non-core assets and prioritizing debt reduction amid softer-than-expected office occupancy.

- This marks a sharp reversal from earlier confidence in maintaining the payout and highlights how weaker leasing conditions are reshaping the REIT’s income profile.

- We’ll now examine how the substantial distribution cut, alongside ongoing asset sales, reshapes Allied’s investment narrative for existing and prospective unitholders.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Allied Properties Real Estate Investment Trust's Investment Narrative?

To own Allied today, you really have to believe its urban office portfolio can eventually justify the balance sheet strain and recent income reset. The 60% distribution cut to CA$0.06 per unit is a clear acknowledgment that high leverage, weaker-than-hoped office demand and recurring net losses are now front and centre. In the near term, the key catalyst shifts from income stability to whether Allied can keep executing non core asset sales at acceptable prices and use the proceeds to materially ease interest pressure. The cut also underlines that previous assumptions about dividend sustainability and occupancy progress were too optimistic, which raises the risk that any recovery in earnings or unit price could take longer than bulls once expected.

However, there is a real risk that slower leasing and asset sales drag out this repair job, which investors should be aware of. Despite retreating, Allied Properties Real Estate Investment Trust's shares might still be trading 43% above their fair value. Discover the potential downside here.Exploring Other Perspectives

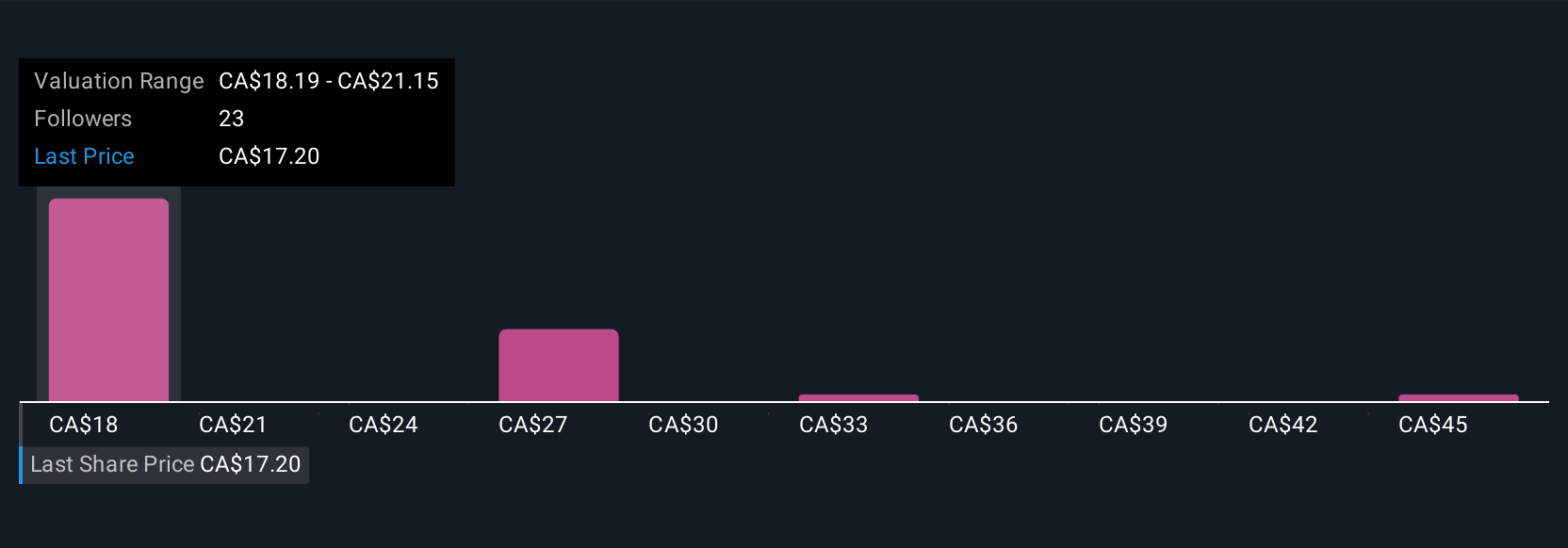

Ten fair value estimates from the Simply Wall St Community span roughly CA$15 to above CA$48 per unit, underscoring how far apart views are on Allied’s upside. Set against the recent distribution cut and ongoing balance sheet repair, this wide spread in expectations shows why it can be useful to compare several independent viewpoints before deciding how Allied might fit into a portfolio.

Explore 10 other fair value estimates on Allied Properties Real Estate Investment Trust - why the stock might be worth just CA$15.17!

Build Your Own Allied Properties Real Estate Investment Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allied Properties Real Estate Investment Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Allied Properties Real Estate Investment Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allied Properties Real Estate Investment Trust's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AP.UN

Allied Properties Real Estate Investment Trust

Allied is a leading owner-operator of distinctive urban workspace in Canada’s major cities.

Established dividend payer with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026