- Canada

- /

- Energy Services

- /

- TSX:TCW

Canadian Undervalued Small Caps With Insider Activity For October 2024

Reviewed by Simply Wall St

As the Canadian market continues to ride a wave of optimism, fueled by recent rate cuts and strong corporate earnings, the TSX has reached all-time highs alongside global indices. In this environment of economic expansion and easing central bank policies, investors are increasingly on the lookout for small-cap stocks that show potential for growth, particularly those with insider activity indicating confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Nexus Industrial REIT | 3.7x | 3.7x | 21.72% | ★★★★★☆ |

| AutoCanada | NA | 0.1x | 48.65% | ★★★★★☆ |

| Foraco International | 5.5x | 0.5x | -25.64% | ★★★★☆☆ |

| Rogers Sugar | 15.4x | 0.6x | 48.00% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.6x | 3.4x | 46.35% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -36.47% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.2x | -65.41% | ★★★★☆☆ |

| Trican Well Service | 8.0x | 1.0x | 9.22% | ★★★☆☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | -58.37% | ★★★☆☆☆ |

| Metalla Royalty & Streaming | NA | 62.8x | -125.66% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Real Matters (TSX:REAL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Real Matters is a technology company that provides network management services for the mortgage lending and insurance industries, with a market cap of approximately C$0.21 billion.

Operations: The company generates revenue primarily from its U.S. Appraisal segment, followed by contributions from Canada and U.S. Title segments. Over recent periods, the gross profit margin has shown fluctuations, reaching 26.88% in June 2024. Operating expenses are a significant component of costs, with general and administrative expenses being the largest portion within this category.

PE: 280.8x

Real Matters, a Canadian small cap, showcases potential despite recent challenges like being dropped from the S&P Global BMI Index in September 2024. The company reported improved financials for Q3 2024 with sales of US$49.49 million and net income of US$1.7 million, reversing a prior loss. Insider confidence is evident with share purchases earlier this year. Although reliant on external borrowing, earnings are projected to grow significantly at 168% annually, suggesting future growth opportunities amidst current undervaluation concerns.

- Navigate through the intricacies of Real Matters with our comprehensive valuation report here.

Gain insights into Real Matters' past trends and performance with our Past report.

Trican Well Service (TSX:TCW)

Simply Wall St Value Rating: ★★★☆☆☆

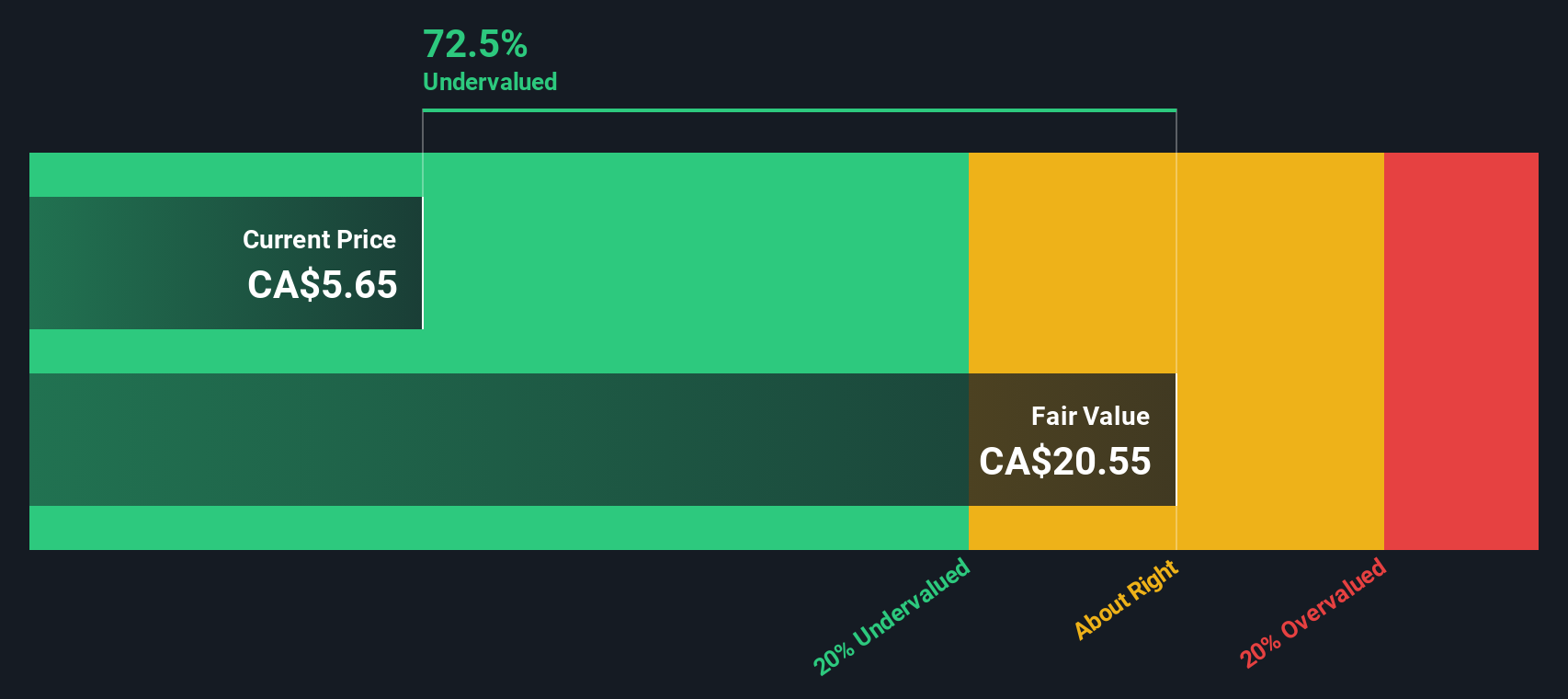

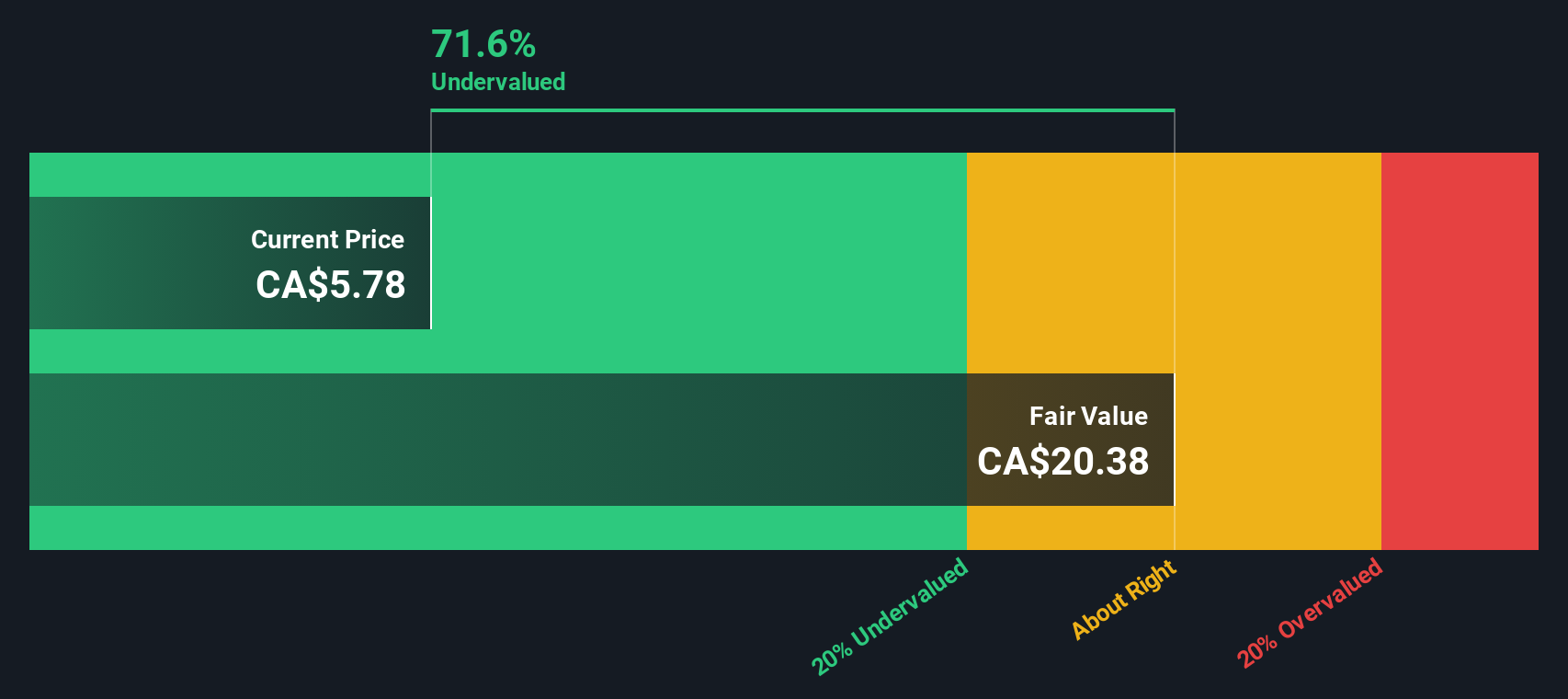

Overview: Trican Well Service operates in the oil well equipment and services industry, with a market capitalization of approximately CA$1.14 billion.

Operations: Trican Well Service's revenue primarily stems from oil well equipment and services, with recent figures indicating CA$991.15 million. The company has experienced fluctuations in its gross profit margin, reaching 28.06% as of June 2024. Operating expenses have varied but were recorded at CA$115.30 million in the same period, impacting overall profitability.

PE: 8.0x

Trican Well Service, a Canadian company in the energy sector, has seen insider confidence with Scott Matson purchasing 27,000 shares for C$130,140 between April and July 2024. The company reported solid second-quarter earnings with sales increasing to C$211.81 million from C$168.23 million year-over-year and net income rising to C$16.23 million from C$9.84 million. A recent partnership aims to construct a new terminal in British Columbia by early 2025, enhancing operational capacity significantly.

Vermilion Energy (TSX:VET)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vermilion Energy is an oil and gas company focused on exploration and production, with a market capitalization of CA$3.2 billion.

Operations: The company's revenue primarily stems from oil and gas exploration and production, with recent figures showing a gross profit margin of 65.72%. Over time, the net income margin has experienced fluctuations, notably reaching -45.56% in the latest period. Operating expenses have been significant, impacting overall profitability.

PE: -2.6x

Vermilion Energy, a smaller Canadian company, showcases potential with its recent operational updates and strategic moves. In September 2024, they completed testing on a deep gas well in Germany, achieving encouraging results and planning further exploration. Despite reporting a net loss of C$82.43 million for Q2 2024, Vermilion is actively managing risk by reducing capital requirements through farm-down agreements. Insider confidence is evident with share repurchases totaling C$112 million from April to July 2024. The company anticipates increased production guidance for the year and continues to focus on cost efficiencies across operations.

Turning Ideas Into Actions

- Explore the 18 names from our Undervalued TSX Small Caps With Insider Buying screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trican Well Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TCW

Trican Well Service

An equipment services company, provides various products, equipment, services, and technology for use in the drilling, completion, stimulation, and reworking of oil and gas wells in Canada.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives