Undervalued Small Caps With Insider Action On TSX In November 2024

Reviewed by Simply Wall St

In the wake of a decisive U.S. election, markets have experienced a significant rally, with the S&P 500 and TSX reaching record highs as investors anticipate potential policy shifts that could influence economic growth and corporate profits. As volatility subsides, Canadian small-cap stocks on the TSX present intriguing opportunities for investors seeking to capitalize on favorable fundamentals, particularly those with insider activity indicating potential value in this dynamic post-election landscape.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Trican Well Service | 8.2x | 0.9x | 15.82% | ★★★★★☆ |

| Calfrac Well Services | 11.7x | 0.2x | 35.15% | ★★★★★☆ |

| Rogers Sugar | 15.4x | 0.6x | 48.27% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 13.0x | 3.5x | 45.05% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -40.31% | ★★★★☆☆ |

| Coveo Solutions | NA | 3.8x | 36.54% | ★★★★☆☆ |

| Hemisphere Energy | 6.0x | 2.3x | -217.80% | ★★★☆☆☆ |

| Nexus Industrial REIT | 13.3x | 3.3x | 17.86% | ★★★☆☆☆ |

| European Residential Real Estate Investment Trust | NA | 2.3x | -199.13% | ★★★☆☆☆ |

| StorageVault Canada | NA | 5.0x | -714.99% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

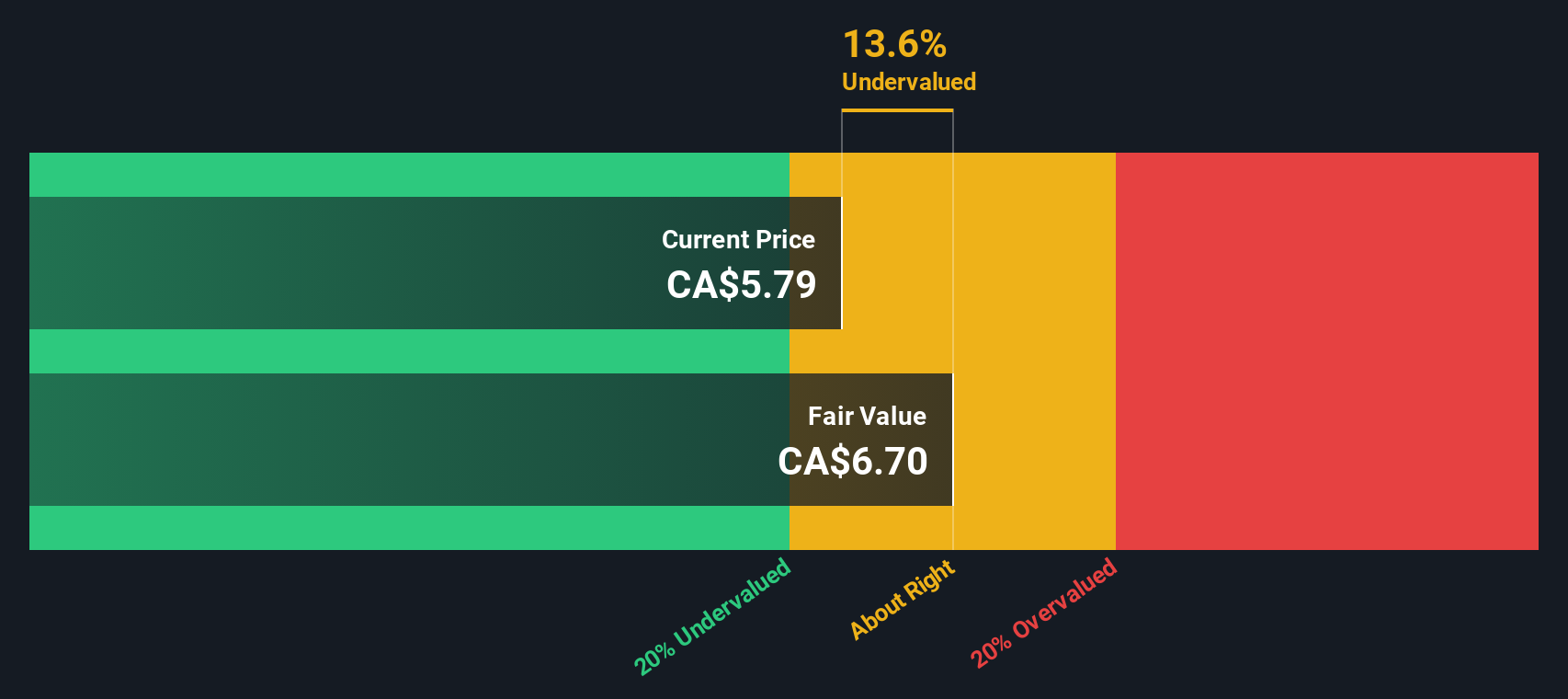

Coveo Solutions (TSX:CVO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Coveo Solutions is a technology company specializing in AI-powered search and recommendation software, with a market cap of approximately C$0.54 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, reaching $129.30 million in the latest period. Its cost of goods sold (COGS) was $27.97 million, resulting in a gross profit margin of 78.37%. Operating expenses are significant, with sales and marketing being the largest component at $56.34 million, followed by research and development expenses at $36.97 million.

PE: -22.7x

Coveo Solutions, a Canadian company focusing on AI-powered search and personalization, has seen insider confidence with Louis Tetu purchasing 18,000 shares valued at approximately US$102,163. Despite being currently unprofitable and reliant on higher-risk external borrowing for funding, Coveo's revenue is projected to grow by 11.45% annually. Recent earnings showed improved performance with reduced net losses compared to last year. The company is expanding in Europe with significant partnerships like SAP and continues to attract notable talent such as Eric Lamarre to its board.

- Get an in-depth perspective on Coveo Solutions' performance by reading our valuation report here.

Assess Coveo Solutions' past performance with our detailed historical performance reports.

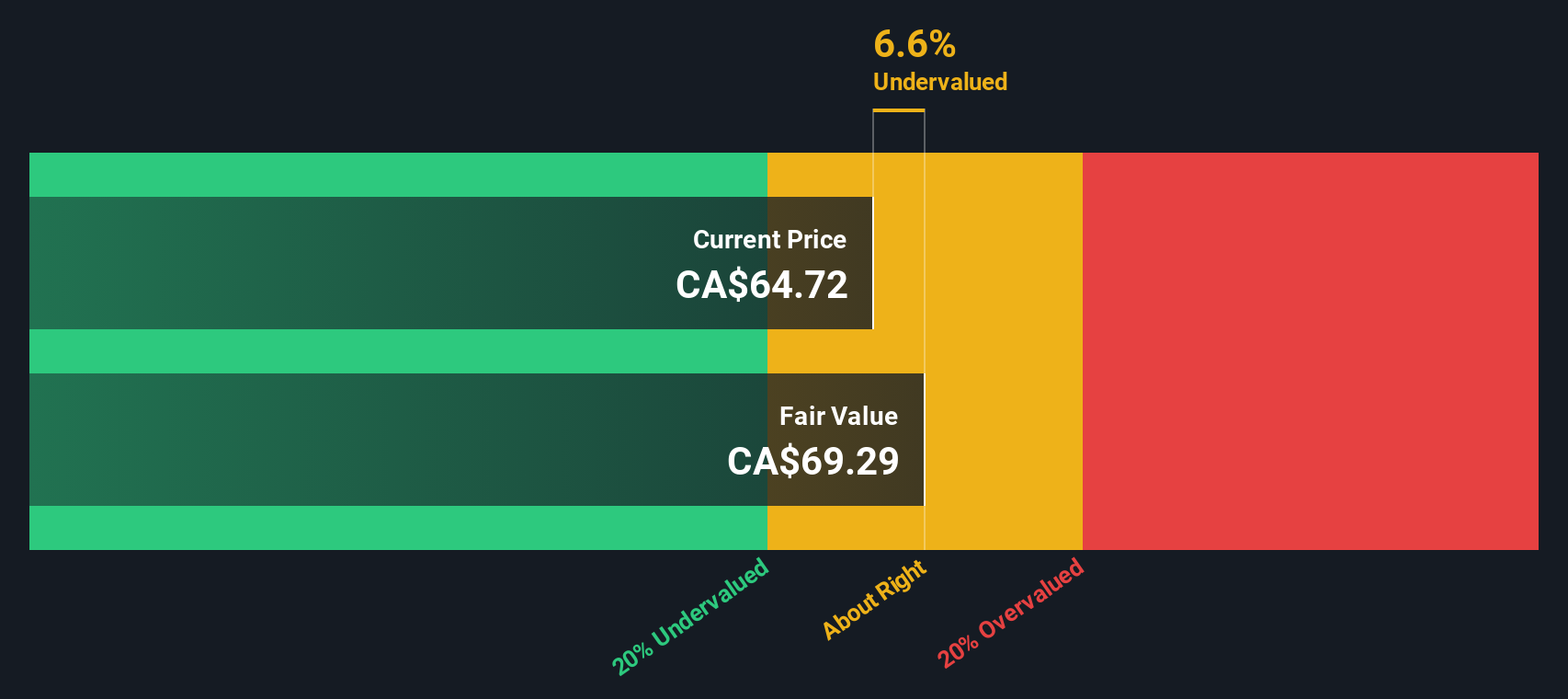

Exchange Income (TSX:EIF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Exchange Income is a diversified company engaged in manufacturing and aerospace & aviation operations, with a market cap of CA$2.05 billion.

Operations: The company generates revenue from its Manufacturing and Aerospace & Aviation segments, with recent figures indicating CA$1.01 billion and CA$1.61 billion respectively. The gross profit margin has shown variability, reaching 35.72% in the latest period. Operating expenses have grown alongside revenue, impacting net income margins which were recorded at 4.64% in the most recent quarter.

PE: 21.7x

Exchange Income, a Canadian company, recently reported third-quarter sales of C$433.48 million, up from C$414.69 million the previous year. Despite higher-risk funding through external borrowing, their profits are on an upward trajectory with earnings per share rising to C$1.18 from C$1.06 year-over-year for the quarter ending September 30, 2024. Insider confidence is evident as they continue purchasing shares throughout 2024, indicating potential value recognition within this smaller market segment.

- Click here to discover the nuances of Exchange Income with our detailed analytical valuation report.

Understand Exchange Income's track record by examining our Past report.

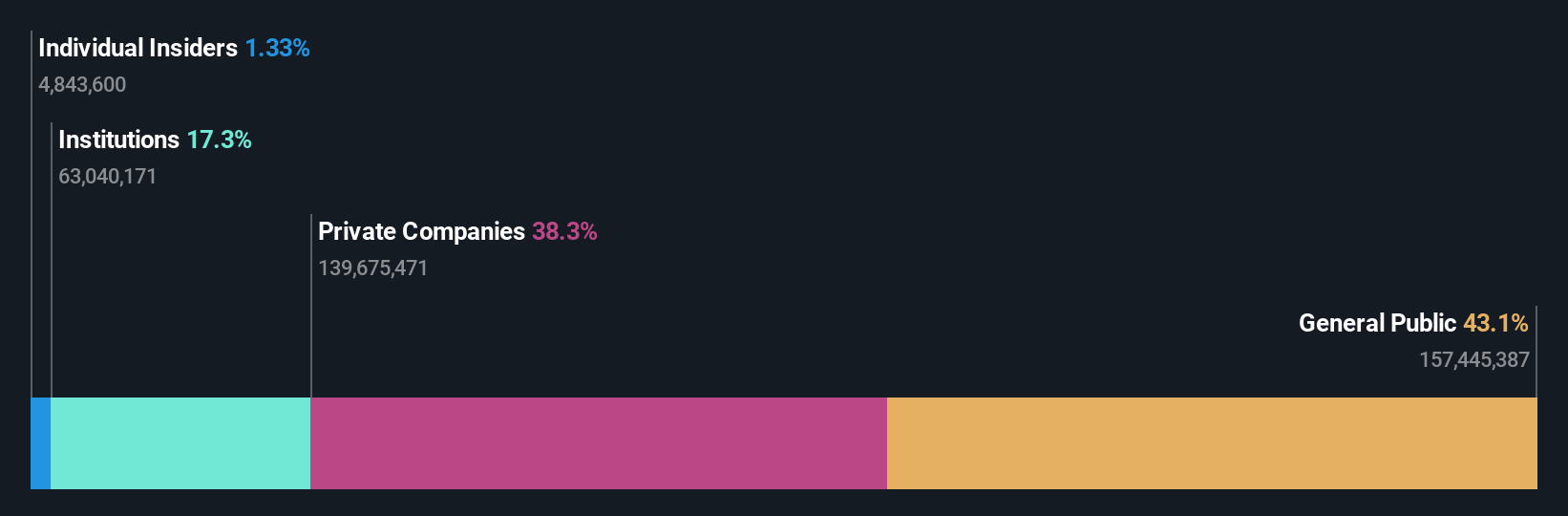

StorageVault Canada (TSX:SVI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: StorageVault Canada operates in the self-storage industry, offering services through its self-storage facilities, portable storage solutions, and management division, with a market capitalization of CA$2.33 billion.

Operations: The primary revenue streams for the company include self-storage, portable storage, and management services. The gross profit margin has shown variability over time, with a recent figure of 66.34% as of September 2024. Operating expenses have been significant, often surpassing $100 million in recent periods.

PE: -29.0x

StorageVault Canada, a small player in the storage industry, recently expanded by acquiring two Ontario stores for C$10.5 million using available funds. Despite a net loss of C$6.97 million in Q3 2024 compared to last year's profit, they increased their quarterly dividend slightly to C$0.002932 per share, reflecting insider confidence in future prospects. While reliant on external borrowing for funding, the company continues to grow its revenue base and explore strategic acquisitions.

Summing It All Up

- Delve into our full catalog of 25 Undervalued TSX Small Caps With Insider Buying here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Exchange Income might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EIF

Exchange Income

Engages in aerospace and aviation services and equipment, and manufacturing businesses worldwide.

Reasonable growth potential with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion